On April 6, the dark web’s cryptocurrency of choice, Monero (XMR) hard forked to version 12. The controversial move was carried out expressly to combat ASIC miners.

ASICs, or application specific integrated circuits, are specialized computer chips powerful enough to be used for mining specific cryptocurrencies more quickly. Though expensive—the newly released Antminer X3 ASIC costs $12,000 and is targeted specifically for mining Monero and other digital currencies that use the same algorithm—according to Motherboard, "these powerful...chips...are disrupting cryptocurrency.

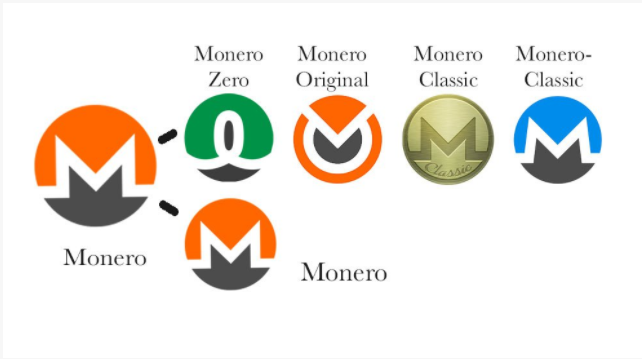

Monero's latest hard fork introduced a new algorithm, solely to protect the network from ASIC mining hardware and retain the decentralized nature of the alt-currency. The hard fork was completed at block number 1,546,000, resulting in the birth of four new coins - two versions of Monero Classic, Monero 0 and Monero Original.

Courtesy BitcoinMagazine.com

Post hard fork, Monero briefly dropped 75% to trade just above $160. It's recovered somewhat though still trading at its lower end.

Dr. Omri Ross, assistant professor at the University of Copenhagen and CEO of Firmo Network notes that hard forks aren't that rare for Monero, indeed, they occur fairly often. In his view, this development can be seen as a natural extension of the community's ability to cope with internal fractions and new market-based demands.

According to Monero's website, this recent move, “intends to close the gap between CPU and GPU, FPGA, and ASIC mining by using a proof-of-work system that is memory bound over a moderate amount of memory.” ASICs are the next technological developmental step after CPUs, GPUs and FPGAs.

Implications Beyond XMR

Blockchain researcher Udi Wertheimer says the Monero hard fork is of great interest, but not just for the XMR community. He believes the elephant in the room is Ethereum (ETH), whose market cap is much larger than that of XMR and thus has much more money at stake.

It makes sense that ASIC miners would be inclined to move from Monero to the more lucrative Ethereum. The second most popular cryptocurrency has a market cap of $19.03B at time of writing, while Monero, currently the eleventh most popular digital token, is valued at $2.63B. Indeed, many believe ASICs have already been encroaching on Ethereum mining since Bitmain, the company that released the Antminer X3 is also releasing an E3 version, with an $800 retail price tag, targeted specifically at ETH mining. Says Wertheimer:

“GPU miners on ETH already suspect that ASICs are secretly mining Ethers, hurting the profitability of GPUs. In the longer term, there’s a potential political debate coming to Ethereum soon, as the community tries to hard fork away from PoW [Proof of Work] to PoS [Proof of Stake] (or a different PoW). Some players from the mining community are likely monitoring closely the outcome of the Monero forks, as a preparation for a possible ETH fork attempt down the line.”

Marc Bernegger, a Swiss-based web entrepreneur and investor who is also a board member of Falcon Private Bank and ICO advisor at SwissRealCoin, points out that although blockchain-powered platforms and currencies are meant to be decentralized, with the advent of ASICs there’s a real threat that some might become dominated by a small group of corporations that could develop specifically designed ASIC-based computers to target a certain algorithm or task, thereby centralizing those currencies.

He cautions that this could prove disastrous for any specific cryptocurrency if or when ASIC miners 'corner the market' as it were. Should that happen, the currency in question would be mined much more quickly and by a very small group who would then control pricing and availability. According to Bernegger:

“When new players bring ASICs into the game, they start finding new blocks much faster. Many of the cryptocurrencies respond through increased complexity, making it useless for regular people to mine coins, with the focus then shifting to those with large bankrolls or know-how of the system.”

Bernegger raises another significant point. Monero's developers wanted to keep cryptocurrency decentralized. That was always a core tenet of the asset class. This week's hard fork was aimed squarely at maintaining that status, by shifting to a new hashing algorithm, because Monero's creators feared a potential takeover of the network by ASIC miners.

For Bernegger, as for many others currently active in the cryptocurrency space, the beauty of digital currencies is that they provide users an opportunity to choose the particular projects they prefer and in which they can participate. Bernegger believes that at some point, the situation will stabilize.

He expects a few outcomes: the old Monero will keep its name, while new forks will become known as something else, much like what occurred with (Bitcoin, which forked into Bitcoin Cash, Bitcoin Gold and Bitcoin Diamond; similarly the Ethereum Classic scenario. In his view one of Monero's new forks will overcome the original Monero blockchain in its hashrate and a number of users and will eventually become the new “Monero.”

Others are a bit less sanguine, favoring more aggressive methods to block ASIC miners entirely. There's strong sentiment for changing Ethereum's software as well as having it undergo similar hard forking precautionary measures. At the moment Ethereum co-founder Vitalik Buterin, has come out against such measures. Still, as one ETH developer recently noted, "if the community truly wants this to happen...we can definitely do that." For now, however, the tug-of-war between the forces in favor of decentralization and those on the side of ASICs has only just begun.