By Kathy Lien, Managing Director of FX Strategy for BK Asset Management

- USD/CAD Falls Sharply Ahead of Bank of Canada Meeting

- RBNZ: Are 3 Back to Back Rate Cuts Warranted?

- AUD Soars on Stronger Chinese Trade Data

- Trading the Dollar Before FOMC

- Sterling Extends Recovery, But Beware of BoE

- Euro Bounces but Downtrend Intact

More Policy Surprises from Canada & New Zealand?

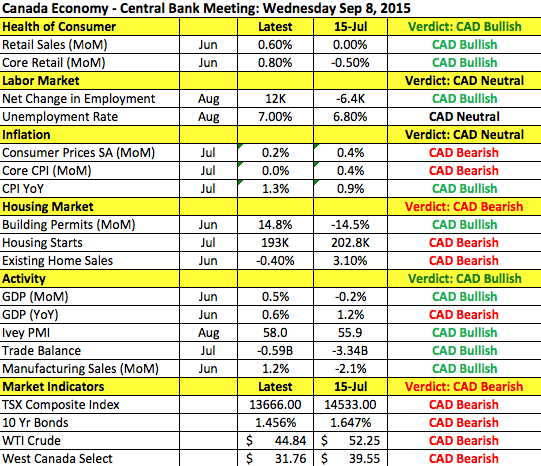

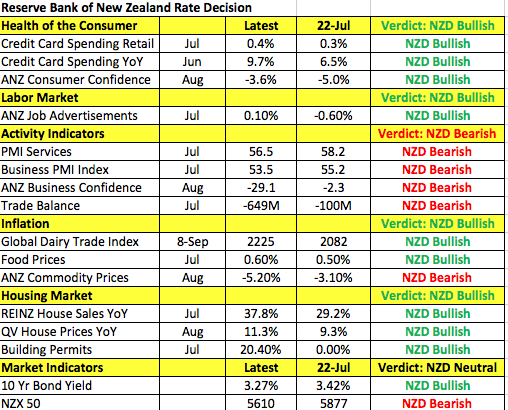

In the next 24 hours we have two very important monetary policy announcements from the Bank of Canada and the Reserve Bank of New Zealand. Central bank rate decisions can have a significant impact on currencies and in these cases we expect big moves in the Canadian and New Zealand dollars. Both central banks could surprise investors who are looking for no change from the Bank of Canada and a 25bp rate cut from the Reserve Bank of New Zealand. Back in July, the Bank of Canada unexpectedly lowered interest rates by 25bp. At the time, the central bank expressed concerns about the slowdown in the economy and increased downside risks to Canadian inflation. While the BoC expected the U.S. economy to strengthen, they were puzzled by the weakness in exports and said they expected the Canadian economy to be less in sync with the U.S. No rate cuts are expected in September and judging from the strong gains in the Canadian dollar on Tuesday, investors are positioning for a less dovish BoC statement. However when the BoC lowered rates, Governor Poloz said they have a fair bit of room to maneuver, implying that the door to more easing remains open. Since the last monetary policy meeting (shown in the first table below), we have seen an improvement in the labor market, pickup in retail sales and manufacturing activity. Yet consumer price growth remains slow and oil prices prices are still well below July levels. So while the BoC may have less to worry about than 3 weeks ago when oil was at $39 a barrel, they may not be ready to shift their bias. If that's the case, then the risk is to the upside for USD/CAD. However we will view any rally as an opportunity to sell the currency pair at a higher level. For the Reserve Bank of New Zealand, the question will be whether the economy deteriorated enough to warrant three back-to-back rate cuts. Every one of the 17 economists surveyed by Bloomberg expects a 25bp rate cut, but at the last meeting the central bank dropped its reference to NZD being at an unjustified level, which suggested they could keep rates steady in September. While there have been widespread problems in China, the second table below details New Zealand data like consumer spending, job ads and the housing market, which all saw improvements since the last meeting. Dairy prices also increased at the last 2 auctions leaving the Global Dairy Trade index at a higher level in September compared to July. For these reasons, we believe that another rate cut is not a done deal and if we are right, the New Zealand dollar will spike higher.

Trading the Dollar Before FOMC

There was very little consistency in the U.S. dollar's performance Tuesday with the greenback strengthening versus the Japanese yen and Swiss franc but weakening versus the euro, British pound and commodity currencies. U.S. stocks performed extremely well while 10-year yield moved sharply higher, which should have been overwhelmingly positive for the dollar but following a long weekend on a day with no U.S. data, investors were reluctant to pile back into the dollar. The only U.S. economic reports scheduled for release this week will be Friday's PPI and University of Michigan Consumer Sentiment numbers. Sixty percent of economists surveyed by Bloomberg are still looking for the Federal Reserve to raise interest rates next week but Fed fund futures are pricing in only a 30% chance of a move. Realistically most of the investors we have spoken to pretty much ruled out a rate hike. This divergence in expectations is limiting a one-way bias in the dollar. Based on the performance of the U.S. economy alone, the Fed should raise rates but they do not operate in a vacuum and between the volatility in international equities, the dovishness of the ECB and the dovish bias of other central banks, it will be difficult for Janet Yellen to pull the trigger. We now expect USD/JPY to range trade ahead of the FOMC meeting with a lean to the downside. We believe the lack of market-moving U.S. data next week could lead to a post-NFP bounce before a decline the following week.

Sterling Extends Recovery, But Beware of BoE

Over the last 48 hours, sterling experienced a strong recovery against all major currencies. Having fallen hard since the end of August, the market's demand for the pound shifted as risk appetite improved. However we believe that traders should be cautious of the recovery because Monday's move was driven by low liquidity and Tuesday's rally was sparked by talk of sterling-positive M&A flow. While important, M&A transactions have an extremely brief impact on currencies. What's far more important is data and monetary policy and that's where the risk of owning sterling lies. U.K. industrial production and trade balance are scheduled for release on Wednesday. Based on the drop in the PMI manufacturing index the odds favor a downside surprise. The Bank of England meets on Thursday and the series of U.K. data-misses along with the problems in China encourages U.K. policymakers to delay tightening. The last time we heard from the central bank, the urgency to raise rates diminished with fewer than expected MPC members voting for a rate hike. The BoE monetary policy announcement this week has the new protocol with the minutes released at the same time as the rate decision. That means that Thursday will be a big day for the British pound and chances are that the central bank will validate our concerns.

Euro Bounces but Downtrend Intact

While the euro rebounded against the U.S. dollar Tuesday, its gains were modest compared to other major currencies. Even higher highs and higher lows in the past 48 hours failed to mask the fact that on both days, EUR/USD ended virtually unchanged. Better than expected economic data lent support to the currency but with the European Central Bank talking about additional easing, it will be difficult for EUR/USD to see any significant gains. Nonetheless, a weaker euro continues to help the economy with Germany's trade balance growing more than expected on a 2.4% pickup in exports. Second quarter GDP was also revised higher in the Eurozone from 0.3% to 0.4%. With no major Eurozone economic reports scheduled for release the rest of the week, we expect quiet trading in EUR/USD. The recent decline in EUR/USD stopped right at the 50-day SMA. If the moving average is broken, there is no support until the psychologically significant 1.10 mark. On the upside, there is resistance at the Tuesday and Wednesday high of 1.1331. Selling anywhere between 1.12 and 1.1350 for a move down to 1.10 is an attractive trade.