The opinions expressed here are those of the author alone and do not represent the views of any associated entities.

According to Canada’s leaders, there is a single major cause of, and solution to, our housing affordability problems: supply.

The “supply theory” asserts that prices have been driven up because there just aren’t enough homes. Therefore, to restore affordability, all we need to do is build more homes.

Chrystia Freeland, Minister of Finance, said that affordability concerns are first and foremost an issue of supply. So did Ahmed Hussen, who until recently was Minister of Housing.

Romy Bowers, CEO of the Canada Mortgage and Housing Corporation agrees. In 2021 she explained that “the best way to address house price escalation is to provide more supply”.

The Bank of Canada is on the same page. Earlier this year, Governor Tiff Macklem said that “the key to the housing market is more supply. Interest rates affect demand, housing affordability more fundamentally will be affected by what happens on the supply side”.

While there is something to be said for the supply theory, it is my view that we are greatly overemphasizing the role of supply. In this edition of People Over Profits, I’ll explain why.

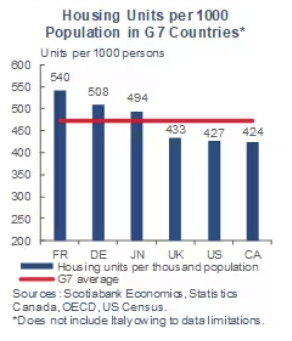

A while back, Scotiabank (TSX:BNS) published a report that helped to propagate the supply theory. The main conclusion of the report, illustrated in the chart below, was that out of all the G7 nations, Canada has the fewest housing units per 1000 residents. This easily digestible tagline gained enormous traction. Stories about Canada’s supply shortcomings were featured in just about every imaginable publication, including the Financial Post and the Globe and Mail.

However, the report failed to mention that Canada’s supply situation doesn’t look all that bad with additional context.

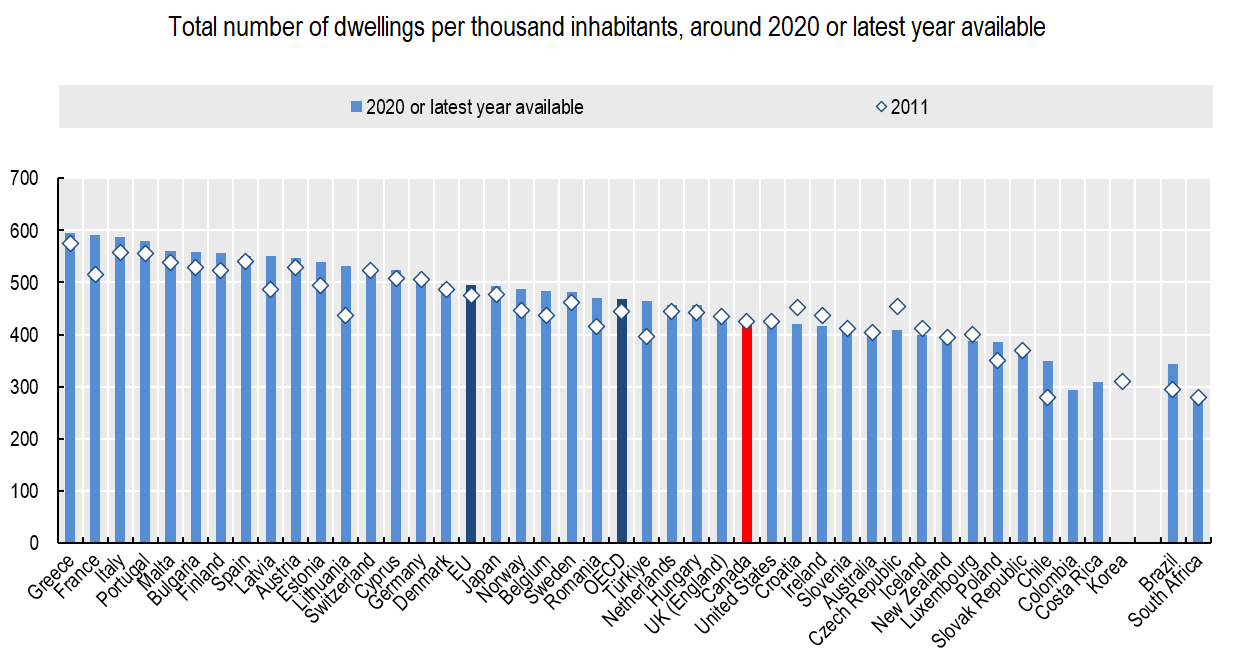

Here is a similar chart of housing units (per 1000 residents) of all countries tracked by the OECD.

Canada falls towards the middle of the pack, sandwiched between the UK and the US. In this context, the difference between the housing supply of these countries appears to be marginal.

This broader international comparison paints a very different picture: Canada does not stand out amongst its peers in terms of housing supply.

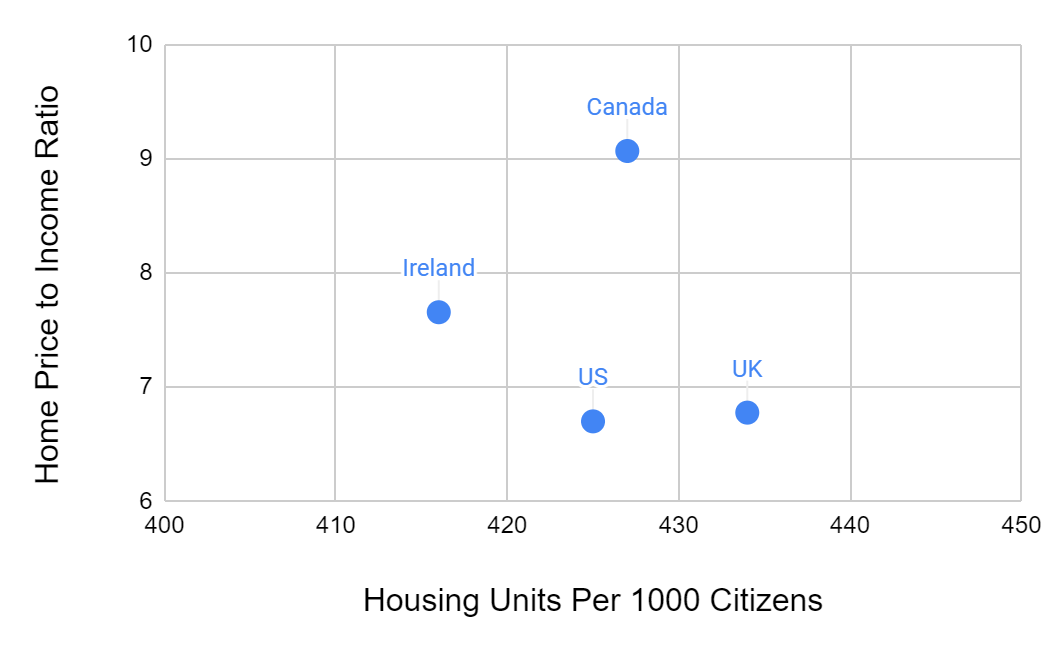

If supply is the key determinant of home prices, as claimed by our leaders, then we would expect countries with similar supply levels to have similar pricing. To test this theory, I created the following plot, which compares Canada’s home price to income ratio with other countries that have similar levels of supply.

The US, UK, Canada, and Ireland all have a similar number of housing units per capita, yet housing in Canada is far more expensive. With a price to income ratio of 9.06, homes in Canada are 18% more expensive than in Ireland (7.66) and over 30% more expensive than in the US (6.70) and the UK (6.77).

This comparison illustrates why we can’t only focus on the supply side of the home price equation. Countries with similar levels of supply have less expensive housing than Canada, so there must be more to the story.

If low supply cannot fully explain why housing in Canada is so expensive, basic economic theory leaves us with another obvious culprit: high demand.

After years of relentless growth in house prices, real estate is viewed as a foolproof investment by Canadians. This belief has resulted in a tremendous amount of investment demand. In Ontario, for example, a staggering 42% of condos are owned by investors. Overall, across the country, upwards of 20% of homes are purchased by investors.

Curtailing real estate investment would go a long way toward bringing supply into better balance with demand.

This is not to say that we don’t need to build more homes. However, building new homes would be a much more effective strategy for reducing prices if so many of them weren't purchased by investors.

It’s not terribly surprising that our leaders have failed to focus on the demand side of the equation.

If they did, politicians, 40% of whom are invested in real estate, would implicate themselves, and likely put their own finances at risk. Our former Housing Minister, for example, has two mortgages on two rental properties, so it’s not surprising that he didn’t clamp down on investor demand.

The Bank of Canada is similarly disincentivized from focusing on the demand side of the equation. The Bank of Canada’s job is to moderate economic activity using tools like interest rates to influence demand. As long as our housing affordability issues are considered to be a supply problem, not a demand issue, The Bank of Canada will not take any blame.

If we really want to make housing affordable again, we need to curtail unnecessary demand, not just build more homes. We need to change our perspective and start looking at houses as places to live, not investments. We need to start thinking about People over Profits.

Given how ingrained real estate investment is in our culture, our collective mentality likely won’t change without some external motivation. Fortunately, there are numerous policies that could help push us in the right direction. For example, we could implement rent controls and taxes to make investing in real estate less profitable, and thus less enticing.

That’s all for this time.

As always, I would love to hear any thoughts, comments, or concerns you might have about all of this. Feel free to reach out!

This content was originally published here.