By Ketki Saxena

Investing.com -- It’s been a busy week in Canadian markets, with earnings still in full swing. Here’s a look at the most popular instruments in Canada this week, and why they’ve been moving markets.

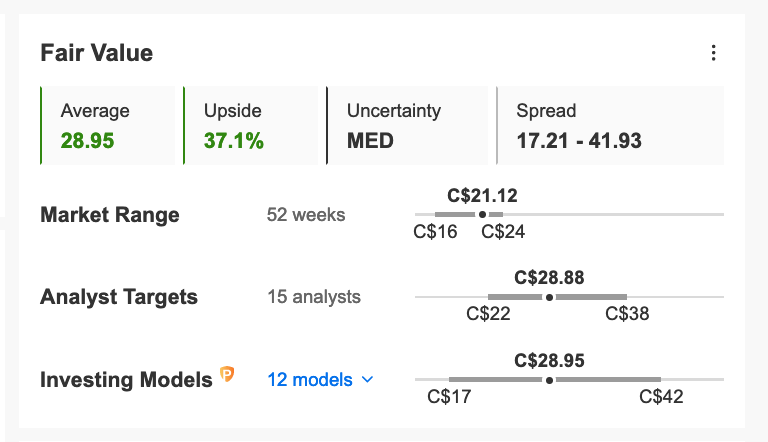

Air Canada (TSX:AC)

Air Canada saw revenue nearly double to $4.9 billion, up from $2.6 billion this time last year as demand rebounded. The airline reported a net income of $4 million, up from $974 million in losses a year ago - marketing the second straight quarter of profit after 10 consecutive quarters of losses. On a per diluted per share basis, Air Canada reported a loss of three cents, compared with a loss of $2.72 per diluted share in the same quarter last year.

Today’s Closing Price: 21.12 CAD

Fair Value: 83.12 CAD

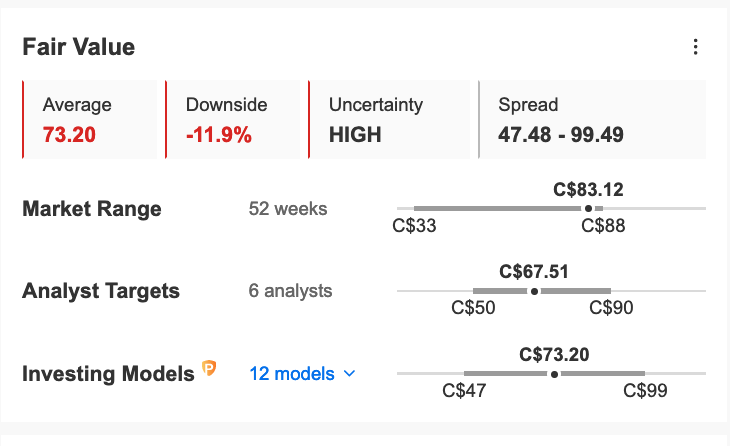

Shopify (TSX:SHOP)

After reporting better than expected earnings last week, an announcement to cut 20% of its workforce, and its decision to sell Shopify Logistics to Flexport, investor interest this week was piqued by a downgrade from Atlantic Equities. Atlantic downgraded the company to Neutral from Overweight after shares surged nearly 24% last week on Q1 results. The analysts noted “We continue to see upside to consensus estimates, with gross profit growth likely to accelerate over the next few quarters. However, the stock has quickly reacted to these positive developments and, while further business momentum could support the stock near term, we are downgrading the stock to Neutral on valuation.”

Today’s Closing Price:

Fair Value:

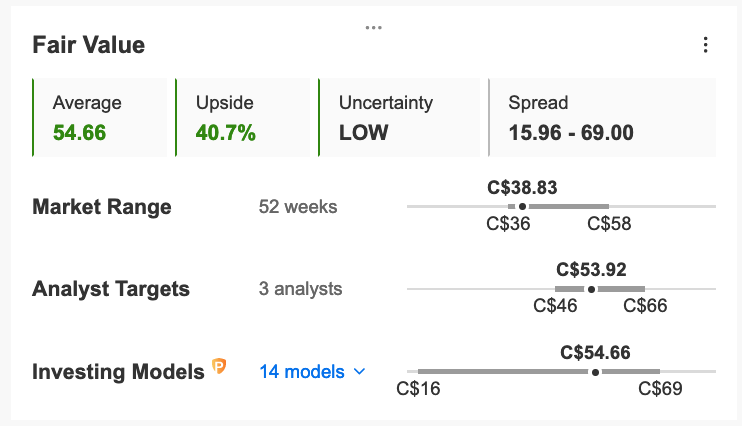

Suncor (TSX:SU)

Suncor reported earnings on Monday, posting a profit of $2.05 billion in the first quarter of 2023, down from $2.95 billion in the same quarter of 2022.On an adjusted basis, Suncor says its operating earnings for the first quarter were $1.81 billion, or $1.36 per common share, a 34-per-cent decrease year-over-year. But that’s not the only reason Suncor awas in the news - a bear attack at an oilsands site in Alberta injured a worker, adding to the company's safety record after a slew of fatalities in recent years.

Today’s Closing Price: 38.83 CAD

Fair Value:

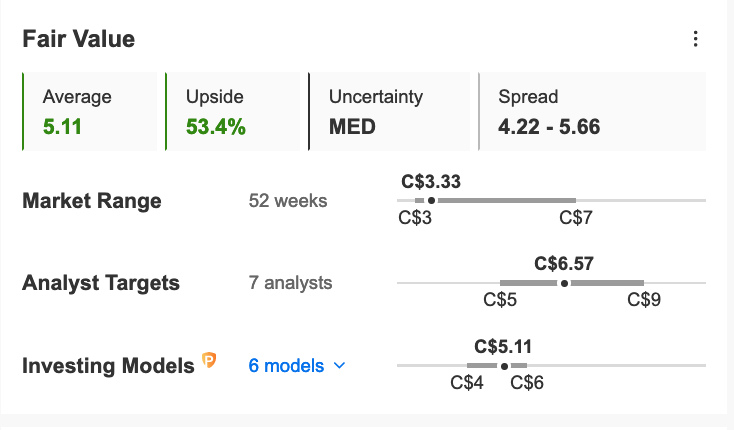

STEP Energy Services (TSX:STEP)

STEP Energy reported a Q1 revenue of $263 million, up 20% year over year as demand for oil field services grew. The numbers marked STEP’s second best quarter ever. Net income came in at just over $19 million, compared to roughly $9 million in the quarter prior. Earnings amounted to $0.26 per share on a diluted basis, compared to $0.13 in the quarter prior.

Today’s Closing Price: 3.33 CAD

Fair Value Target (NYSE:TGT):

Hut 8 (TSX:HUT)

Hut 8 Mining posted a first-quarter revenue drop of a whopping 64% to $19 million from the year earlier. Earnings came in at $80.2 million or 35 cents per share. The company also revealed it had to take about 8,000 machines in Ontario offline in November, as it remains embroiled in a dispute with its energy provider. Hut 8 is currently in the process of merging with U.S. Bitcoin Corp. (USBTC), a private US based miner.

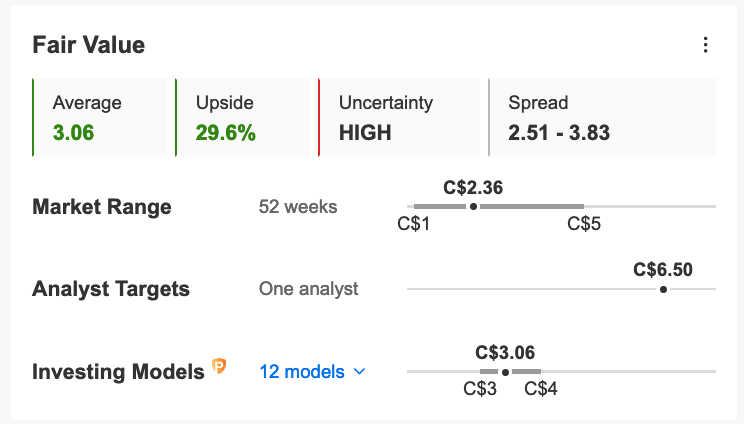

Today’s Closing Price: 2.36 CAD

Fair Value Target:

All Data Sourced from Investing Pro . Start your 7-day free trial to unlock must-have insights and data.