By Ketki Saxena

Investing.com -- With earnings season still ongoing in Canada, here’s a look at the most popular equities on the TSX this week, and why they’ve been moving markets.

Lightspeed Commerce

Lightspeed (TSX:LSPD) garnered interest as it posted earnings, reporting a loss than narrowed to US$74.5 million in its latest quarter compared to a loss of US$114.5-million this time a year ago. Revenue meanwhile grew to US$184.2 million compared to revenue of US$146.6-million this time last year. Shares in Lightspeed fell however as the company issued an outlook that “reflects caution on the near-term results given the economic climate.”

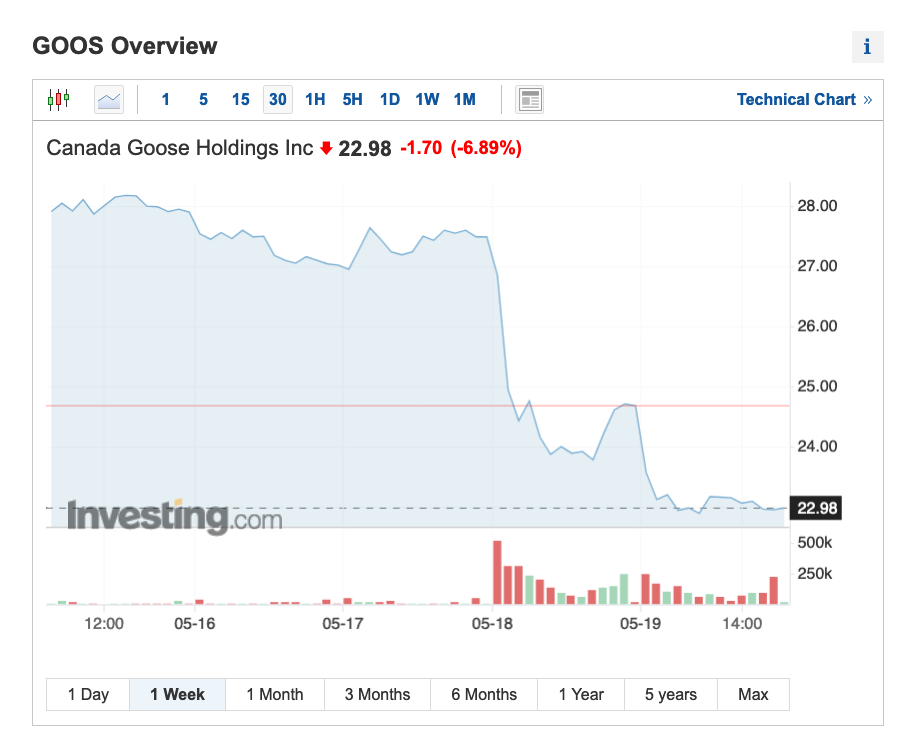

Canada Goose

Canada Goose (TSX:GOOS) shares dropped after the company reported a loss of $3.1 million, an improvement from a $9.1 million loss in the same period a year earlier. Revenue was $293.2 million, up 30% from $223.1 million in the same quarter last year. Goose Stock was further pressured by comments from their CEO concerning challenges in the US market this year.

Toronto Dominion

TD (TSX:TD) is once again in the headlines on reports of tougher sales policies that increase regulation that govern investment advisers. As per reports from people familiar with the matter, TD has introduced more stringent due diligence and concentration limits on “alternative investment funds,” which include hedge funds and private funds. The new rules include limits on how much its retail clients, collectively, can own of particular funds, according to people familiar with the matter.

Enbridge

Enbridge (TSX:ENB) meanwhile was in the news (hardly surprising) over a controversial pipeline - this time the Line 5 pipeline. Last week, Enbridge pushed back against the Bad River Band of the Lake Superior Chippewa, who are asking a federal judge in Wisconsin to order the pipeline closed, citing worries of a rupture in the pipeline within its territory further to spring flooding. In new court documents, Enbridge said the group is overstating the risk and engaging in "counter- factual speculation."

Air Canada

Air Canada (TSX:AC) was once again amongst the most popular Canadian equities this week, with the country’s national carrier in the news again for a variety of reasons. Firstly, the news that the company was close to a deal for 20 Boeing (NYSE:BA) Co. 787 Dreamliners to renew and expand its long-haul fleet. Secondly, given the ongoing West-Jet strike - the largest aviation strike in Canada since the 1980’s - there were growing concerns that Air Canada’s roughly 2,500 pilots who are members of the Air Line Pilots Association (ALPA) could kick off bargaining in the peak summer season.