Shares of MSCI Inc. (NYSE:MSCI) rose 7.90% on the trading day after posting strong second-quarter earnings on July 23. During the three months ended June 30, the financial data company was able to beat analyst expectations by a modest 2.47% for earnings per share and 1.66% for revenue. Thereafter, management reiterated year-end free cash flow guidance within the same range of $1.22 billion to $1.28 billion.

Even though the earnings surprise was minimal, and perhaps not justifiable for an 8% single-day gain, market sentiment rose and added approximately $3.14 billion in value to MSCI's market cap following the announcement.

An international index leaderMSCI is one of the world's largest index providers. Its primary business comes from collecting royalties from licensing the intellectual property of its stock market indexes, including the MSCI World Index, MSCI Emerging Markets and MSCI ACWI. In essence, it is known for its international indexes, which tend to have more expensive fees than local indexes from S&P, for example.

Although the Indices segment hosts 56.30% of the revenue, the company also has Analytics (24.0%), ESG & Climate (11.4%) and Private Assets (8.4%) segments that contribute to the top line. The latter contains part of the revenues that came from the acquisition of The Burgiss Group, which became an MSCI business line renamed Private Capital (Trades, Portfolio) Solutions within the Private Assets segment.

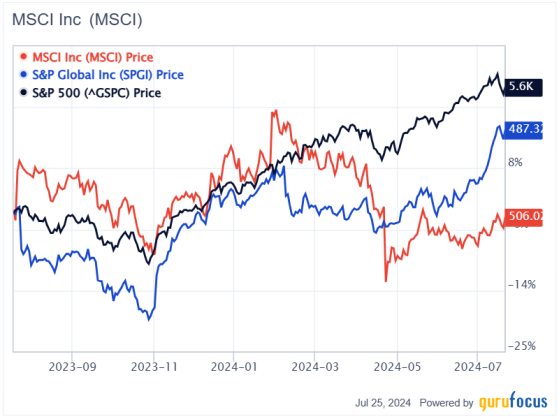

2024: A roller coaster of trendsPrior to earnings, the market overall seemed pessimistic about the stock, which has underperformed major peer S&P Global (NYSE:SPGI) by approximately 15% and the S&P 500 by around 23.40% over the last year.

MSCI Data by GuruFocus

The pessimism started in early February and continued until the release of the lackluster first-quarter earnings, where the stock experienced a drop of 13.43% in a single trading day. This movement was due to higher reported operating expenses and a period of elevated product cancellation following the merger of two bank clients.

MSCI Data by GuruFocus

In total, that negative market sentiment caused the stock to drop 26.2% in a single quarter. Nonetheless, since reaching a low on April 23, MSCI has gained 20.80%, doing better than S&P Global and outperforming the S&P 500 by a solid 13.80%.

With these movements, it is clear MSCI has revamped its sentiment based on the recent share price performance. In markets where stocks known for their quality have been trading far below their 52-week highs and good news arrives, their share price tends to soar rapidly. This has been exactly the case for MSCI and proposes a period of strong price momentum going forward.

Outstanding earnings drive the rallyDespite earnings expectations being modestly beaten, there are reasons to be bullish. Overall total operating revenue increased 14% year over year, with strong growth from asset-based fees of 18.20% that were primarily driven by an increase in average assets under managements from funds linked to its indexes. In addition, recurrent subscriptions grew at a robust 14.40% thanks to ongoing demand from analysts and the ESG & Climate segments.

A day before the earnings release, MSCI also announced the launch of 130 private market indexes that would further expand the product offering of Private Assets, an operating segment that in the second quarter was notable due to its adjusted Ebitda of $17.36 million, which grew 39% quarter over quarter. Although the Private Assets segment constitutes a small fraction of the business, secular tailwinds toward higher alternative investment allocations position it to gain some licensing deals going forward.

Trading with a margin of safetyBased on the GF Value Line, the stock's underperformance has caused it to become modestly undervalued. Currently, even with the price recovery, the share price sits $93 away from its intrinsic value of $630.89, representing an upside potential of 14.70%.

Nonetheless, it can be seen on the graph that the transition from negative momentum to positive has quickly brought the stock to be classified from significantly overvalued to modestly overvalued. Based on this trend, it is not far from reaching fairly valued territory.

Ultimately, MSCI has a strong explanatory power to the quality factor of the French Five-Factor Model, with key profitability metrics all higher than the industry. On top of that, all metrics have improved and sport an unbeatable profitability score of 10 out of 10.

Source: MSCI 10-Q

However, some bears could argue its debt levels are too elevated, with the debt-to-equity ratio hitting -6.32 (as its equity is negative). Nonetheless, these arguments could be refuted by the fact MSCI obtained these debts during a period when interest rates were significantly low and most of its debt was fixed and will start maturing in 2029. At the same time, this debt was used in part to buy back shares, benefiting the company and increasing earnings per share as the earnings yield was higher than the cost of debt at that time. In addition, the interest coverage ratio stands at a solid 7.70 and the Altman Z-score is at safe levels, meaning the company is not at risk of having a liquidity or solvency problem.

Guru and insider tradesAmong the gurus invested in the stock, billionaire Ron Baron (Trades, Portfolio), who holds a net worth of $5.20 billion, manages an equity portfolio where MSCI is the fifth-largest asset, helping Baron Asset Fund to control approximately 2.85% of the business. Although he still maintains a sizable position, at some point during the first quarter, he sold a modest 1.10% of the shares, which at that low amount is probably coming from portfolio rebalancing.

At the same time, Chairman and CEO Henry Fernandez and President and Chief Operating Officer Baer Pettit bought the dip after the poor first-quarter earnings. Those trades have seemed to play out, appreciating by approximately 17.30%.

ConclusionThe key takeaway is that after the rally, the opportunity to get MSCI at a bargain is probably gone. Still, with the recent surge in price, there exists plenty of opportunity to get this quality company at a fair price.

The index licensing business has many fascinating characteristics and, due to the market share, industry oligopoly and brand recognition that MSCI has, this is clearly a stock that would most likely survive economic downturns, making it a growth and defensive play in an equity portfolio. At the same time, elevated repurchase of stock to free cash flow implies a shareholder-friendly management team, which would ultimately help investments to obtain faster gains going forward.

This content was originally published on Gurufocus.com

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI