Amid the uncertainty and challenges prevailing in the current commercial real estate (CRE) sector, multifamily and industrial properties have emerged as a ray of hope for lenders and CRE investors. Consequently, two asset classes – multifamily and industrial – have been the focus of most of the recent transactions in the US CRE market.

In this blog, we take a look at why lenders are increasingly favouring the multifamily property sector. Some of the factors that act as catalysts for the sector are

-

Shortage of supply due to increase in construction costs

-

Challenges faced by construction companies

-

Increase in demand

Why lenders prefer multifamily properties

The US government’s housing programmes have been aimed at making affordable home ownership a possibility, particularly for those in the low to moderate income brackets. In the wake of the unprecedented economic challenges caused by the COVID-19 pandemic, government and government-sponsored enterprises (GSEs) have taken measures to help homeowners and renters. These include limitations on the eviction of renters for non-payment of rent and allowing borrowers to defer mortgage payments

Below, we look at some of the reasons why lenders prefer multifamily properties.

(1) Revival in demand for housing amid economic recovery

Given that shelter is one of the three basic necessities, housing has generally seen revival in demand once economic uncertainties settle. The nature of the multifamily property itself provides strong resistance compared with other property types.

(2) Consistent value creator for investors

During past recessions, returns from bonds and stocks have faltered. However, residential properties, such as single and multifamily properties, have proven themselves more reliable investments given stable returns in the form of rental income and capital appreciation.

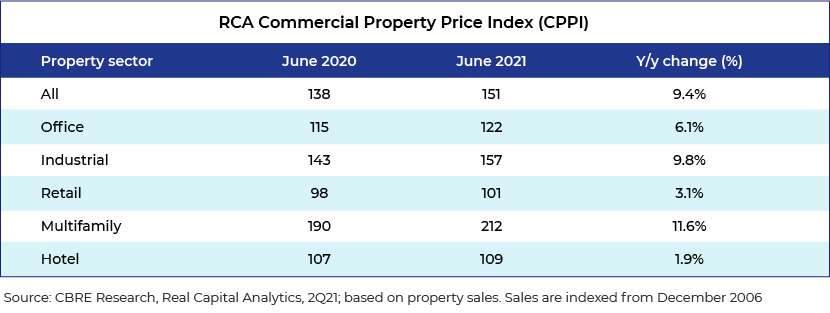

As shown in the below table, amid the chaos and uncertainty due to the COVID-19 pandemic, overall asset segments grew 9.4% over June 2020-June 2021. The multifamily property sector, however, outperformed the other asset segments, growing at a rate of 11.6% y/y.

(3) Stable rent collection

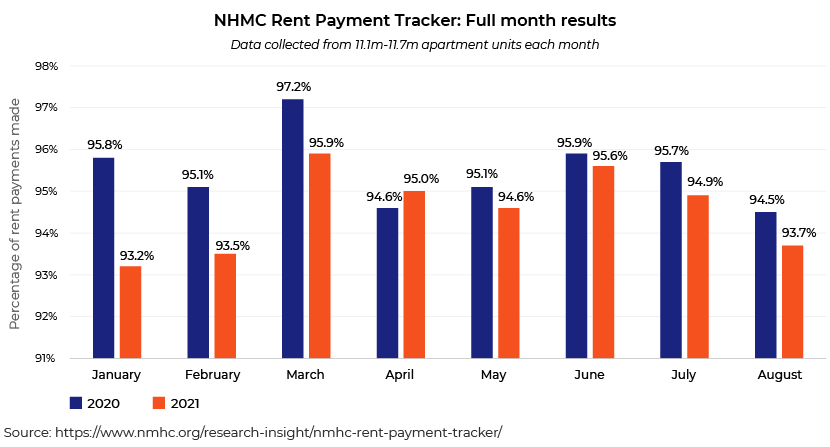

According to NHMC data collected from more than 11m apartment units, rental collection (partial or full) remained strong at 93.7% in August 2021. Notably, this was the lowest collection rate since March 2021. Furthermore, the difference between rent collection in the current market and that before the pandemic was minimal.

(4) Low delinquency rates

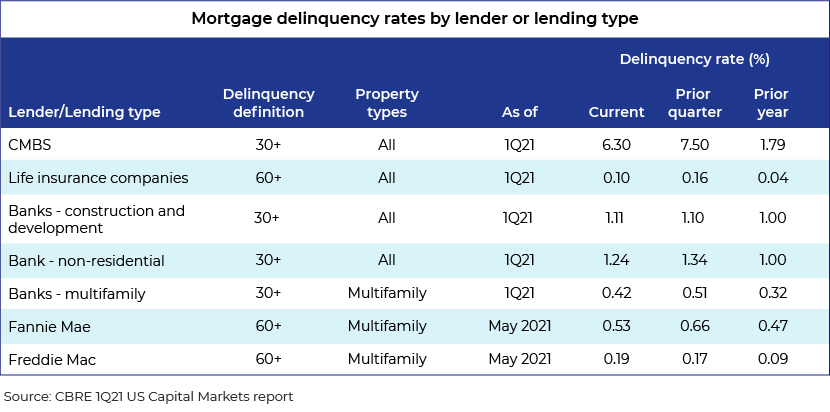

As per CBRE’s 1Q21 US Capital Markets report, while the delinquency rate for non-residential properties was 1.24%, it was significantly lower at 0.42% for multifamily properties. This is a good indicator of why banks prefer this asset type in lending.

Factors that could adversely impact multifamily properties in future

As per Reonomy, a leading data provider on the US CRE sector, multifamily properties could face headwinds from the following factors in 2021 and beyond:

-

Slower net operating income growth and the switch to working from home amid the pandemic. Regardless of whether this cultural shift is temporary or here to stay, it is likely to bring new trends in multifamily layouts and amenities

-

Smaller incoming renter population (millennials out, Gen Z in)

-

Excess supply in major markets

Summary

Fundamentals in the multifamily property market, which include factors such as vacancy rates and rents, were negatively impacted throughout most of 2020. However, there has been a significant turnaround since 1Q21, with multifamily property demand increasing, leading to improving rent growth and higher occupancy levels. After continued downturns for four consecutive quarters, rent growth for these properties turned positive in 2Q21. According to Yardi Matrix, overall asking rent increased 0.6% in July 2021, although it remained down 3.6% y/y. The national multifamily property occupancy rate improved to 95.3% in July 2021, a 0.6% y/y increase.

While it is difficult to predict how the future of the market will unfold, current economic conditions, coupled with the likelihood of limited inventory additions in the near term, point at positive growth in the multifamily property sector. We believe the sector can be a good value creator for the next 12-18 months. Emerging out of 2020, in which most of the lenders were cautious and following a wait and watch approach, the first half of 2021 was quite encouraging. Furthermore, lending and investing activities are expected to accelerate in the coming months.