We primarily use the Elliott Wave Principle (EWP) to forecast the financial markets, such as the Nasdaq 100 (NDX). In our last update from July 5, we assessed the state of the market and found that the Bears had to wait to get their chance,

“Ideally, the green W-3 tops around the 161.8% Fibonacci extension ($20450+/-50). The green W-4 bottoms around the 100.0% Fib-extension ($20110+/-50), followed by the last green W-5 to ideally the 200.0% extension at $20665+/-50. This pattern should unfold over the next 2-3 trading weeks.”

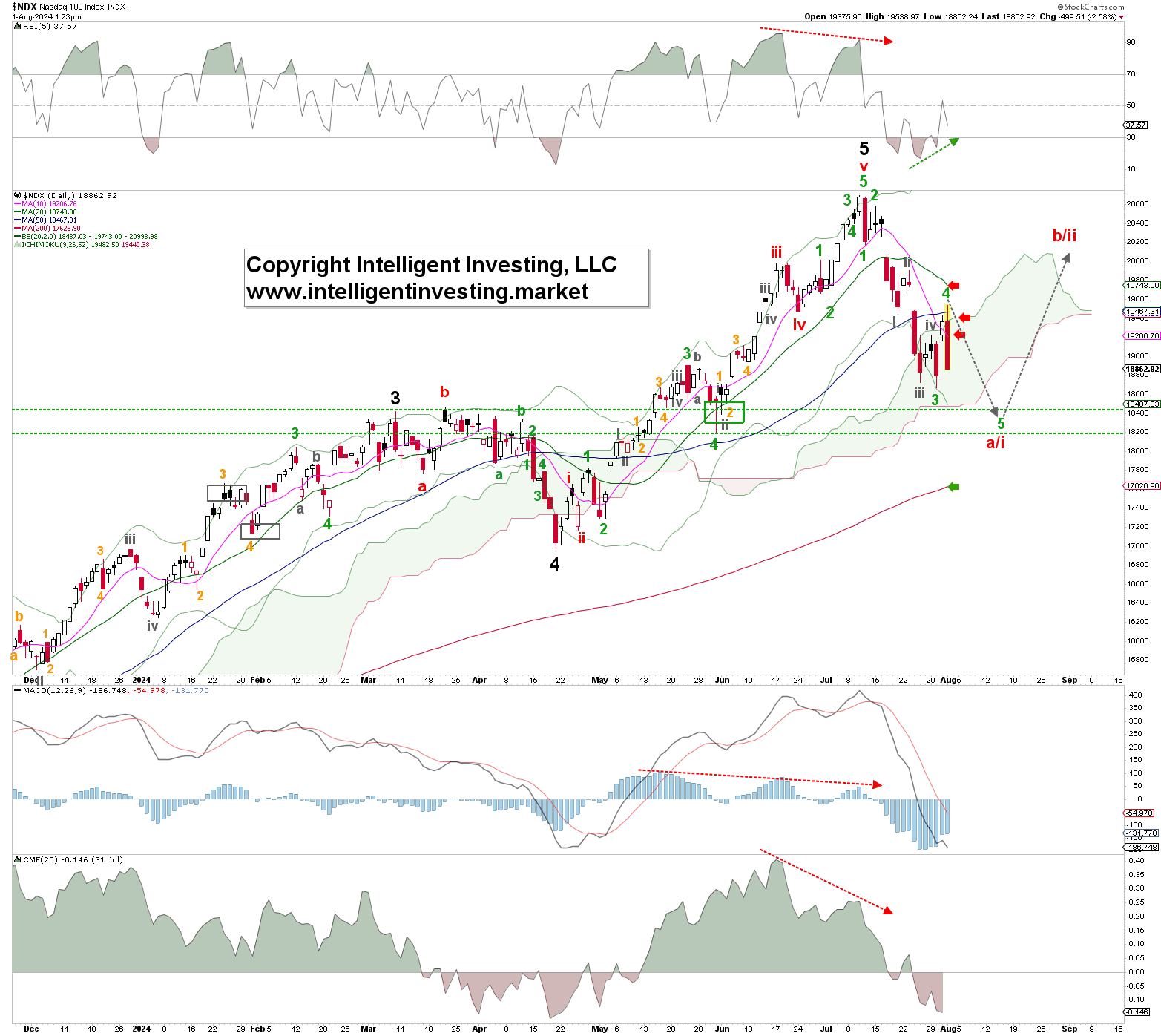

Our bullish stance was correct, as our forecasted impulse path predicted the index’s movement rather closely. Namely, it topped out on July 9 at $20543 and had an intra-day low of $20395: W-3 and W-4. It then peaked at $20690 on July 10: W-5. Since then, it has lost almost 10%. See Figure 1 below.

We are currently tracking a potential impulse lower, which in the bigger picture means the larger trend has changed from up to down. Today’s pop and drop has most likely completed the green W-4 and started the green W-5 to ideally the support zone at $18200-400, respectively.

A move below Monday’s low will confirm the green W-5 of the larger red W-a/i. From there, the red W-b/ii back to ideally a 50-76.4% retracement of the red W-a/i must be anticipated: $19300-800. Once the multi-week countertrend rally, W-b/ii, completes a “devasting” W-c/iii should start, which could target as low as $15600 depending on where the red W-b/ii will top and the Fibonacci relationship between W-c/iii and W-a/i: C/iii = 1.00 to 1.618x a/iii.

Our alternative scenario, which is our insurance policy, so to say, will kick into effect if the index does not move below Monday’s low but bottoms out at around $18800+/-50 and rallies back above today’s high.

In that case, we will look for $20150+/-50 to be reached for a more protracted, complex red W-b/ii, from where the red W-c/iii can still take hold. However, in that case, we expect it to reach as low as $17000 instead. For now, that remains our alternative, and our focus is on completing the impulse lower.