On Thursday, U.S. stocks failed to rebound, with the Nasdaq 100 and S&P 500 extending Wall Street's latest Big Tech sell-off, driven by fears that the artificial intelligence trade might be losing momentum.

The S&P 500 dropped 51 basis points, while the Nasdaq 100 declined by over 1%. Despite these losses, the market saw more gainers than decliners, with 289 stocks in the S&P 500 rising compared to 211 falling, a trend that has persisted for months.

After falling initially, the Nasdaq 100 Futures bounced after the opening as the USD/JPY pushed higher. But that wasn’t enough to save the Nasdaq from a late-day sell-off.

It left the Nasdaq 100 pretty much just above a support level of around 18,650. So one could imagine that if the USD/JPY should break that 152 level, the NASDAQ could potentially break that 18,650 level which opens a door to 17,540.

The absolutely insane thing is that the NASDAQ has fallen 9% since July 10, and would need to fall 25% more to get back to the October 2023 low.

That was 9 months ago? It isn’t like the economic outlook dramatically improved, or like the Fed has even cut rates.

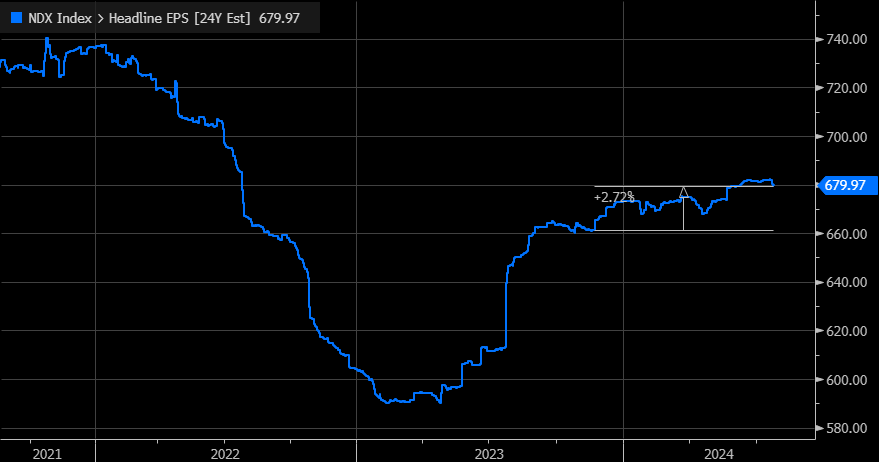

Maybe that's because Nasdaq earnings estimates for 2024 have risen a whole 2.7% since October. So if earnings aren’t improving and the market is rising it means that the entire gain for the Nasdaq 100 in 2024 has been on multiple expansion, a higher PE ratio. That is a lot of multiple expansions. But who knows, maybe the NASDAQ earnings estimates have formed a cup-and-handle pattern and are due to break out to the upside.

Better-Than-Expected GDP Prevents Bigger Selloff

I think yesterday would have been much worse had it not been for the better-than-expected GDP print. You could see it across the FX pairs in the yen; it looked like it was ready to break major support. The USD/JPY hit support yesterday at that 152 region, bounced right off it, and got a big boost from the GDP report at 8:30.

If GDP had missed estimates, dollar selling would have likely intensified, and the USD/JPY would probably have blown through that support level at 152. Once through 152, there isn’t much stopping the USD/JPY from falling through 150 and heading into the mid-140s. So, for now, at least, support held, and we will see what today will bring.

S&P 500, USD/CAD Correlation Signals a Bottom for the Index

Once again the USD/CAD testing resistance is at 1.385, for now, the 5 time. Maybe this time the drive for five will work out, and the USD/CAD will bust through resistance and make a move for 1.40. I’m not sure, but the S&P 500 index has put in some big bottoms every time the USD/CAD has gotten to 1.385 and then retreated.