- US futures rebounded after a Wall Street tumble driven by a hawkish Federal Reserve meeting and disappointing earnings from tech giants.

- Does this week's drop signal a temporary top in equity indexes or could the dip-buyers will swiftly drive to fresh record highs?

- Meanwhile, Nasdaq 100 futures have rebounded following a 2-day drop and it could continue considering the prevailing bull trend.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

US futures rebounded alongside a slightly firmer tone in Europe on Thursday, after Wall Street took a tumble on Wednesday following a hawkish Federal Reserve meeting and poor earnings from Alphabet (NASDAQ:GOOGL) and Advanced Micro Devices (NASDAQ:AMD) that took some shine off the A.I. rally.

The S&P 500 suffered its worst day since September and sharp falls were witnessed for the other major indexes such as the Dow and Nasdaq.

Several short-term support levels were taken out in the process, with the Dow Jones forming a bearish outside day, albeit at its record high, and the Nasdaq extending its drop from severely overbought levels.

The key question for traders is whether the drop this week will mark at least a temporary top in equity indexes, or will the dip-buyers step right back in to drive the major indexes to fresh record highs.

After all, the trend is still technically bullish, following a sharp 3-month rally that lifted the major US indexes to unchartered territories.

Powell-triggered selling takes the shine off AI-drive rally

Following the release of mostly positive data since the FOMC’s last meeting, the Fed was always going to push back against overly optimistic rate cut bets.

Chairman Jerome Powell tried his best to reset expectations for how soon and how fast the FOMC will cut rates this year at the press conference.

While Powell did acknowledge the fact that the Fed is shifting its focus on easing policy this year, they won’t be in any sort of rush to do this.

If the rally was mostly driven by speculation over a sharp drop in interest rates, then following the Fed’s hawkish meeting, investors may think about applying the brakes on the rally that has propelled Wall Street stocks to record highs in recent week.

There are also some concerns that the A.I. hype was getting a bit too much.

Last week it was Intel (NASDAQ:INTC) that provided a gloomy forecast, while this week saw stocks of Alphabet, AMD, and Microsoft (NASDAQ:MSFT) drop following their earnings results and updates.

January Barometer points to a positive 2024 for stocks

Still, the bulls will argue that regardless of the short-term direction of stock prices, 2024 will be another positive year. They will point to the fact that the direction of January often dictates the directional bias for the rest of the year.

As per Bloomberg, citing Stock Trader’s Almanac, the theory of a phenomenon known as the “January Barometer” suggests that if stocks rise in January, they’ll be poised to finish the year higher, too.

Data going back to 1938, suggests the January Barometer has been right about 74% of the time.

Nasdaq 100 technical analysis and trade ideas

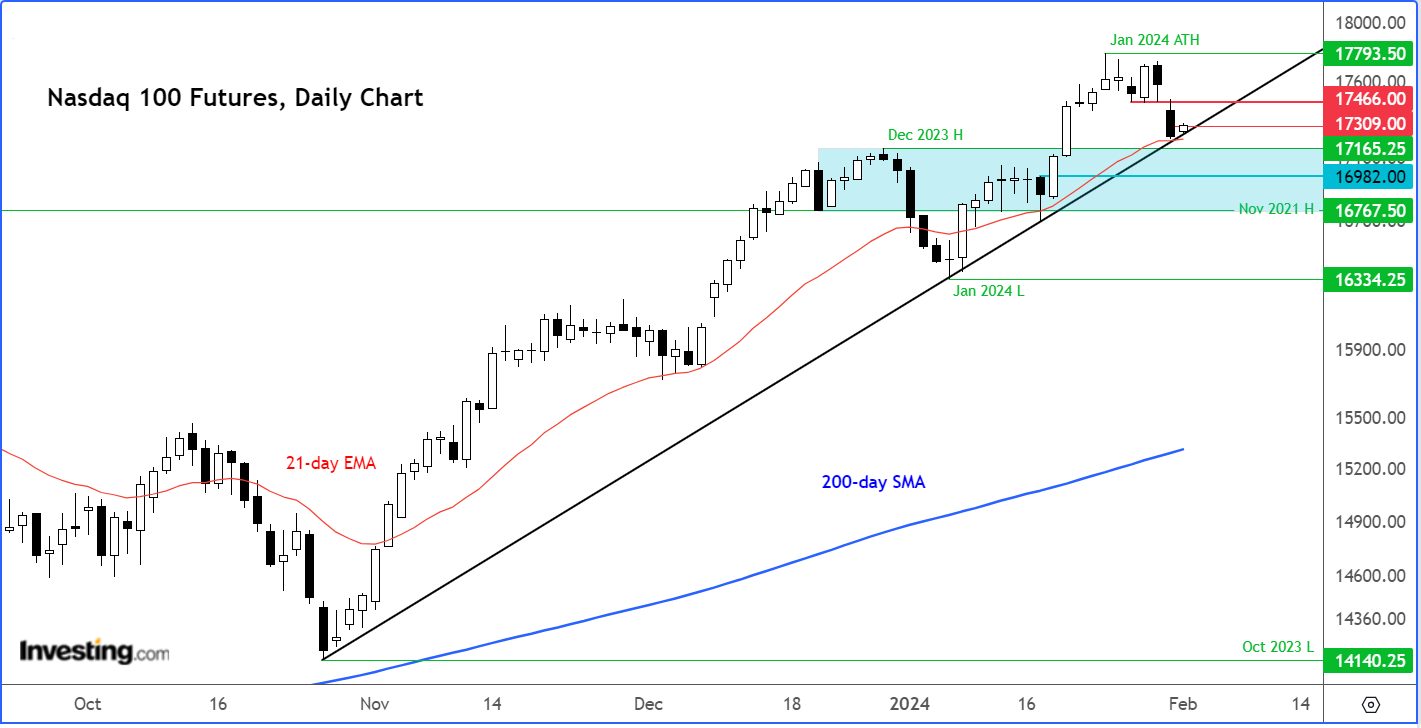

After a two-day drop, the Nasdaq 100 Futures have now arrived, and bounced, from the first key support area around 17220/30.

This is where the bullish trend line which has been in place since November, meets with the 21-day exponential moving average.

Given the steep bullish trend, it is hardly surprising to see a bounce here, even if it turns out to be a temporary stop.

Below this area, we have a cluster of support marking the previous all-time highs made in December of last year and in November of 2021, at 17165 and 16767 respectively.

In between these two levels is the base of the bullish breakout that started in the middle of January at 16980ish is another potential support level where the index may at the very least bounce from.

There are now at least two areas of resistance to watch on the upside, which the bears will need to monitor and defend if they want to exert more pressure.

The first one was being tested at around 17310 at the time of writing, correspondingly to an intraday level which you won’t be able to see on the daily time frame.

The bears wouldn’t want to see too deep a retracement, so for them, it would be an ideal scenario if the selling pressure were to resume around this area.

The second level of potential resistance is at the 17465 area, which was support for a few days before Wednesday’s drop.

This level was already tested on Wednesday, so it will take a lot of effort from the bulls to lift the market back up to this level before we potentially see a bit of a deeper pullback.

All told, the mid-week sell-off has not yet caused any major technical breakdown in this bullish trend.

Key support areas are still below market, where we might see the market stage its next up leg. Until such a time we see a lower low, it is important not to get too excited by this week’s drop if you are a bear.

But the drop does serve as a reminder that the markets can go down as well as up. Risk management should therefore never be forgotten regardless of how confident one is in the market’s direction.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 952% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here for up to 50% off as part of our year-end sale and never miss a bull market again!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and by-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.