As the second quarter dust settled on Wednesday’s markets, Henry Hub futures on the New York Mercantile Exchange stood atop the commodities heap with a 43% gain.

While natural gas bulls unabashedly toasted the blockbuster win, some discerning analysts caught what starry-eyed longs in the market had missed (or probably noticed but waived away in their euphoria)—for the first time in seven sessions, prices were unable to break out of their trading range to set a new definitive high for the day.

Wednesday’s peak for the front-month gas futures on Henry Hub was $3.8114 per mmBtu, or million metric British thermal units. It marked a 2-½ year high, being the loftiest level since the December 2018 peak of $4.666. Yet, on closer scrutiny, it was virtually unchanged from Tuesday’s high of $3.811.

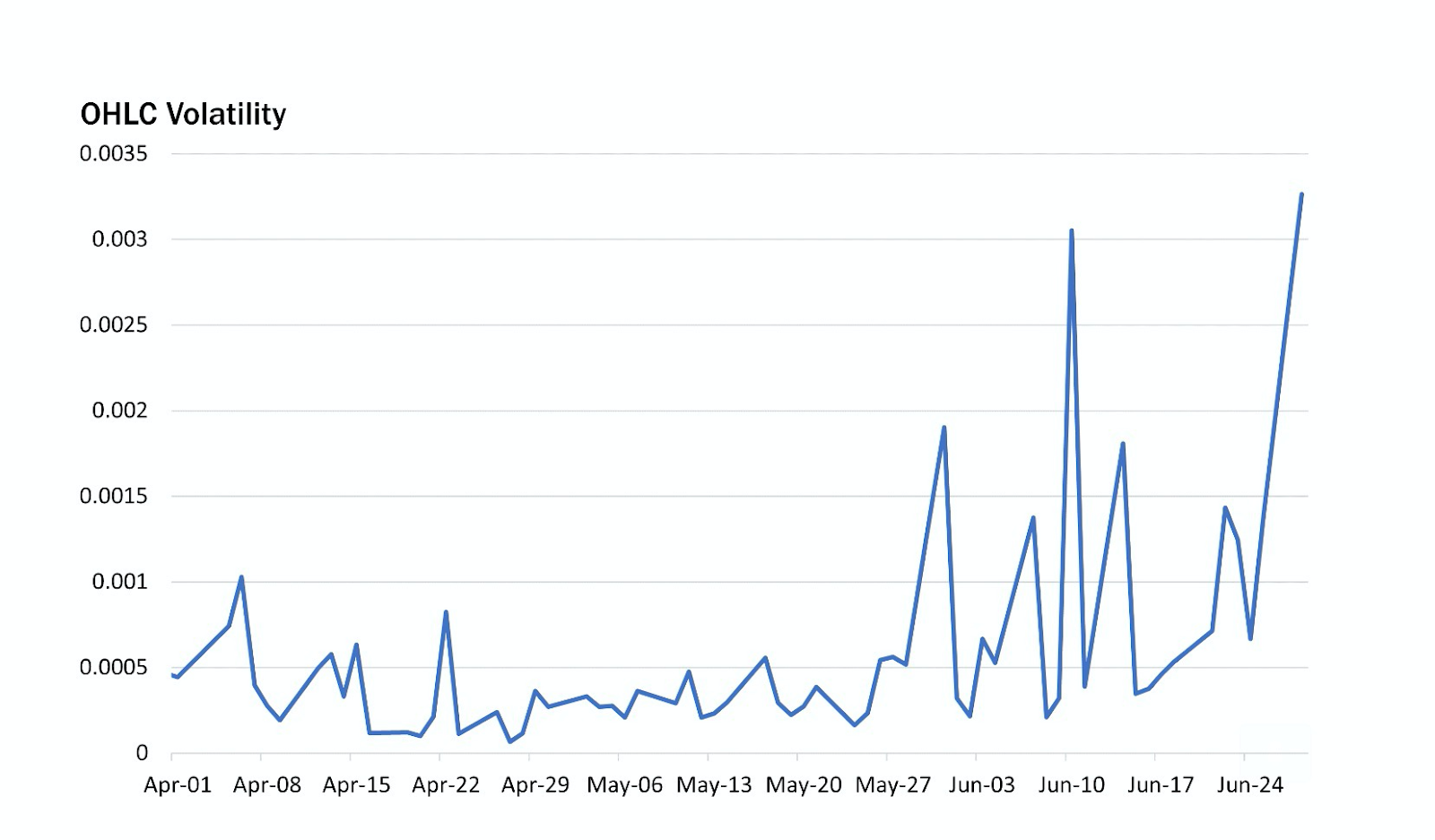

To some gas analysts, it meant that volatility—an inherent nature of this market that has been conspicuously missing for some time, to the surprise of its long-time followers—might be coming back in a bigger way.

Fatigue From One-Way Prices vs. Summer Heat

That ultimately raises the question: after a blowout second quarter, does this natural gas rally still have legs?

Or, more precisely, will the rally be running on slightly slower legs after this, given the natural fatigue from one-way price direction juxtaposed against forecasts for runaway summer heat across the United States?

Dan Myers of Houston-based gas markets consultancy Gelber & Associates was among analysts mulling the permutations for gas prices after Wednesday’s outcome.

“Despite an early 12-cent move upward in the morning, prices were unable to break out of yesterday’s trading range,” Myers said in a note circulated to clients of the consultancy and shared with Investing.com.

All charts courtesy of Gelber & Associates

OHLC (Open-High-Low-Close) volatility is a measure of historical volatility in natural gas that records account differences in a day’s entire trading range.

Contrary to the casual observer’s eye, trading-range volatility has actually been higher since the start of April, Myers said—although daily outcomes were almost always positive, leading to a 12% gain in April, 4% in May and nearly 20% in June.

Notwithstanding this, spot prices of gas, which are markers for utility pricing, have followed the action of futures on Henry Hub, remaining elevated, he noted.

“Out of the 100 basis locations that Gelber & Associates monitor, all of them have increased by an average of $1.17/MMBtu since Apr. 5, the beginning of the current price rally.”

In other parts of the country, record-breaking June heat has pushed Southern (NYSE:SO) California’s Socal and Chicago’s Citygate gas prices up beyond $7 along with other regional spot prices.

In the Northwest, however, price hikes have been more tempered, shadowing Henry Hub levels at around $3.72, despite the heat in that region too.

International Gas Prices Up Too

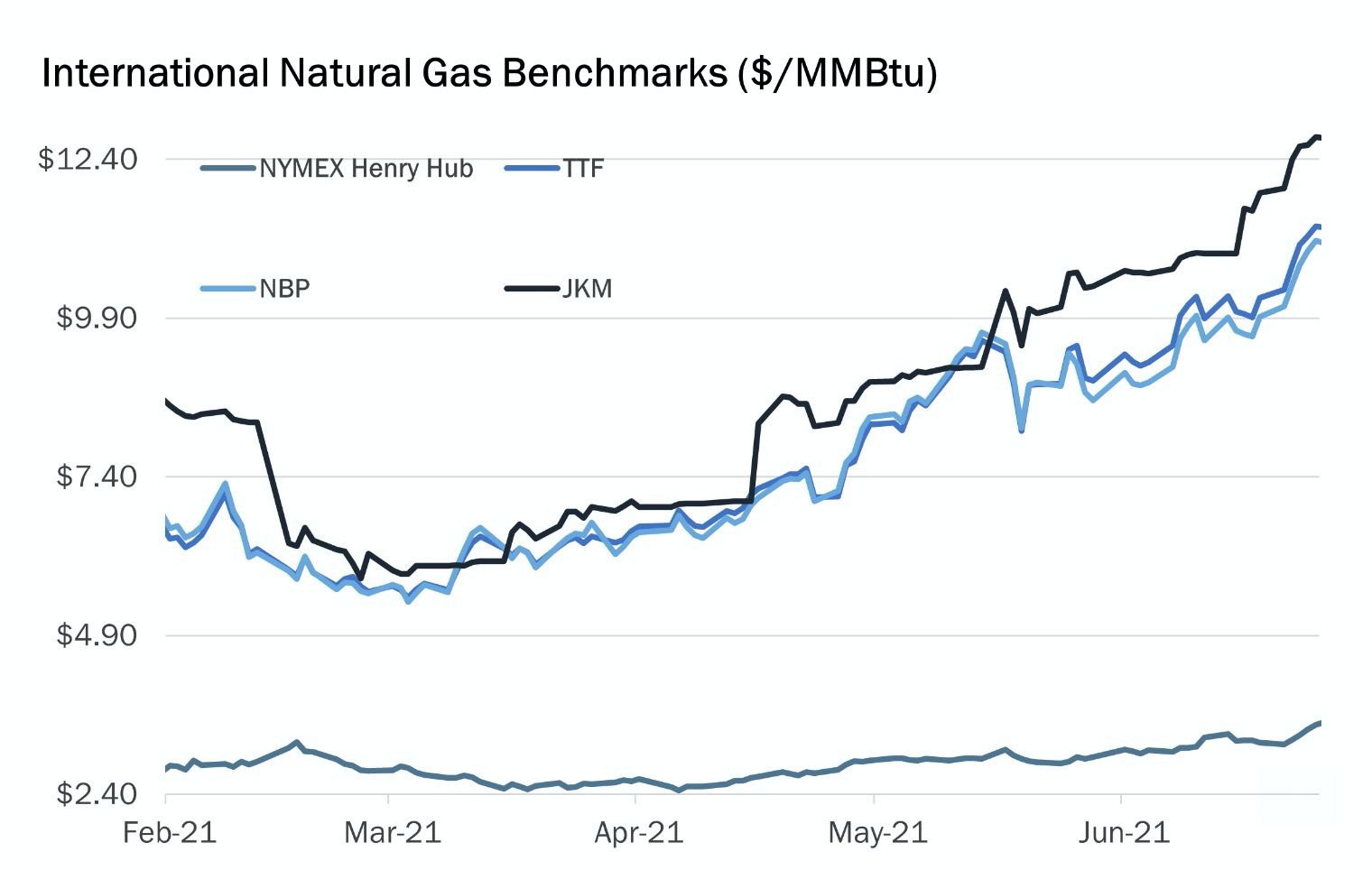

Gelber & Associates’ research also shows that international natural gas benchmarks have also soared since February.

The JKM, or Japan/Korea Marker, has risen to over $12 per mmBtu, while its European peers—the UK-based NBP, or National Balancing Point, and the Netherlands’ TTF, or Title Transfer Facility—have increased beyond $11 per mmBtu.

The move upward was largely driven by low national storage levels for gas, as well as strong incoming demand for the summer.

As for US gas storage levels, last week may have been the third straight time that inventories have risen—if forecasts from analysts tracked by Investing.com are right.

US Gas Injections Into Storage Nearing Normal

The Energy Information Administration’s weekly storage report on natural gas, due at 10:30 AM ET (14:30 GMT) today, should show a near-normal injection of 68 bcf, or billion cubic feet, into inventories for the week ended June 25. In the previous week to June 18, utilities added 55 bcf of gas into storage.

A year ago at this time, there was a weekly injection of 73 bcf, while the five-year (2016-2020) average injection was 65 bcf.

If analysts’ gas storage estimates for last week are on target, the injection during the week ended June 25 would take stockpiles up to 2.55 tcf, or trillion cubic feet, some 5.6% below the five-year average and 16.9% below the same week a year ago.

According to a temperature reading by data provider Refinitiv, last week’s conditions were warmer than usual, with 76 CDDs, or cooling degree days, versus a 30-year average of 72 CDDs for the period.

CDDs are used to estimate demand to heat homes and businesses, measuring the number of degrees a day's average temperature is above 65 degrees Fahrenheit (18 degrees Celsius).

EBW Analytics Group and NatGasWeather—concluded that the pattern in July looked to be “very hot.”

“Three weeks of very hot weather are still predicted nationally” beginning on Monday (July 5) and then spreading east, EBW analysts said.

“The market might look past the holiday drop in demand, keeping prices high. At least some profit-taking is likely, though, before the week ends.”

NatGasWeather pointed out that it was not only just temperatures that were driving gas prices higher.

Supply/demand balances were tighter on Wednesday versus Tuesday because of a drop in gas production in the Lower 48 US States, along with a rise in power burns to nearly 40 bcf, it said.

The forecaster added:

“Of course, it helps weather patterns remain hot enough to be considered bullish July 6-14, and likely longer. We also need to watch for the potential of a tropical cyclone tracking through the Caribbean this weekend, as it has the potential to become a threat to the US after.”

An extreme heatwave shattered temperature records across the US Southwest last month and pushed power systems to the brink of failure as homes and businesses cranked up air conditioners.

On the LNG, or liquefied natural gas, front, exporters remain relatively unfazed from the hike in Henry Hub prices as their margins continued to expand from increasing international rates for gas.

Arbitrage margins between US LNG and internationally-landed gas, estimated at $4-$5 per mmBtu a month ago, are pushing toward $6 now.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.