- Hedge funds’ one-step back, two forward help prevent market capitulation

- Despite cooling in European gas prices of late, bulls bought Henry Hub’s dips

- Consolidation above $9 can help break above $9.50 and run back to $9.80-$10

The one-step-back-two-steps-forward play in natural gas suggests that the deep-pocketed hedge funds in the sector are doing all they can to prevent a market capitulation, despite unsupportive weather and production heading their way.

Wednesday’s trade resulted in a 1.5% gain for gas futures on the New York Mercantile Exchange’s Henry Hub, after the previous day’s 3.3% slide.

Likewise, the market advanced 3% net in the four days prior to that, after conceding 0.8% in one of those days.

Leticia Gonzales, analyst at Natural Gas Intelligence outlined:

“Given the back and forth swings along the front of the futures curve midweek, the gas market appeared to be close to turning the page—at least temporarily—on the rally that pushed gas prices above $10 in recent weeks.”

But despite the cooling in European gas prices that were the basis of the two-month long rally, “bulls have done what they’ve done each of the past few months and bought the dip anytime prices slide lower,” noted Gonzales.

As trading for August closed on Wednesday, the front-month contract on the Henry Hub finished up 15%, extending July’s 46% run.

Alan Lammey, analyst at Houston-based gas markets consultancy Gelber & Associates said:

“Market bulls are finally beginning to acknowledge the swell of bearish catalysts that are becoming increasingly hard to ignore.”

Yet, the current technical momentum on the Henry Hub might prevent a break below $9 pricing.

According to Sunil Kumar Dixit, chief technical strategist at SKCharting.com:

“Consolidation above $9 can cause renewed attempts to break above $9.50 and head towards $9.80 & $10.

“A stronger bull run will, however, require more assertive consolidation above the $10 mark, which, if confirmed, can trigger the first leg of a massive rally with initial targets reaching $12.”

“In order to break the bull momentum, you’ll need a rejection from $9.50 to push gas to revisit $8.50 & $7.80. But even this can be used to gather new momentum for the bigger move up.”

Fundamentally, the story for gas isn’t getting any better.

In addition to cool and rainy weather across much of the southern tier of the US, including Texas, major weather forecast models are showing largely warm and mild conditions across the northern tier of the country.

From a longer range perspective, the Global Forecast System (GFS) and the European Centre for Medium-Range Weather Forecasts (ECMWF) models indicate that September, and particularly October, may produce some notably bearish temperatures across the bulk of the nation.

US dry gas production has remained stable at near record highs with volumes slightly above 98 billion cubic feet daily for three consecutive days before pulling back somewhat on Tuesday amid typical maintenance operations.

Lammey of Gelber & Associates explained:

“It’s becoming increasingly clear that the trend in production is upward, and it wouldn’t be out of the question for volumes to test or exceed 99 bcf/d in the weeks ahead.”

“Should all of these price-setting mechanisms persist along with growing weekly gas storage builds, the bigger picture suggests that NYMEX front-month gas futures should see a significant correction to the downside over the course of the next couple of months, with prices aiming at $6.00 or lower.”

Natural Gas Intelligence noted that increased global ties have contributed to much of the US price surge throughout this summer, with Europe working to replenish storage inventories left drained after a cold winter. The continent also is aiming to wean itself off Russian supplies, which have fallen dramatically following its invasion of Ukraine. Combined with hot summer weather in Europe, as well as in Asia, record-high gas prices spilled over into US markets that also face low inventories.

European gas prices have tumbled off late, recording their biggest drop since April, according to Rystad Energy. The decline has been attributed to healthy storage levels in Germany and the rest of the continent.

Rystad senior analyst Wei Xiong said:

“European gas markets are taking a sigh of relief after aggressive purchasing for LNG cargoes and piped gas resulted in storage inventories being filled faster than European Union targets.”

“Europe is in full bunkering mode and taking no chances with Russian supplies heading into the winter.”

According to Rystad, Germany’s underground storage is nearly 83% full, exceeding the five-year average. As injections have been faster than expected, Germany expects its gas storage to be 85% full by early September—ahead of a previous target of October. Europe’s overall storage levels are also healthy, reaching an average of 80% full, which was the November 1 target.

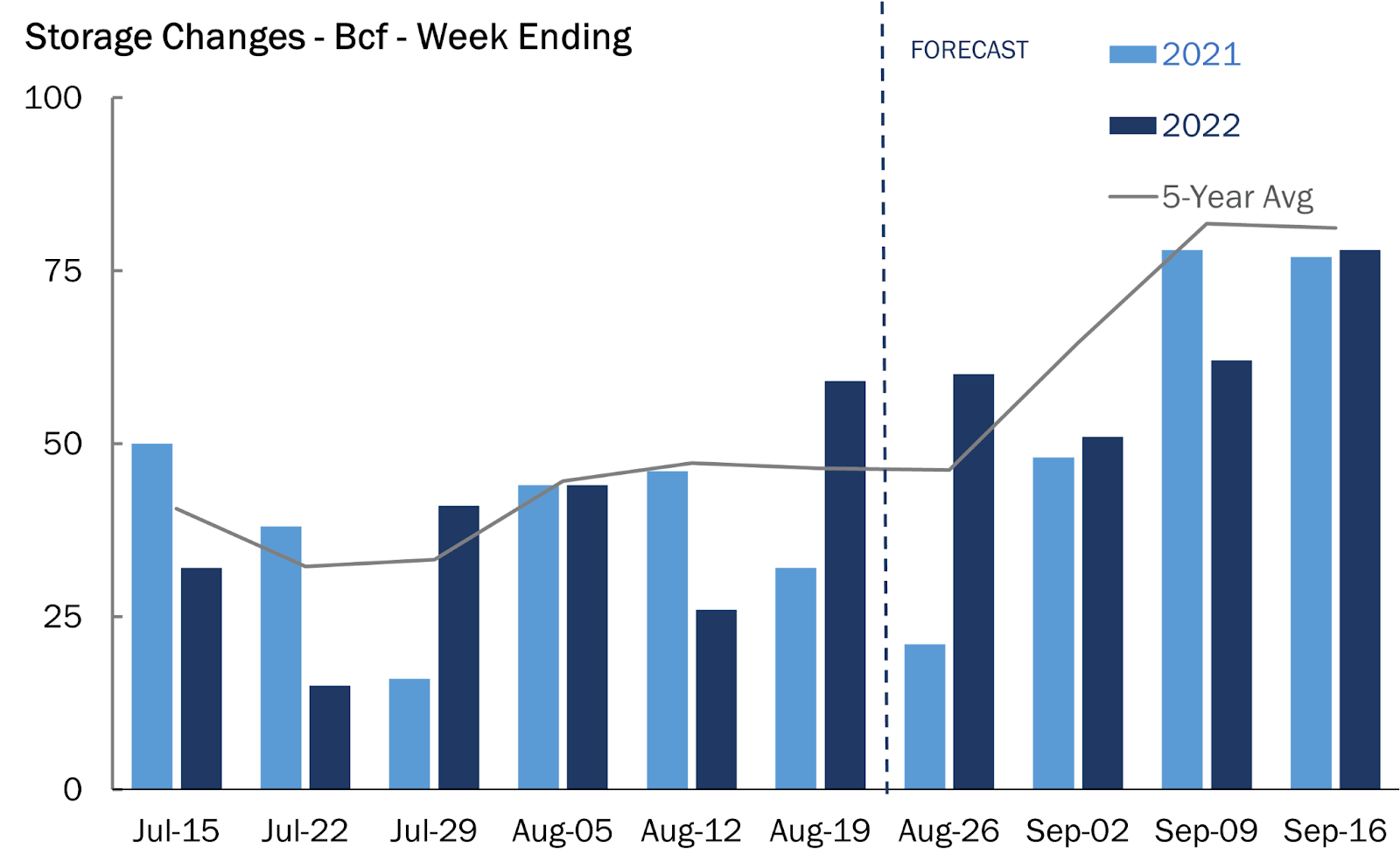

Source: Gelber & Associates

The rise in storage stocks, in part, has soothed supply concerns over maintenance on the Nord Stream 1 gas pipeline from Russia, according to Rystad. Gazprom (MCX:GAZP) on Wednesday shut off NS1 flows through Friday for the planned work. However, a risk remains that flows may not return on schedule.

On the US storage front, analysts tracked by Investing.com expect the Energy Information Administration to report a build of 58 billion cubic feet during the week ended August 26 versus the prior week’s 60 billion.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.