- Gas bears need cold to arrive faster and convincingly to keep Henry Hub above $3

- Inflation, labor shortage, and materials scarcity have bumped up extraction costs for gas

- But sheer plunge in futures pricing, already down 20% in 2023, can still shock

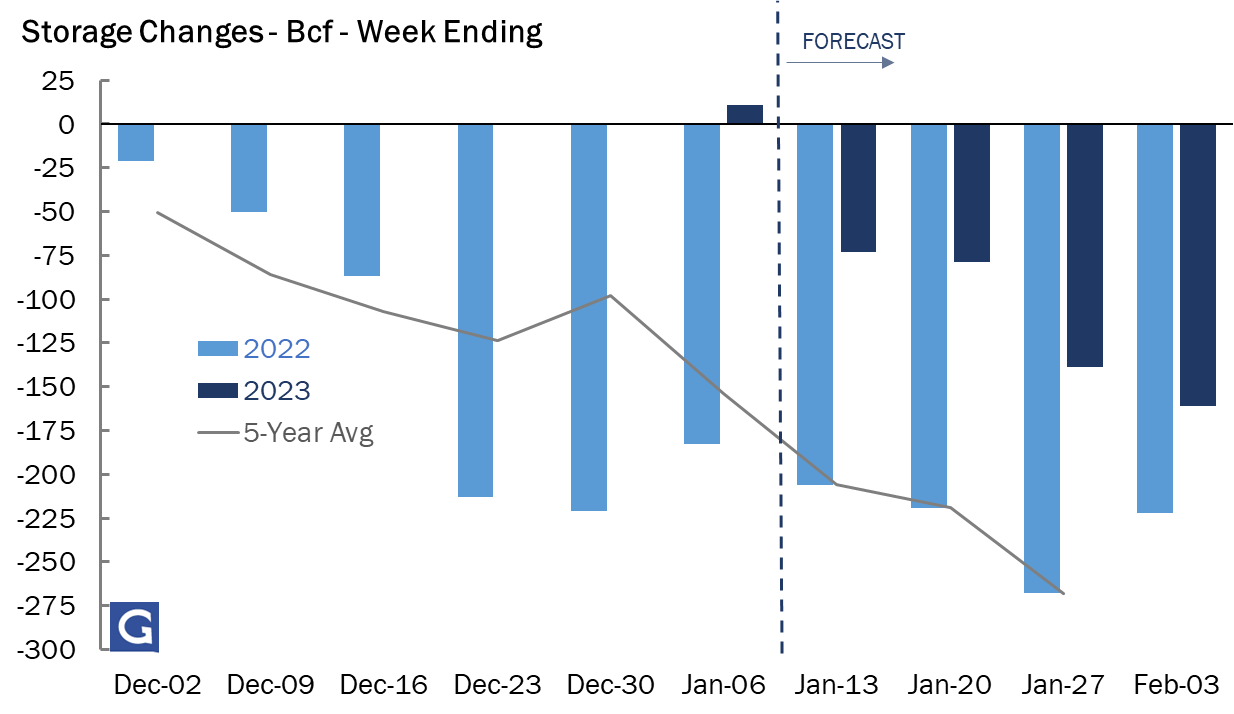

- Trade expects a 71 bcf draw from gas storage last week after the prior build of 11 bcf

“The days of inexpensive gas funded by investors willing to burn their own cash are over,” Bloomberg energy analyst Liam Denning declared back in August as natural gas hit $10 per mmBtu, or million metric British thermal units, for its first double-digit price since 2008.

Denning noted then that gas futures across New York Mercantile Exchange’s Henry Hub futures were “mostly above $5 for years out” due to hot, muggy weather that made last year’s summer unbearable without air-conditioning.

It was also weather that drove the front-month gas contract on the Henry Hub to a 19-month low of $3.27 on Wednesday. This time though, it was unseasonably warm weather that was helping Americans get past the early days of 2022/23 winter with little — or even no — indoor heating, a dynamic that was making life quite unbearable for gas bulls.

It’s not just the weather. Record production of gas in recent months has created stockpile security for the fuel not seen over the past 18 months. Pricing-wise, those developments are keeping gas futures for all of 2023, except December, under $4 as there are few bets as of now that supply will seize up in the coming summer or at least until the start of winter 2023/24.

Talk about nature playing it both ways.

In 2022, it was explosive price action that sent the Henry Hub to not only $10 per mmBtu but also gas in Europe to record highs of €321 per megawatt-hour from under €30 (€1 = $1.0821) a year ago as weather extremities added to the blockade on Russian supplies in the aftermath of the Ukraine war.

Now, it is implosive price action that’s threatening to send US gas futures below the key $3 support for the first time since May 2021, with market bulls in a race against time in their hope that sufficient cold weather arrives quickly enough to rescue them from such a predicament.

Some are also wondering about the validity of Denning’s proclamation that “the days of inexpensive gas funded by investors willing to burn their own cash are over.”

While inflation, labor shortage and materials scarcity have bumped up extraction costs for natural gas with the advent of the coronavirus pandemic, futures on the Henry Hub can still tumble beneath the wildest expectations of gas bulls, as the past month has shown.

Invoking Mother Nature

Thomas Saal, senior vice president of energy at New York-based energy broker StoneX Financial Inc, said in comments carried by naturalgasintel.com:

“Mother Nature is pretty mild right now, and without a change, it’s looking like a relatively warm winter. Now, there’s a lot left of the season, but for the most part, the market is waiting to see. And in the meantime, there’s plenty of supply, and that’s weighing on prices.”

Houston-based energy trading consultancy Gelber & Associates also invoked “Mother Nature” in comments aimed at its clients in natural gas, saying if she “throws gas markets bulls a bone, buyers will run into some resistance at around $3.80 per mmBtu.”

Should the Arctic intrusion be as intense as some weather forecast models are touting for February onwards, “then it wouldn’t be out of the question for buyers to test the $4.00/mmBtu to $4.50/mmBtu zone.”

On the flip side, if weather models had to backpedal on their forecasts, “it would likely set the stage for a move down to the $3.20s/mmBtu range or lower,” Gelber said.

Gas bears, of course, expect even lower levels, with $2.50 being the trough expressed by some in that constituency before a strong colder-weather-backed rebound sets in. For what it’s worth, US gas futures are down about 20% since the beginning of 2023 and off 15.5% when viewed on a year-over-year basis.

The near-term outlook for the weather is mixed and even confusing.

Major weather forecast models, including the US-based Global Forecast System, or GFS, and Europe’s ECMWF model, expect a colder near-term temperature outlook by the final week of January. Above-normal Gas-Weighted Degree Days (GWDDs) are also expected to emerge around January 25 and possibly linger well into February.

Even so, the GFS is downplaying the intensity of the looming winter weather event and is depicting a rather average Arctic air mass instead of the impressive chill that swooped as far south as Houston, Texas, in late December, ushering in temperatures in the teens.

Other weather models, such as the Canadian (GEM) and the CFSv2, are factoring in Siberian temperatures that are 80 degrees below zero that could plunge deep into the US. The amount of GWDDs for the period of January 18-31 is the third most for the period in the last five years, which is a notable improvement from the first half of January, which saw record mild temperatures in most regions.

Forecaster NatGasWeather said Wednesday in a blog that ran on naturalgasintel.com:

“Overnight data maintains very light national demand the next three days, light this weekend into the start of next week, but still strong demand Jan. 26-31. However, the outlook in the latest model runs was simply not as impressive with the amount of cold into the US and also not as aggressive in advancing subfreezing air into the southern and eastern US.”

Amid those wildly fluctuating forecasts, traders are also bracing for what the US Energy Information Administration could report as the latest weekly draw by utilities from the national gas storage for heating purposes.

Source: Gelber & Associates

A Reuters poll on Wednesday showed utilities likely pulled 71 bcf, or billion cubic feet, from storage last week, less than half of levels typical for this time of year, as mild weather reduced heating demand.

There were around 152 heating degree days (HDDs) last week, which is fewer than the 30-year normal of 194 HDDs for the period, according to Reuters-affiliated data provider Refinitiv. HDDs, which are used to estimate demand to heat homes and businesses, measure the number of degrees a day’s average temperature is below 65 degrees Fahrenheit (18 degrees Celsius).

The latest draw will compare with the 203 bcf pull during the same week a year ago and the five-year (2018-2022) average decline of 156 bcf from storage. In the week ended Jan. 6, utilities added 11 bcf of gas to storage. That was the only storage injection during the month of January on record, according to federal energy data.

The forecast for the week ended Jan. 13 would leave stockpiles at 2.831 trillion cubic feet — some 1.6% above the five-year average.

Despite the lack of strong weather and fundamentals-based support, gas’ technical charts indicate the market could not only survive the $3 test but also rebound closer to $4 levels.

“As prices keep dropping, gas stochastics have been under extreme oversold conditions,” said Sunil Kumar Dixit, chief technical strategist at SKCharting.com.

“This calls for a bounce back from the support areas of $3.29 and $3.18. On the upside, we expect prices to stabilize for resuming recovery towards $3.55, followed by $3.77 and $4.05.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.