Call it the black swan event of natural gas.

Just like how COVID-19 totally threw the world off guard, the Artic freeze that’s paralyzed part of the energy production in Texas has caught the US energy capital completely unprepared.

Horror story media reports of millions of Texans struggling without heat and electricity after the worst snowstorm in 30 years in the typically sweltering state. While those with power are having to pay thousands of dollars as their utility bills skyrocket.

But that’s not all.

An Occurrence As Rare As A Pandemic

Prompt prices of natural gas are already at $4 per mmBtu, or per million metric British thermal units, at some hubs. And the entire one-year calendar strip on NYMEX’s Henry Hub futures, from March 2021 to March 2022, has flipped to above $3—an occurrence as rare as a pandemic itself.

The last time Henry Hub gas got to $4 levels was between November and December 2018, when it traded at highs of between $4.50 and nearly $5.

At Thursday’s pre-New York open, Henry Hub’s front-month March gas hovered not far from the previous session’s 3-½ year high of $3.316. Natural gas futures are already up almost 30% year-to-date, running parallel with the gains in gasoline, the biggest beneficiary thus far from this year’s energy rally.

To get to $4, Henry Hub futures need to rise another 25% from current levels. A lot may depend on how quickly the Texas situation is rectified and that might be a big ask. On Tuesday, after snow blanketed the state, Governor Greg Abbott announced that natural gas was freezing in the pipeline and freezing at the rig.

Natural gas is the fuel that heats the majority of homes in Texas and powers a substantial portion of the state’s 680 electric generating plants. And gas pipelines, rigs and production equipment in Texas were not hardened to handle the cold, just as the generation and transmission infrastructure under state power grid ERCOT wasn’t “winterized.”

Gas Supply Across US Also Worrying

Even if the Texas situation improves rapidly, there is gas supply for the rest of the country to worry about.

Data compiled by Bloomberg and naturalgasintel.com showed output dipping to 72 billion cubic feet per day by Wednesday, “a level not seen consistently since January 2017,” according to NGI Director of Strategy & Research Patrick Rau.

For perspective, gas output from the lower 48 states was above 90 bcf per day just 10 days ago on Feb. 5.

Another supply shock from the current Arctic event could tip Henry Hub futures toward $4 and beyond.

Scott Shelton, energy futures broker at ICAP in Durham, North Carolina, said “cash market explosiveness” in the Midcontinental and Texas markets has given optimism for Henry Hub’s front-month March contract, identified by the NGH21 symbol, to keep grinding higher. Adds Shelton:

“Prompt prices at +$4 for Feb Hub and $3.30 for the last week of February suggests that NGH21 now has upside and just needs the 11-15 day to start looking like the 6-10 day.”

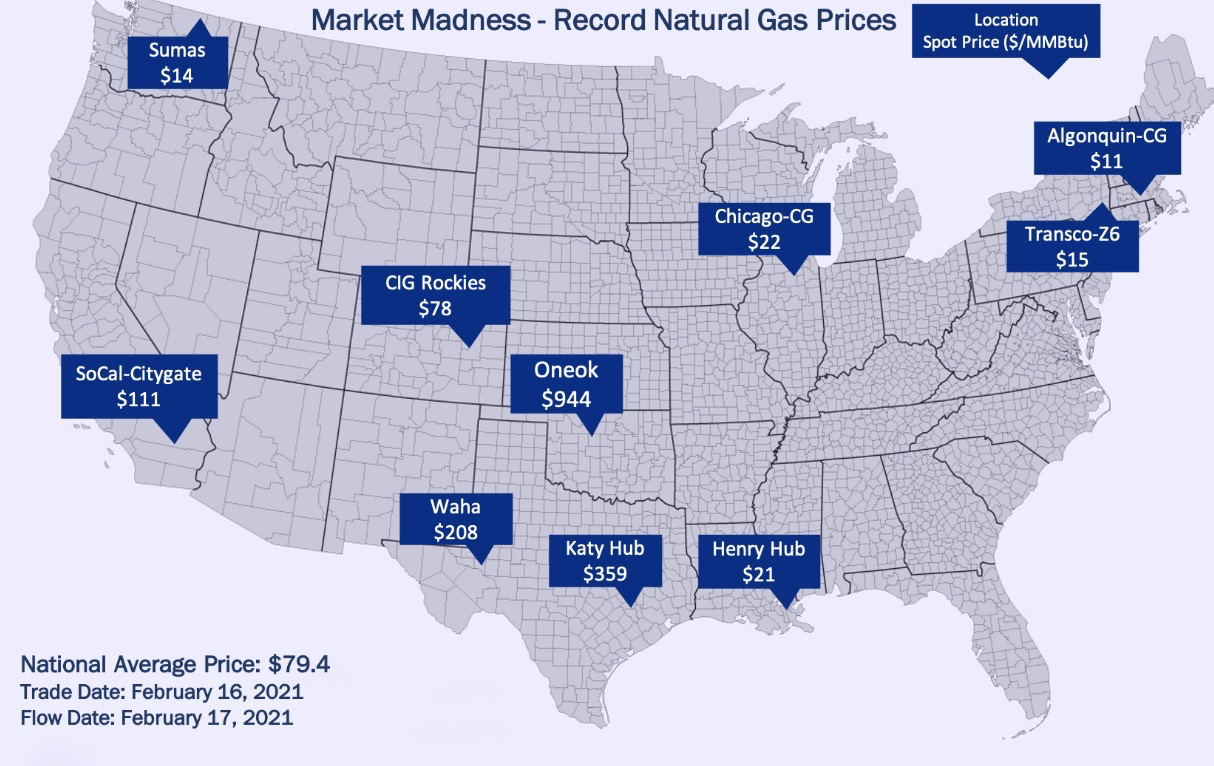

Market Madness

Houston-based Gelber & Associates, which serves as a consultancy in gas market risk, characterized the supply-demand situation as “Market Madness” in an email on Wednesday to its clients and Investing.com:

“The madness in the natural gas market continues, with production estimated under 75 Bcf/d today, below 2018's levels in a severe, near-20% reduction since last week.”

“Residential and commercial demand is beginning to come off its peak from earlier in the week but remains very elevated. Total seasonal residential and commercial, industrial, and power demand were estimated at what could be an all time high above 135 bcf per day on Monday.”

Chart courtesy Gelber & Associates

The Gelber note concurred with ICAP’s Shelton that Midcontinent and Texas dominated Wednesday’s price action in physical gas, citing Kansas and Oklahoma spot prices above $500/mmBtu and Oneok at $1,250.

Yet, some conflicting readings on the weather suggested that a thaw in temperatures may be setting in. Naturalgasintel.com said in a blog that “the worst of the coldest temperatures have passed as conditions gradually moderate in the days ahead.” The forecaster added that rather than lows plunging as low as minus 20 degrees, the region could see overnight temperatures from sub-zero to the 30s.

There is some discrepancy, however, in the Global Forecast System model and its European counterpart, which is “neutral to potentially a touch bearish,” according to the most recent run.

NatGasWeather added:

“But we do caution, the start of March needs close watching because it wouldn’t take much of a colder trend for the pattern to quickly look more intimidating, although any further milder trends and the pattern would take on a rather bearish stance.”

In between the market’s attention on the storm comes Thursday’s weekly gas storage report from the US Energy Information Administration at 10:30 AM ET (15:30 GMT).

Gargantuan Draw Expected

Industry analysts tracked by Investing.com expect the EIA to report a gargantuan draw 252 bcf for the week ended Feb. 12—some 47% higher than the 171 bcf burnt during the previous week to Feb. 5 for heat and power generation.

If accurate, it would be the highest storage draw since the all-time high of 359 bcf from 2018.

One other thing that’s making less news in gas this week, though it’s very much in the scheme of the news in gas: LNG, or liquefied natural gas.

LNG terminals in Texas slashed demand after Governor Abbott asked exporters to curb operations in order to help ERCOT avoid an even more dire system outage, naturalgasintel.com reported.

Freeport LNG shut down the second and third production units at the facility on Tuesday, the company said in a regulatory filing. The first train was shut on Monday because of freezing conditions that affected a pretreatment facility.

Cheniere Energy (NYSE:LNG) also is said to be diverting vessels away from Corpus Christi to Sabine Pass in an effort to curb electricity use. Meanwhile, power was restored at Cameron LNG in Hackberry, LA, which is working to ensure it can safely restart operations.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. As an analyst for Investing.com he presents divergent views and market variables.

Comments are welcome and encouraged. Inappropriate comments will be reported and removed.