- Dollar’s rally of over 25% is making investment magazine covers

- Some technicians calling a potential peak in sentiment and a bearish price reversal

- DXY trend remains high and Fed likely focused on USD's impact on global markets

Did you enjoy this past weekend? Maybe you relaxed with a hot cup of joe, a pumpkin spice donut, and your Sunday morning edition of Barron’s.

If so, you were greeted with a macho-looking George Washington on the cover. 'The Powerful Greenback' was the title of the feature story underscoring just how ‘strong like bull’ the US Dollar Index has been over the last year-plus.

Dollar Strength: Commanding Headlines And Magazine Coverage

Source: Barron’s

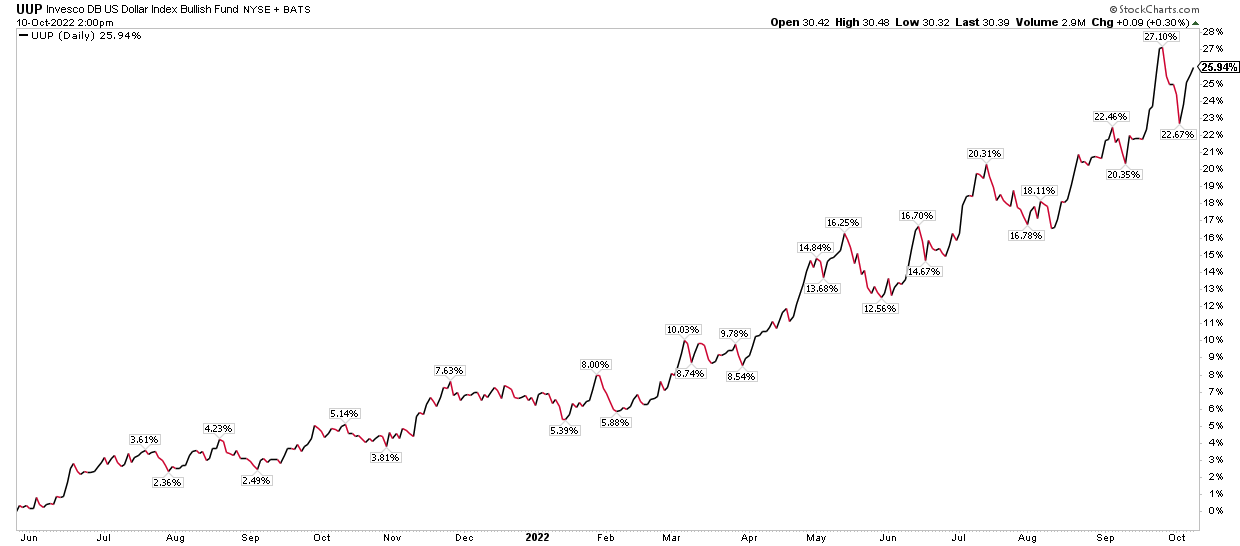

Over the last 17 months, in fact, the buck is up a stunning 26%, as measured by the Invesco DB USD Bull ETF (UUP). The advance has sent shockwaves across global financial markets—stocks have headed south, bond yields are at 15-year highs in many cases, and foreign markets are dealing with historic currency moves within their economies.

UUP ETF: +26% From May 2021

Source: Stockcharts.com

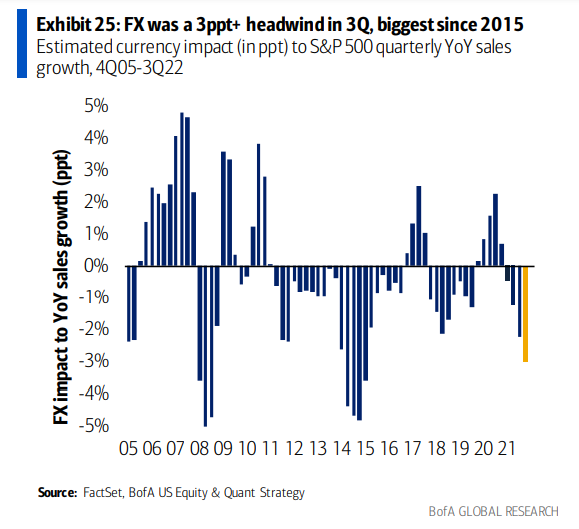

It’s also tough for corporate America. As we embark on the all-important Q3 earnings season the dollar’s rip from a year ago means profits for multinationals with significant overseas revenue exposure will be hit. Bank of America Global Research calculates that the negative currency impact on firms’ collective top lines will be three percentage points. That’s the largest FX impact on sales growth since early 2015.

Foreign Exchange A Major Drag on Profits This Earnings Season

Source: Bank of America Global Research

The dollar didn’t only don the cover of Barron’s. Bloomberg Businessweek also put the greenback as its lead story. Is the 'long dollar' trade now consensus? Should investors consider taking the other side of the trade? Perhaps, but you do not have to go outright short UUP or long individual currencies to play a reversal.

Playing A Dollar Top

Simply owning stocks, particularly foreign shares, will probably serve the purpose of being short dollars. So far this year, when the USD has spiked, it’s usually meant bad things for most risky assets. Hence, a big dollar gain year-to-date has corresponded with a terrible return for the S&P 500, and even worse performances for dollar-sensitive regions like emerging markets. So simply being positioned long to either of those areas would capture ample inverse-dollar effective exposure.

Pay Attention, Jay!

Something I have been wondering about recently is how much the dollar’s strength weighs on the minds of Federal Reserve Board members. I assert that if there is anything likely to break further across the global financial markets, it is going to be currency related. Just take a look at the turmoil in the British pound in late September.

The Cable was crushed to all-time lows as the UK’s new Prime Minister Liz Truss announced a fiscally stimulative tax cut. That ran contrary to the Bank of England’s hawkish monetary policy stance up to that point. Central banks and other government officials not being on the same page impedes the Fed’s goal to tighten financial conditions.

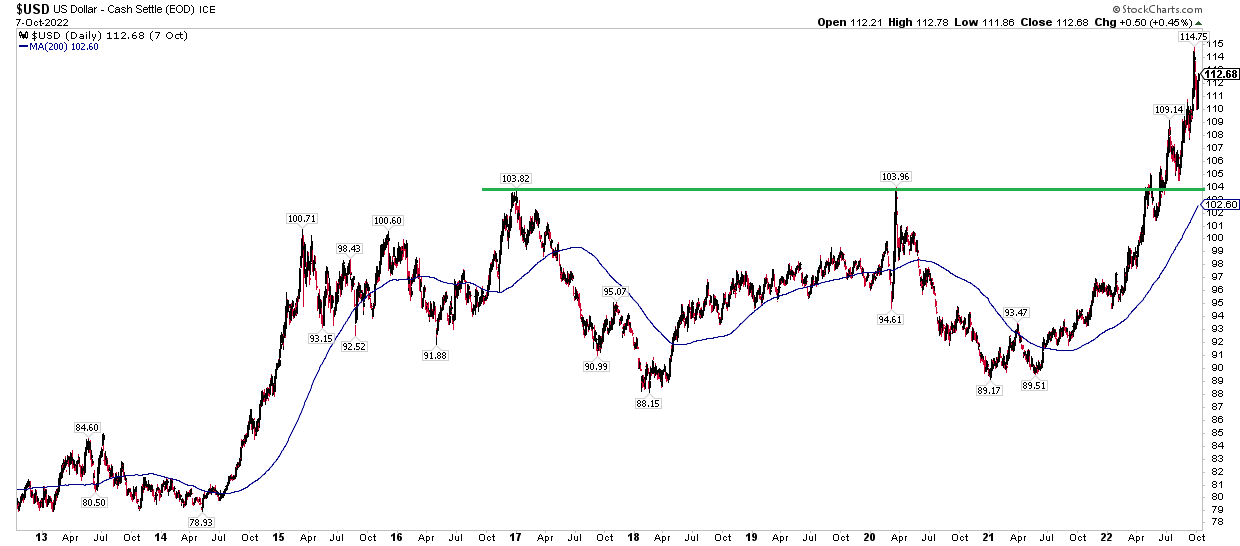

A Bullish Trend Until Proven Otherwise

For now, though, the USD’s strong momentum is evidenced on any small dip—buyers simply step back up to the plate. I think the dollar will continue to be strong until there are hints from the Fed that it will take its foot off the brakes. As for now, there is no sign of it. If we do see a pullback, look for long-term support near the 104 level on the DXY.

US Dollar Index: Breakout Above 104, Nearly 10% Above its 200-Day Moving Average

Source: Stockcharts.com

The Bottom Line

A duo of popular investment magazines put the US dollar as the top story recently. It’s a common sign of over-optimism and that a trend reversal could be in the cards. The greenback will undoubtedly be top of mind this earnings season and has been a de facto tool the Fed has relied on to inflict pain on global markets. Investors must remember that while sentiment indicators are important, price trends usually win out.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.