This article was written exclusively for Investing.com

- Natural gas fell to a 25-year low last June

- The price is more than double that level in June 2021 - Demand is back and better than ever

- US energy policy - Elections have consequences

- Higher lows and higher highs on the horizon

- Hurricane season has potential for fireworks - Inventories remain below last year’s and the 5-year average levels

Natural gas began trading on the CME’s NYMEX division in 1990. The combustible energy commodity in its natural form is also highly volatile when it comes to price action. Over the past 31 years, natural gas futures have traded from a low of $1.02 to a high of $15.65 per MMBtu. The low came in 1992, when the futures market was immature. The high was in 2005, when storms ravaged the Louisiana Coast, home to natural gas infrastructure and the delivery point for NYMEX futures.

The market has changed over the past years. Massive discoveries of natural gas in the Marcellus and Utica shale regions of the US and technological advances in extracting gas from the earth’s crust via fracking dramatically increased supplies.

Since necessity is the mother of invention, the demand side of natural gas’ equation also grew as liquefication allowed exports to other countries worldwide, where prices are far higher to soar. The burgeoning LNG business continues to grow. Simultaneously, US power generation switched from coal to natural gas, increasing demand for the energy commodity.

Under the previous administration, the US followed a “frack-baby-frack” policy, increasing output as technology lowered production costs. On Jan. 20, 2021, that policy changed, as President Joseph Biden pledged to address climate change by limiting hydrocarbon production in favor of alternative energy sources.

Over the past weeks, the prices of crude oil and natural gas have been trending higher. The trend is always your best friend in markets. In early June 2021, natural gas prices were more than double the price in late June 2020, which could be a sign of things to come for the volatile energy commodity.

Natural gas fell to a 25-year low last June

One year ago, at the end of June, nearby natural gas futures reached the lowest price since 1995, when it found a bottom at $1.432 per MMBtu.

Source: CQG

The chart shows the two and one-half decade low in natural gas prices last June. Ample supplies and weak demand during the height of the global pandemic caused the energy commodity's price to plunge.

The low came at the end of June 2020, during the week of June 22. As natural gas dropped to the low, Warren Buffet’s, Berkshire Hathaway (NYSE:BRKb) was busy scooping up the natural gas transmission assets from Dominion Energy (NYSE:D).

The price is more than double that level in June 2021 - Demand is back and better than ever

In the deal announced in early July, Berkshire paid $4 billion in cash and $10 billion in assumed debt for Dominion’s transmission and storage assets. The purchase boosted Berkshire Hathaway's control of all interstate natural gas transmission from 8% to 18%. The value investor bought the lows in natural gas, as in June 2021, the price is over double the June 2020 low.

Source: CQG

As the weekly chart shows, natural gas futures experienced the typical peak season rally in late October and early November, as the heating and peak demand season approached. However, the energy commodity has made higher lows and higher highs over the past year and was above the $3.00 per MMBtu level on June 7. The last time nearby natural gas futures were above $3 in June was in 2017 and 2018. Before that, it was back in 2014.

Vaccines creating herd immunity to COVID-19 are increasing energy demand in the US and worldwide in 2021. At the same time, US production is under pressure because of a change in administrations in Washington DC.

US energy policy - Elections have consequences

On Jan. 20, 2021, Joe Biden became the 46th US President. On his first day in the Oval Office, he fulfilled a campaign pledge to address climate change by canceling the Keystone XL pipeline project that carries crude oil from the oil sands in Alberta, Canada, to Steele City, Nebraska, and beyond to the NYMEX delivery point in Cushing, Oklahoma.

The current administration’s budget for the coming years reflects the shift in US energy policy, from traditional fossil fuels to alternative and renewable energy sources. Over the past weeks, the administration suspended all oil and gas leases in Alaska’s Arctic National Wildlife Refuge the former President opened to drilling for the first time.

The US has been the world’s leading crude oil and natural gas producer over the past years, but elections have consequences. One of the many issues on the 2020 ballot was the future of US energy policy. Drill-baby-drill and frack-baby-frack lost the election to the candidate supporting addressing climate change through more regulations and encouraging alternative fuels.

Higher lows and higher highs on the horizon

The move away from fossil fuels comes when energy demand is booming as the pandemic fades into the US’ rearview mirror. Vaccines creating herd immunity are causing people to return to work, travel, and consume far more energy than in June 2020.

Meanwhile, the dramatic shift in US energy policy means that supplies will struggle to keep up with the robust demand. In the natural gas market, the growing export business for LNG only exacerbates the demand side of the energy commodity’s fundamental equation.

Source: CQG

The monthly chart shows that the pattern of lower highs and lower lows that took natural gas from a high of $6.493 in early 2014 to a low of $1.432 per MMBtu in late June 2020, is in jeopardy. The natural gas futures market has been trading higher over the past year. The shift in US energy policy makes a compelling case for higher lows and higher highs over the coming months and years. Growing demand and fewer supplies are a potent bullish cocktail for the natural gas futures market.

Hurricane season has potential for fireworks - Inventories remain below last year’s and 5-year average levels

Over the coming months, the natural gas market faces the hurricane season, threatening natural gas infrastructure along the Gulf of Mexico. The NYMEX delivery point is the Henry Hub pipeline network in Erath, Louisiana, not far from the Gulf. Hurricanes Katrina and Rita, in 2005 and 2008, caused the energy commodity's price to rise above the $10 per MMBtu level, as the storms damaged infrastructure.

One of the signs that production reflects the change in US energy policy is that inventories in storage across the US are at low levels during the coming injection season.

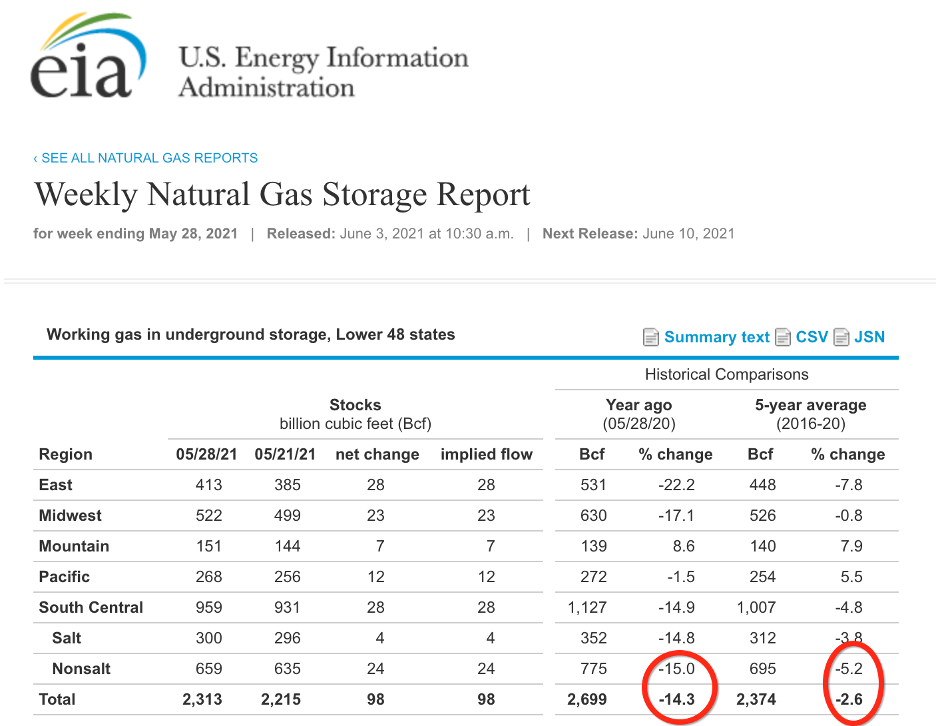

Source: EIA

As the table shows, natural gas stockpiles were 14.3% below last year’s level at the end of May and 2.6% below the 5-year average. With energy demand growing, the deficit looks likely to increase.

Meanwhile, the market will shift its attention to the coming 2021/2022 peak demand season that starts in November over the coming months. An active hurricane season, low inventory levels, and the uncertainty of a cold winter season in the coming months should support the natural gas price.

The natural gas market dropped to a quarter-of-a-century low in June 2020. In the world of commodities, the cure for low prices is those low prices.

In June 2021, the price of the energy commodity is over double the June 2020 low, with the nearby July futures contract closing at the $3.07 per MMBtu level on June 7. While I do not expect the price to run away on the upside over the coming weeks, I believe the market will continue to make higher lows and higher highs.

Buying on price weakness could be the optimal approach in the natural gas market. The shift in US energy policy could be the most significant factor for natural gas in years.

The market went from bear to bull over the past 12 months. Warren Buffett bought those transmission assets at bargain-basement prices as the value investor continues to have a magic touch.