As investors in exchange-traded funds (ETFs), it’s crucial to reframe our understanding of ESG — Environmental, Social and Governance — investing.

ESG isn’t just about being politically correct; it’s about recognising and managing risks that were previously unaddressed, unnoticed, or ignored, which are increasingly relevant today.

Consider several high-profile cases where significant shareholder value was destroyed due to failures in managing ESG-related risks:

- In April 2016, BP (LON:BP) agreed to pay $20bn in fines related to the Deepwater Horizon oil spill¹

- Following a catastrophic dam disaster in Brazil that killed 19 people and devastated the Doce River valley, Vale and BHP were ordered to pay $9.7bn in damages²

- 3M (NYSE:MMM) faced a $6bn settlement over claims that its combat earplugs were defective, resolving nearly 260,000 lawsuits³

These examples demonstrate some of the potential financial impacts of ESG risks. But how can investors mitigate these risks beyond traditional diversification? Is there a way to screen for these risks?

One effective strategy may be through ESG ETFs. Here, we explore how AXA IM’s ETFs not only offer clarity but may also provide substantial value by integrating ESG criteria to aim to manage these often-overlooked risks effectively. Here’s what you need to know as a prospective investor.

What makes an ETF ESG?

ESG ETFs go beyond aiming for financial performance alone to include environmental sustainability, ethical governance and social impact. These factors are integral to identifying potential risks and opportunities that traditional financial analysis may overlook.

In the European Union, the distinction between ESG and non-ESG funds is defined under a framework within the Sustainable Finance Disclosure Regulation (SFDR): Article 6, 8, and 9 funds⁴.

Each offers different levels of sustainability integration and transparency, aimed at reducing greenwashing — the practice of gaining an undue reputational boost by presenting an organisation’s products as environmentally friendly when they are not.

- Article 6 funds are the baseline and do not integrate sustainability into their investment decisions. These might include sectors typically excluded by ESG criteria, such as tobacco or thermal coal production, and must be explicitly labelled as non-sustainable

- Article 8 funds promote environmental and social characteristics, combining these with good governance practices. They are an intermediate level where ESG factors are integrated to a substantial degree but are not the sole focus

- Article 9 funds are the most stringent, targeting bespoke investments with specific sustainability goals, often aligned with an ESG-focused index

ESG in practice with ETFs

Investors wishing to invest sustainably may prefer to seek out funds that meet at least the criteria of Article 8. Notably, 79% of AXA IM’s ETFs fall into this category⁵, as of January 2025.

Let’s look at a practical example to better understand ESG ETFs with AXA IM’s MSCI World Equity PAB exposure, which embodies these concepts.

This ETF falls under SFDR Article 8 – meaning it is designed to promote environmental and social characteristics, integrating ESG considerations into the investment process. It operates with a 0.2% portfolio fee and trades in US dollars as an accumulating share class.

This ETF also adheres to Paris-Aligned Benchmark (PAB) exclusions⁶, which screen out companies involved in controversial weapons, thermal coal mining, oil and gas exploration, and other activities that conflict with global climate objectives.

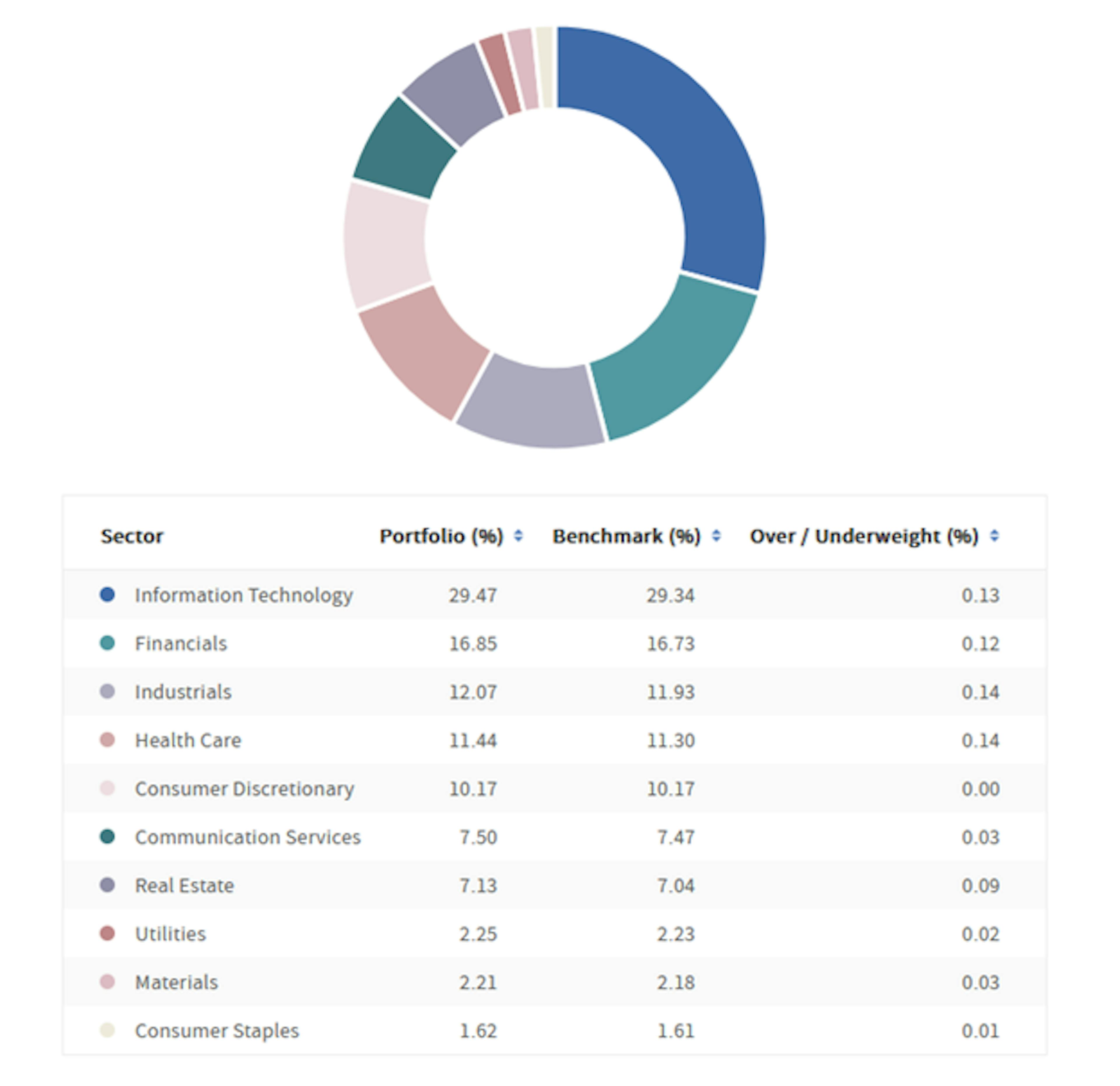

The ETF aims to mirror the performance of the MSCI World Climate Paris Aligned Index⁷. This index includes a diverse sector spread with the top five sectors by weight being technology, financials, healthcare, industrials and consumer discretionary, aligning closely with the MSCI World Index.

Source: Fund Homepage as of 31 December, 2024

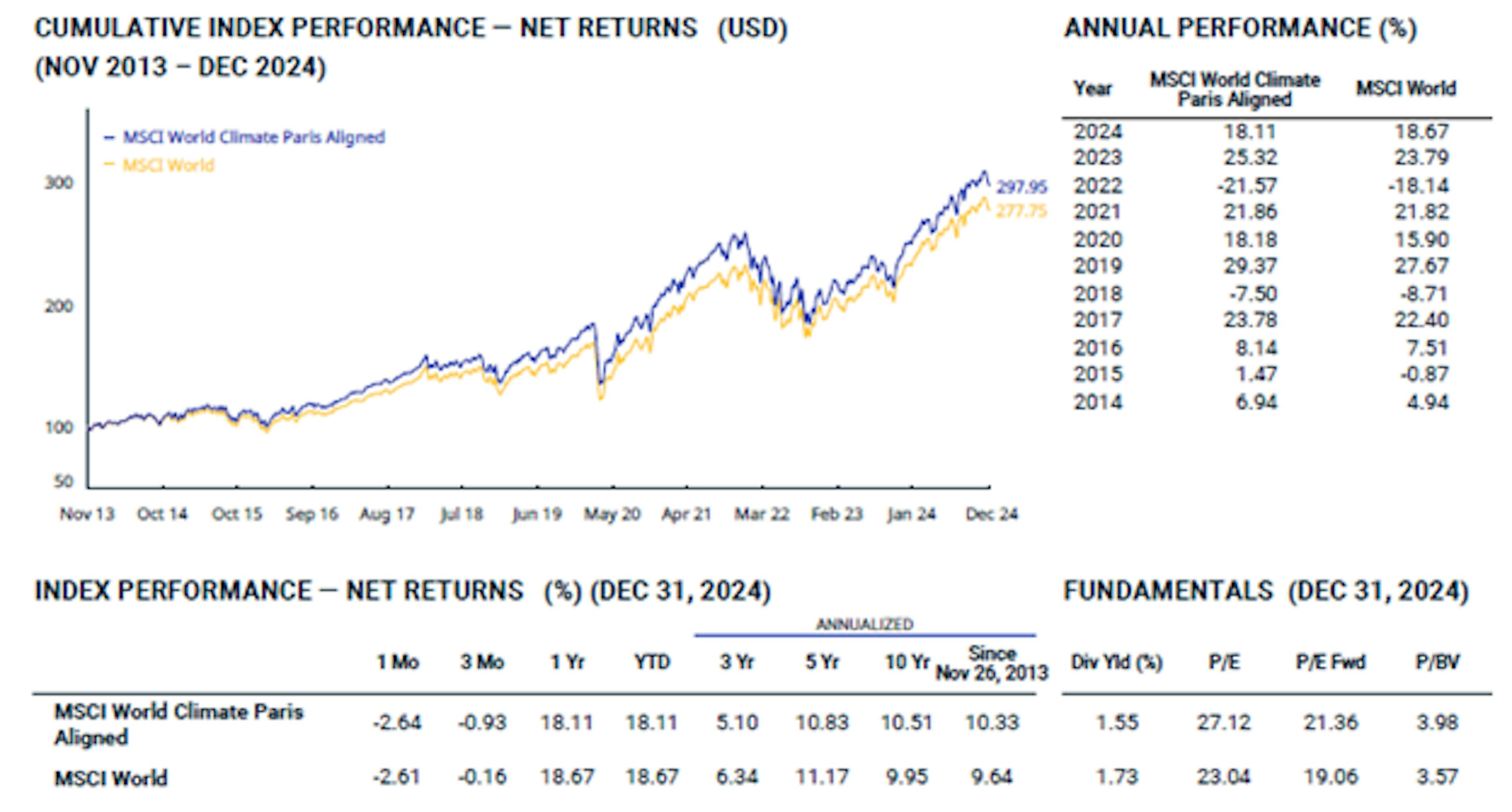

It’s noteworthy that ESG benchmarks, such as the one tracked by this ETF, have historically not underperformed – contrary to some misconceptions.

Source: MSCI World Climate Paris Aligned Index (USD) - MSCI, December 2024

This demonstrates that integrating ESG considerations doesn’t necessarily mean sacrificing performance; historically, it can lead to superior results.

For those interested in tracking the ESG performance of AXA IM’s ETFs over time, AXA IM provides an ESG score, the methodology of which can be found in the “Responsible Investing” section.

Investors can also download detailed reports from AXA IM’s website for greater transparency into how these scores are calculated, offering a clear view of the ETF’s adherence to ESG principles.