- Netflix prepares to showcase its Q4 performance as analysts project strong growth in upcoming report.

- Sports streaming and blockbuster hits could be the key to the streaming giant's next revenue surge.

- Despite fierce competition, optimism grows for the stock to reach the coveted $1,000 milestone in the medium term.

- Kick off the new year with a portfolio built for volatility - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

After the big banks set the stage, earning season is about to kick into high gear as Netflix (NASDAQ: NFLX) steps into the spotlight to report Q4 results after the markets close.

The streaming giant has had a stellar run, with its stock surging 77% over the past year, fueled by subscriber growth surpassing 280 million globally and a boost in advertising revenue.

However, since peaking at an all-time high of $941.75 per share in December—just shy of the symbolic $1,000 mark—the momentum has faltered, with shares dipping 5% in the past month.

Can Netflix Deliver Another Earnings Surprise?

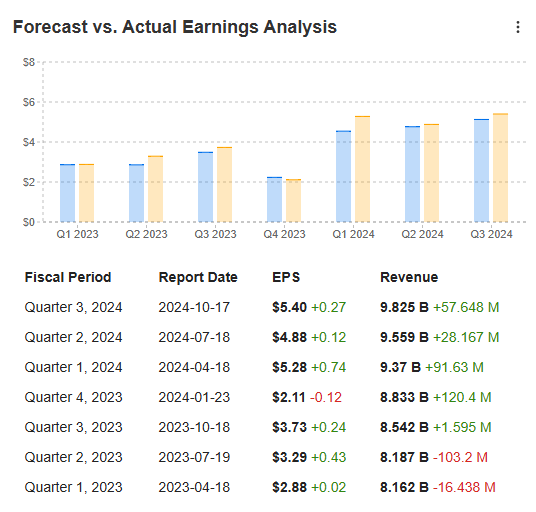

Netflix has consistently outperformed expectations, beating Wall Street estimates in each of the last three quarters. It has successfully tackled challenges like tighter password-sharing rules and the launch of ad-supported subscriptions.

Source: InvestingPro

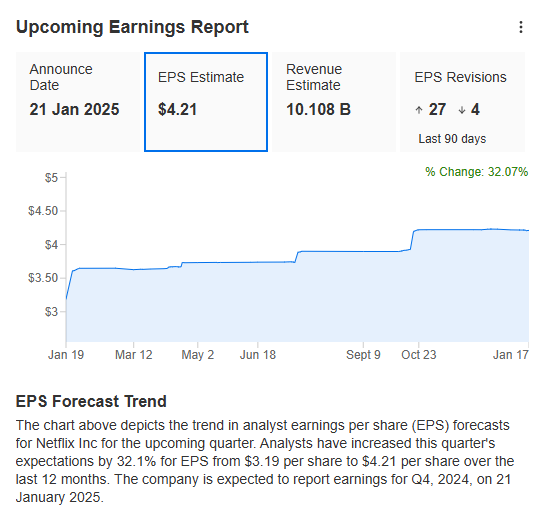

This quarter, analysts project earnings per share (EPS) of $4.21 on revenue of $10.11 billion, marking a 14.4% increase from $8.83 billion a year ago. Sentiment remains upbeat, with brokers raising their EPS forecast by an impressive 32.1% over the past year, from $3.19 in January 2024 to $4.21 today.

Source: InvestingPro

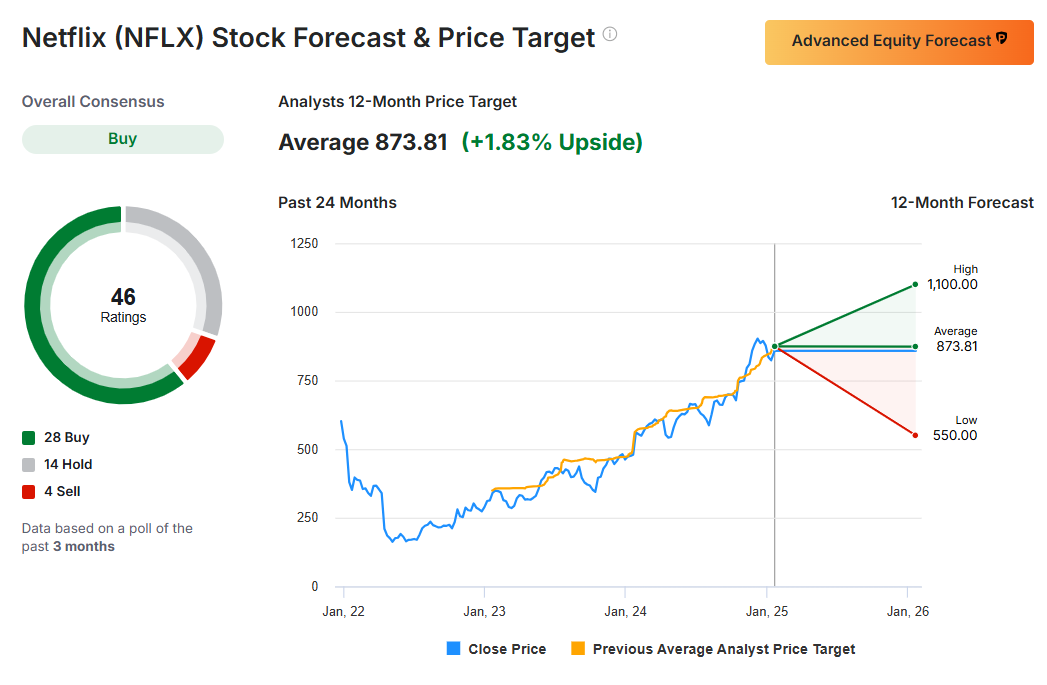

Analysts See a Path to $1,000

Optimism extends beyond earnings. Analysts from Pivotal Research and Bank of America (NYSE:BAC) have recently raised their price targets to $1,100 and $1,000, respectively. Among 46 brokers covering Netflix, 28 recommend a "buy," while only 14 suggest "hold," and just four advocate "sell."

The average price target of $873.81 represents a modest 1.8% upside from the Jan. 20 close at $858.10. However, in a bullish scenario, Netflix could achieve the coveted $1,000 mark within the next 12 months—a potential 16.5% gain from current levels.

Sports Broadcast and Blockbusters to Drive Revenue

Netflix’s management is betting big on sports and popular series to fuel growth, aiming for $43–44 billion in revenue by 2025, an 11–13% increase over 2024 expectations. Free cash flow is projected to reach $9.3 billion.

The company has made notable strides in live sports, streaming high-profile events like the Mike Tyson vs. Jake Paul boxing match and NFL games on Christmas Day. On the content front, the second season of South Korea’s Squid Game and upcoming hits like the final season of Stranger Things and Wednesday are expected to attract massive viewership.

Challenges Loom for the Streaming Giant

Despite its strengths, Netflix faces hurdles. Fierce competition from Disney+, Amazon Prime Video, and HBO Max pressures its market share. Rising production costs, regulatory scrutiny (such as a tax fraud investigation in France), and market saturation in mature regions pose additional risks. Currency fluctuations further complicate its global operations.

The Road Ahead

While challenges persist, Netflix’s ability to adapt, innovate, and deliver compelling content gives it a fighting chance to overcome these obstacles. As the leader in the streaming wars, Netflix could surprise investors yet again with its 2024 performance—and perhaps even take a decisive leap toward the $1,000 milestone.

Is another blockbuster earnings beat in the cards? We’ll find out soon enough.

***

Curious how the world’s top investors are positioning their portfolios for the year ahead?

You can find that out using InvestingPro.

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.