New Oriental Education & Technology Group (NYSE:EDU) is China’s leading educational service provider with the most comprehensive product offerings. Founded by the legendary educator and entrepreneur Michael Yu, New Oriental has built a reputation for quality teaching over almost three decades. Recently, New Oriental’s stock has declined significantly amid near-term challenges and the weaker-than-expected guidance. I believe at the current price, the stock is undervalued with a significant upside if New Oriental can recover from the headwinds. With a track record of multiple times of successful turnaround, New Oriental has a high chance of success.

Business description and operation analysis

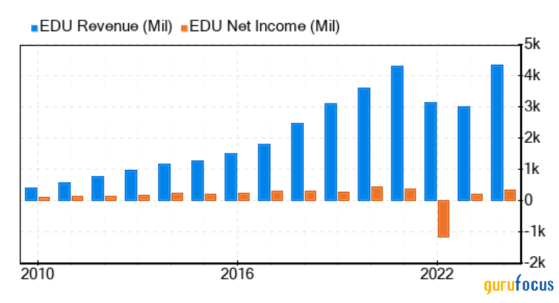

New Oriental was founded in 1993 by the legendary educator and entrepreneur Michael Yu. The company’s initial business was overseas English test preparation, especially for the TOEFL and GRE exams, which were required for admission to prestigious universities in the United States. Michael Yu and other early New Oriental’s teachers pioneered the innovative education approach, which combines teaching with humorous storytelling and interactive teaching techniques. Over the years, New Oriental has expanded its offerings to include a wide range of services such as K-12 tutoring, online education, non-academic tutoring, and live-stream e-commerce.New Oriental’s revenue and net income grew consistently before the Chinese government’s crackdown on the after-school tutoring market in 2021. It was one of the most owned Chinese ADRs.

After the regulatory crackdown, the extent of New Oriental’s revenue decline is much less than its competitors, such as TAL Education (TAL) and Gaotu (GOTU), because New Oriental relied less on the K-9 after-school tutoring business. The company’s management earned respect after announcing the donation of around 80,000 sets of school desks and chairs to rural schools from the closure of its nearly 1,500 teaching locations. New Oriental also pulled off one of the greatest business transformations by launching its own live-stream e-commerce platform called Oriental Select, selling agricultural products.

The live-stream operation was led by New Oriental’s tutors. Initially, it received a lackluster response. Suddenly, Oriental Select took off when one of the tutors, Dong Yuhui, gained enormous popularity and sold hundreds of millions of products by integrating humorous English teaching and stories when promoting the products on his live-stream channel. Dong Yuhui’s unique blend of humor and education in his live-streams resonated deeply with young Chinese consumers. By transforming online shopping into an entertaining and inspirational experience, Oriental Select became hugely successful, a big positive surprise for New Oriental’s investors. As a result, all other for-profit K-12 tutoring competitors tried to copy Oriental Select, but none were successful. Unfortunately, Dong Yuhui departed New Oriental in 2024 after internal fights with Oriental Select’s unit leader. Dong Yuhui’s departure casts significant doubt over the future of New Oriental’s live-stream e-commerce business.

Besides the live-stream business, New Oriental also developed its non-academic tutoring business, which grew rapidly between 2022 and 2024. This new business now accounts for almost 20% of New Oriental’s consolidated revenue, which is quite remarkable.

For the most recent fiscal year, New Oriental has six business units. The overseas test preparation and overseas study consulting business, and the high school academic tutoring business are the two major revenue contributors, each accounting for roughly 25% of the consolidated revenue. The live-stream e-commerce business and the non-academic tutoring service business are both new businesses, each roughly representing about 20% of the consolidated revenue. The rest of New Oriental’s group revenue is divided between the domestic test preparation business for adults and university students and the travel business.

Financial and valuation analysis

New Oriental’s consolidated revenue for FY2024 grew 44% to $4.3 billion year-over-year. The company’s Non-GAAP operating income grew 69.0%, and Non-GAAP operating margin improved to 11.0% from 9.3% in FY2023.For the most recent quarter(Q2 of FY2025), New Oriental’s total net revenues reached $1.0 billion, which only grew 19.4% year-over-year. However, the core education business continued the strong growth momentum with a 31.3% growth rate year-over-year. Operating income decreased by 9.8% year over year due to operating loss generated from East Buy’s private label products and live-streaming business.

New Oriental’s stock plunged 23% after the company reported Q2 FY2025 earnings. The most likely explanation for the sharp decline is management’s disappointing guidance. For Q3, New Oriental’s management team expects total net revenues, excluding the live-streaming business, to increase from 18% to 21%. The consensus estimate was a year-over-year core revenue growth of 25%. During the earnings call, management attributed the lowering of guidance to macroeconomic challenges, which might hurt New Oriental’s most important overseas test preparation and overseas study consulting business. The management team also hinted that the company will slowdown the offline expansion of learning centers.

New Oriental’s free cash flow has been very consistent, except FY 2022 and FY2023, when the company was hit by the regulatory crackdown.

If we use a 10% discount rate and conservatively assume that New Oriental can grow its free cash flow at 6% over the next 10 years and 4% afterward, the implied current intrinsic value per share is $80. At the current price of $55.5, New Oriental’s stock is modestly undervalued, with a margin of safety of almost 30%. Using the reverse DCF tool, New Oriental’s FCF per share only needs to grow 0.6% annually and still justify today’s valuation.

Risk analysis

I am mostly concerned with three risks for New Oriental Education. The first risk is another regulatory crackdown on the sector. This seems unlikely in the near term as China is struggling with a high unemployment rate. However, in the long term, it’s imaginable that regulation may become more stringent.The second risk is the aging and potential decline of China’s population. The fertility rate for Chinese women has also been declining steadily. In the long term, the demographic trend in China is not friendly to education service providers such as New Oriental.

Thirdly, the success of New Oriental has largely been built upon Michael Yu’s personal charisma and competence. Recently Micheal Yu has been gradually handing over the management task to the next generation of professional managers. At the same time, Yu still makes the most important strategic decisions. If Yu decides to step down completely, it could affect the company’s culture and morale.

Conclusion

While New Oriental Education is currently facing various near-term challenges, the company’s strong reputation is still intact, which bodes well for the growth of its non-academic tutoring business and core education business. At the current market price, it seems like New Oriental Education is an attractive opportunity with a significant margin of safety.This content was originally published on Gurufocus.com