- The September FOMC meeting is critical as it includes projections

- This could set the path of monetary policy for the next few months

The Sept. 21 FOMC meeting will be a big one, not because of the size of the rate hike but because of the FOMC projections. The bond and futures markets have repriced dramatically since the July meeting and the hotter-than-expected CPI report. It makes the Fed projections very important, as it will lay out a potential policy path for the remainder of 2022 and 2023. If the Fed gives forecasts that are too low, they run the risk of financial conditions easing, which is not what they want.

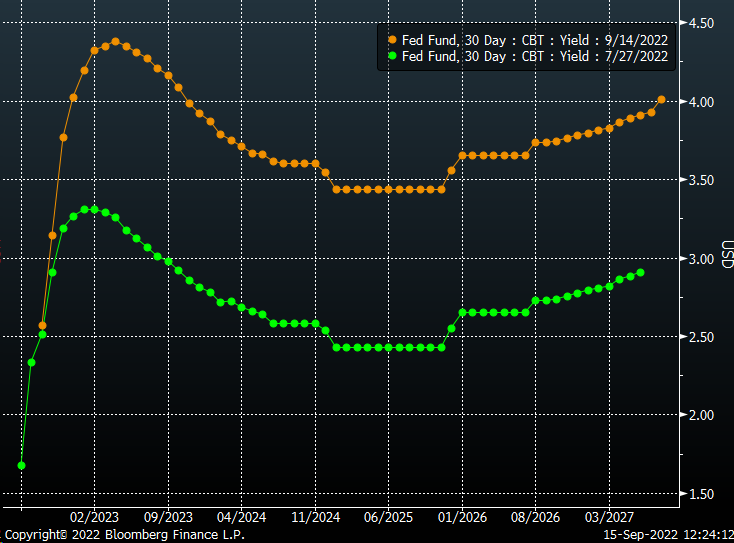

The market may have made the Fed's job easier because the Fed Funds futures now see the overnight rate climbing to a terminal rate of 4.45% by April. The problem lies with what comes next, because currently the market is pricing in rates to fall back to 4.0% by December 2023. That may prove too low for the Fed's liking, given the hotter-than-expected CPI report and calls to hold rates steady for some time.

Inflation Remains Too Hot

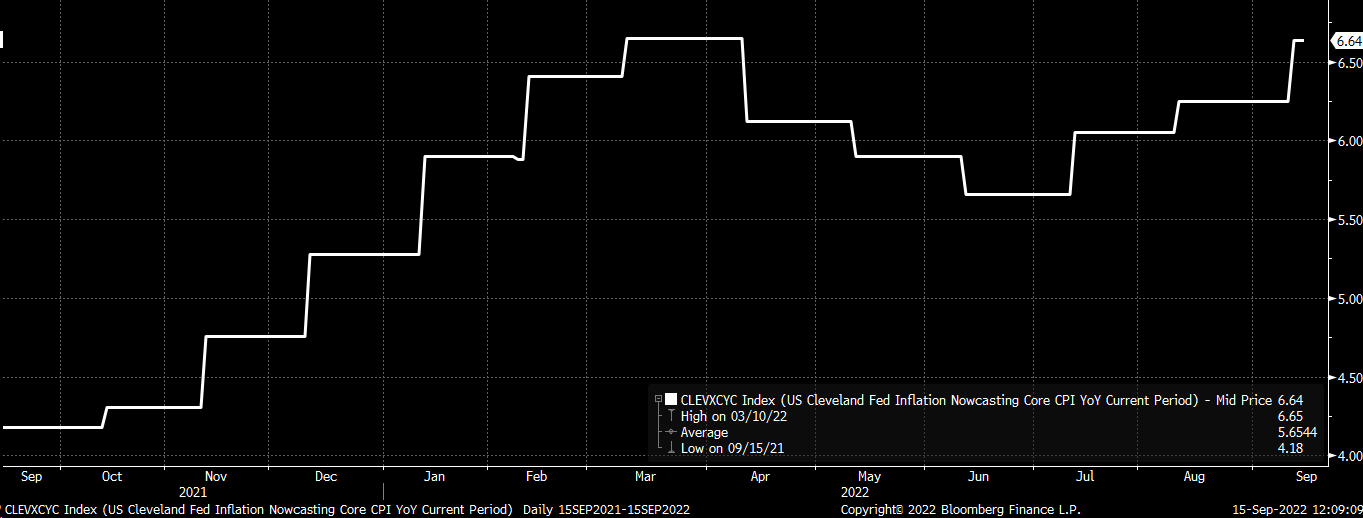

In June, FOMC projections looked for rates to rise to 3.4% by December 2022 and 3.8% by December 2023. But since that time, CPI data has been hot, and while year-over-year headline CPI has hovered in the 8% range, core CPI has accelerated, rising from 5.9% to 6.3%. The Atlanta Fed 12-Month Sticky CPI rose to 6.2% from 5.6%. What makes matters worse is that the Cleveland Fed now sees core CPI rising by 6.6% in September.

The message is that core and sticky inflation is accelerating while falling energy prices have aided headline CPI fluctuations. These sticky and core numbers are likely to be significant concerns for the Fed, with no sign of easing. On top of that, job growth has remained hot, as noted by the Kansas City Fed Labor Market Conditions Index.

The Fed Will Need To Be More Hawkish Than Expected

All of this points to a Fed that is likely to be even more hawkish than it was at the June FOMC meeting. For the Fed to keep financial conditions from easing, it will be left to point monetary policy in a direction that is even more hawkish than where the Fed Fund Futures market is currently priced, which may result in them projecting a 4.5% rate by the end of 2023.

The Fed has made it clear that once it gets rates to its terminal rate, they will be held at that level until it sees ample data to suggest inflation is easing. That means the current 4% December 2023 pricing is probably 50 basis points too low, and the Fed can use its projections to jawbone the back of that future curve higher.

The other option, of course, is to come in with a view that is in line with current market expectations but that will leave the Fed open to the backward way markets tend to think. A Fed that is not as hawkish as expected is dovish, which would allow the risk asset to rally, causing financial conditions to ease.

Nobody ever said this would be easy.

Disclaimer: Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy.

Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.