- The market reacted negatively to Nike's fiscal Q1 2025 results.

- The new CEO faces challenges in implementing a revised strategic direction.

- Forecasts indicate a continued decline in the company's revenue.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Earlier this week, (NYSE:NKE) reported results for the first quarter of fiscal 2025, which were negatively received by the market, as evidenced by more than 6% drop following the report.

Although net profit surprised positively, revenues disappointed with the negative trend forecast to continue in the current quarter.

The sportswear giant is currently undergoing a major transition. This shakeup comes with a change in leadership, as John Donahoe steps down and the seasoned Elliott Hill takes the helm.

Hill, who has been with the company since 1988, rising through the ranks from a statistician, brings deep institutional knowledge to the role.

As the new CEO, Hill faces the significant task of steering the company through its next strategic phase while addressing the persistent challenges it has faced in the post-pandemic era.

Nike’s New CEO to Address Strategic Challenges

The fate of outgoing CEO John Donahoe was virtually sealed during the release of quarterly results at the end of June this year when the company's shares fell in the range of 20% (the biggest one-day drop in the company's history) after announcing a poor outlook for both sales and revenue growth for the next fiscal year.

The decision to change CEOs stems not only from the company's financial performance but also from a lack of new product launches and the withdrawal of several long-established brands. Combined with rising competition from companies like On Holding and Deckers (NYSE:DECK), these issues highlighted the absence of a clear, long-term strategy, further justifying the leadership shift.

The new CEO is starting with a clean slate, as evidenced by the fact that the company has withdrawn from the publication of long-term forecasts and the Investor Day has been postponed. Details of the new strategy will probably be known over the next few months, but there is already speculation about an emphasis on increasing innovation, especially in the running shoe segment.

The transition period and the uncertainty that comes with it aren't favorable for stock prices, which may be vulnerable to sustained supply pressures in the short term.

Falling Revenues Spark Uncertainty

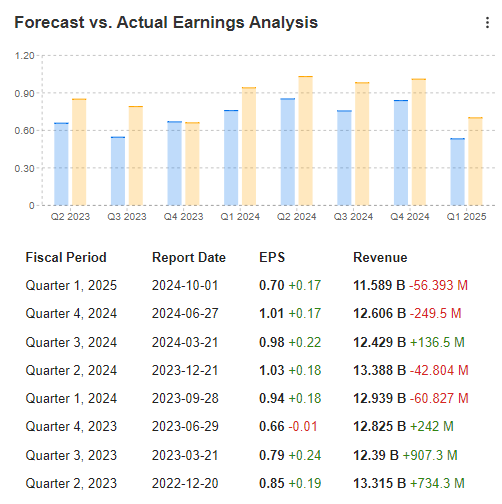

A review of key indicators from the past two years of quarterly results shows a consistent pattern: while earnings per share have regularly exceeded forecasts, a troubling trend has emerged in overall revenue growth.

Source: InvestingPro

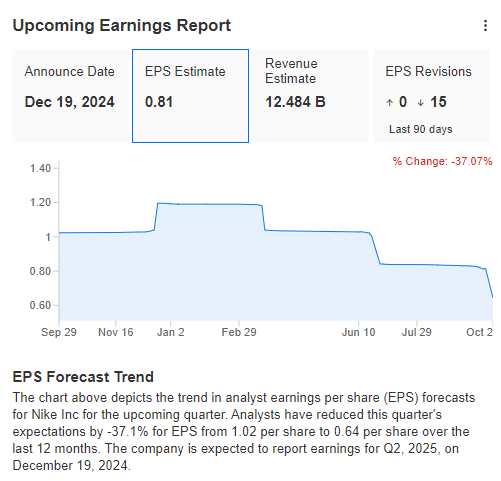

In a wave of not-so-optimistic forecasts, expectations for the earnings per share ratio fell sharply in December, affected by 15 downward revisions with not a single upward revision.

Source: InvestingPro

Nike: Is the Stock a Buy?

Under such conditions, possible technical sell signals are solidly grounded in the fundamental situation, which, at least in the short term, is not conducive to the development of an upward trend.

Currently, the demand side has been braked during the formation of a price channel in the area of the local resistance level falling in the vicinity of $90 per share.

If the supply side manages to break out of the aforementioned structure with the bottom, then the way is opened for an attack on the region of $75 per share in the first place, and slightly lower located long-term minima at $70 per share.

The negation of the downward scenario will be the breaking of the tested resistance at $90 and the negation of the flag formation structure, which from a technical point of view opens the possibility of an approach even to $98, where, in addition, the long-term downward trend line falls.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.