- Two defensive sectors had performed better than the broad equity market

- But recently endured significant selling pressure

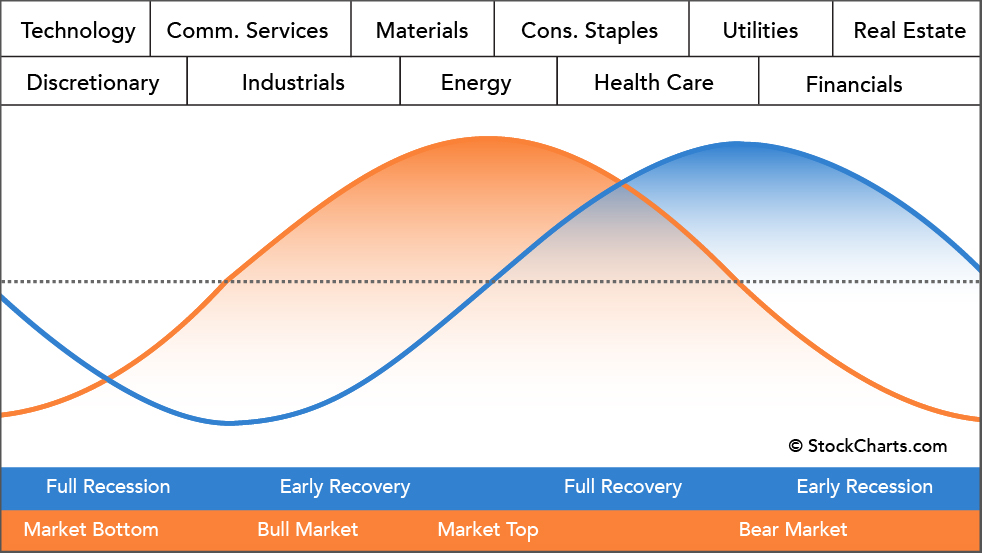

- Important signals might be visible in sector rotation

- Washout in market hideouts puts S&P 500 one step closer to a tradeable low

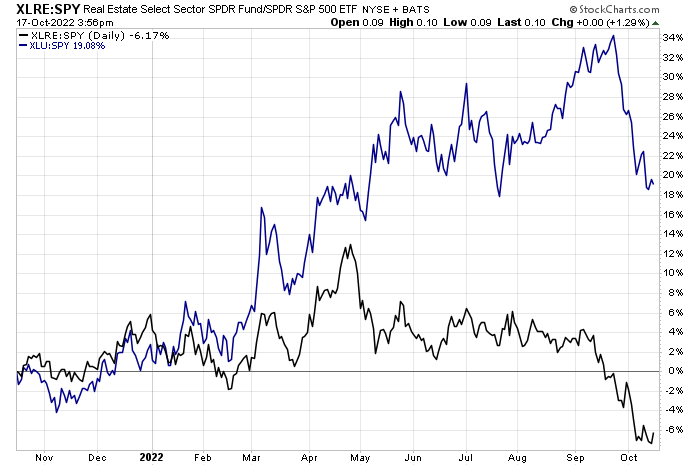

Two sectors that had been outperforming the S&P 500 through much of 2022 were Real Estate and Utilities. The narrative made some sense—hard assets should do well during inflationary times and the consumer was still strong, so housing prices and rents should fare relatively better than say, cyclical chip stocks or industrial plays.

In the utility space, steady and reliable—some might say boring—electricity providers and firms owning important energy transmission lines should not be slammed by an economic downturn. So those groups did fine as other stocks plunged. Real estate and Utilities feature better returns until September.

Source: Stockcharts.com

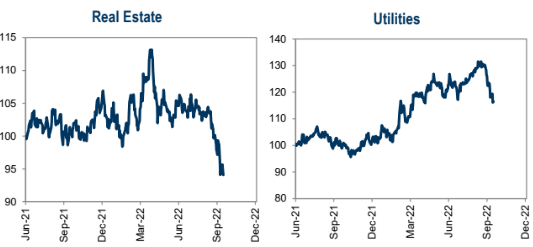

Massive Relative Collapses in Real Estate and Utilities

Source: Goldman Sachs Investment Research

New variables have thrown a wrench into that thesis. First, the highest mortgage rates in 22 years—above 7% as of Monday afternoon—will surely lead to at least a short-term depression in real estate transactions, harming some REITs. Moreover, history shows that even real estate firms can be just as volatile as the S&P 500 when times get truly rough (see 2008).

Surging Mortgage Rates Slam Residential REITs

Source: Mortgage News Daily

Meanwhile, the Utilities sector had gotten creamed over the last month versus the SPX, underperforming by 20%-plus, due to the latest surge in rates. Maybe the move from 3.5% across the Treasury curve to 4% or more changes the ballgame for high-yield utilities. Now there is a safer alternative. Hello, TINA.

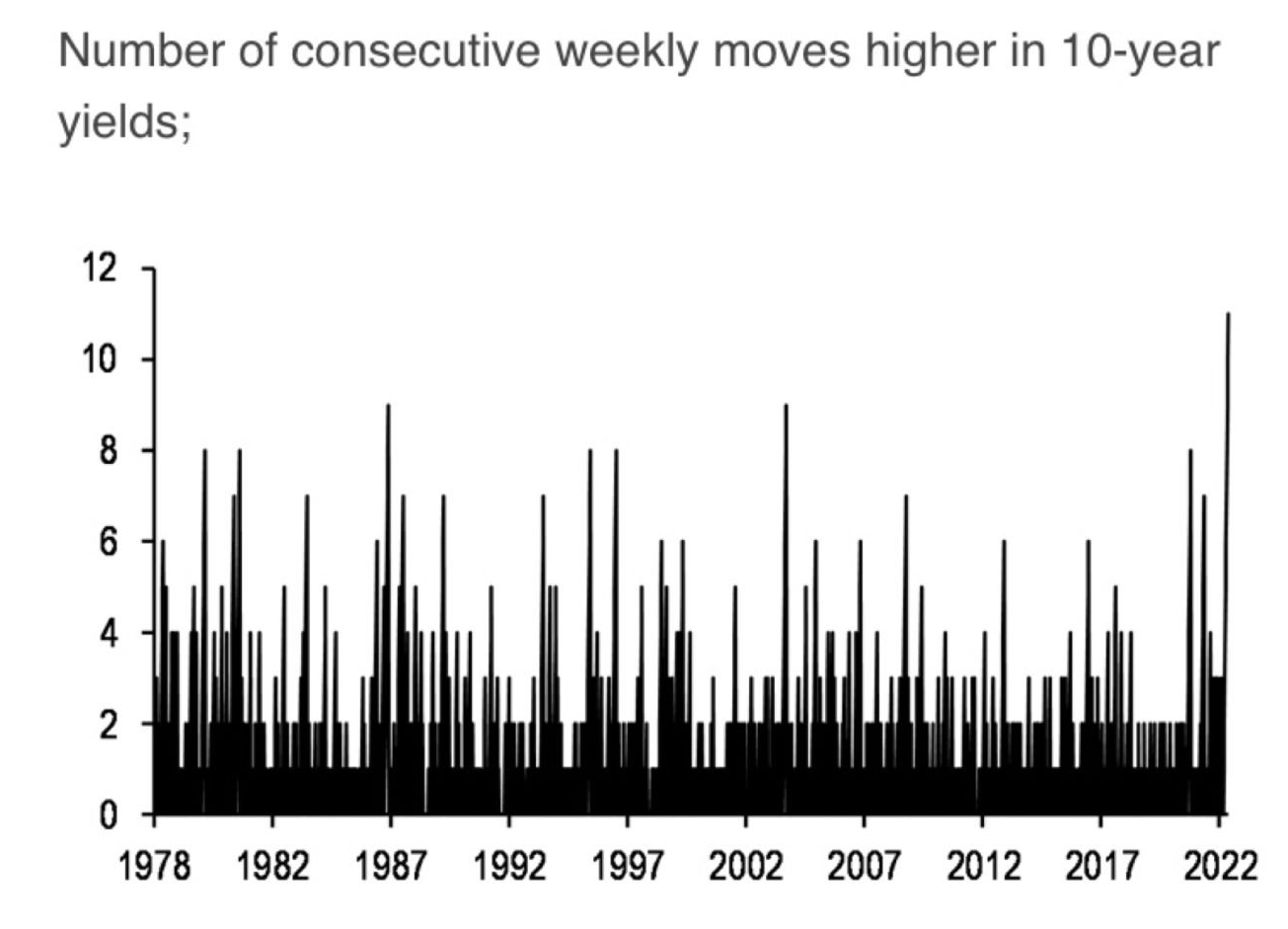

U.S. Bond Market Down For 11 Straight Weeks

Source: J.P. Morgan

So, what does this mean for investors and what moves should they make? Well, I see the latest round of focused selling in these more defensive niches as a positive sign toward an eventual market bottom. Think of it like this: for equities to trough and for capitulation to happen, we need everyone in the bearish pool. Both the outperforming industries and ultra-washed-out names should drop together. Perhaps this is an initial step in that bottoming process.

Something else that can provide clues on where we stand in the market cycle is by analyzing sector rotation trends. During an inflationary environment, it’s thought that the Utilities and Real Estate sectors tend to outperform right before market bottoms, according to Sam Stovall’s S&P’s Guide to Sector Rotation. That outperformance is gone. Are we nearing the market bottom as a result? Unknowable, but keep your eye on the Financials sector (which is now outperforming) and then the Information Technology and Consumer Discretionary sectors for new leadership before we can have confidence in a true low.

Sector Rotation: Past the Peak in Utilities and Real Estate Relative Strength

Source: Stockcharts.com

The Bottom Line

While everyone focuses on earnings season, the Fed, and what the mega-cap growth stocks do over the coming weeks, keep your eye on what’s going on with two small and somewhat defensive spots of the market. Real Estate and Utilities, which were positive from a year ago on a relative basis through much of the third quarter, are now rolling over. It could be a sign that the market cycle has taken another step toward a market low.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.