Investment funds linked to uranium and nuclear energy experienced a downturn over the week, with the Nuclear Energy theme witnessing a decrease of 2.43%. This follows an exceptional year for the sector, with prices soaring close to +50%. In November alone - despite the week's dip - funds tied to nuclear energy posted increases of 2.57%.

The future looks promising for nuclear power even in light of this week's fall off in value. Notably at COP 28, which is currently underway, approximately twenty countries including the United States have expressed support for constructing new power plants. These nations view nuclear power as key in reducing carbon emissions due to its ability to consistently supply near zero emission energy making it a viable contender within global energy alternatives.

However ongoing debate continues to surround nuclear energy, primarily related to environmental and safety concerns, meaning many stakeholders refrain from classifying it as a ‘green’ or renewable source. But regardless of these discussions, when compared with fossil fuels like oil, nuclear power certainly stands out as an effective alternative given its minimal carbon footprint and high-energy yield potential.

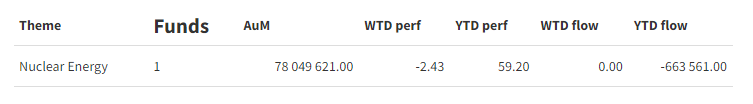

Group Data

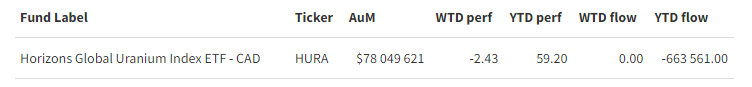

Fund Specific Data