Nuclear energy emerged as the week’s best performing theme, driven by a notable surge in uranium prices. This rally has propelled uranium to its highest level in over a year, with concerns growing over the diminishing supply prospects and a steadfast optimism surrounding long-term demand trends for nuclear energy.

This performance comes amidst significant legislative advancements in the United States. The House Energy and Commerce Committee has recently passed solutions that would ban imports of Russian uranium – the Prohibiting Russian Uranium Imports Act.

Furthermore, Namibia, a prominent player in uranium production, has indicated its intention to nationalize some of its natural resources, potentially resulting in reduced supply from the world's third-largest producer.

Simultaneously, the U.S. Energy Information Administration (EIA) released a report revealing a staggering 75% year-on-year decline in domestic uranium output and a drop of 99% from Q4 2022 as no material was produced this quarter at the White Mesa Mill in Utah. As a result, the country generated a mere 2,511 pounds of U3O8 in Q1 2023.

Moreover, as nations around the world strive to bolster energy security and curtail carbon emissions, governments are continously unveiling expansion plans for nuclear power capacities. These concerted efforts further solidify the expectations of robust demand in the market.

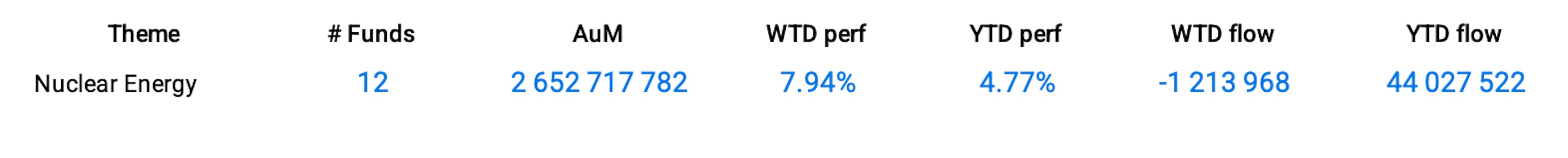

Accordingly, ETFs related to the nuclear energy theme are experiencing strong positive momentum. The Global X Uranium ETF, which tracks the performance of companies involved in the uranium industry, saw gains of 7.58% over the week.

Global Group Data