Following on from last week's news, nuclear energy funds are continuing to exhibit strong performance. Notably, uranium prices soared for the second week in a row, thereby bolstering the nuclear energy sector and its associated funds.

Despite several controversies surrounding the safety risks associated with its application in thermal power plants, uranium undeniably counts as one of the lowest carbon dioxide-emitting energy sources. Within the context of global climate change, nuclear power is clearly emerging as one of the most promising energy alternatives for mitigating fossil fuel consumption. Furthermore, in addition to its minimal greenhouse gas emissions, nuclear power facilitates continuous and cost-effective electricity generation.

Moreover, with the slight yet noticeable advancements in nuclear fusion, uranium will assume a prominent role as a valuable resource should nuclear fusion research yield success. In December 2022, the Lawrence Livermore National Laboratory (LLNL) in California accomplished the first nuclear fusion experiment that yielded more energy than the lasers employed to initiate it. In other words, this marked the first instance of a nuclear fusion reaction producing a net energy output, thereby demonstrating a remarkable breakthrough in nuclear research.

These developments are complemented by the endeavors of numerous countries to expand their nuclear energy production capacities.

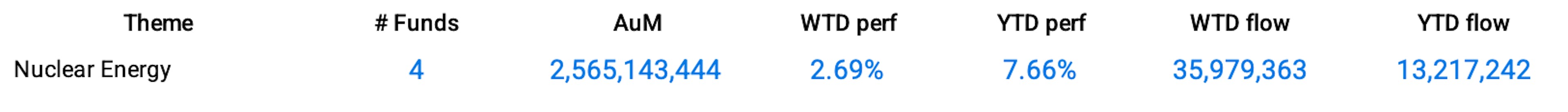

All these factors collectively indicate a promising future for nuclear energy and a corresponding surge in global uranium demand. For instance, as an illustration, since the beginning of this year, the Nuclear Energy theme has witnessed a growth of 7.66%, while the price of uranium has risen by approximately 11%.