Nuclear energy, often viewed as a more efficient and dependable alternative to other renewable sources such as solar or wind, is increasingly attracting investor interest – as reflected in the respective performance trends of various investment themes.

Since the start of the year, the 'nuclear energy' theme has maintained an upward trajectory, with year-to-date performance of +32.56%. This surge suggests growing confidence among investors with regard to nuclear power's capability for consistent returns and sustainable expansion.

In contrast, since the start of the year, other forms of renewable energies haven't performed as well. The 'solar energy' theme has seen a drop of -41.57%, while 'wind energy' has declined by -25.10%. These statistics imply that investor preference might be veering away from these renewables, at least temporarily.

Funding wind turbines and solar panel parks appears to be costlier when compared to depreciating nuclear power plants which have typically been in existence for several decades. Additionally, climbing interest rates add further complexity to financing high-cost ventures such as those related to the above-mentioned alternative energies.

Factors such as enhanced efficiency and dependability linked to nuclear power are also likely to be contributing towards its growing allure amongst investors. Unlike solar or wind power - which can fluctuate due to weather variations and geographical positionings - nuclear facilities can produce electricity consistently year-round using fewer resources whilst emitting less carbon.

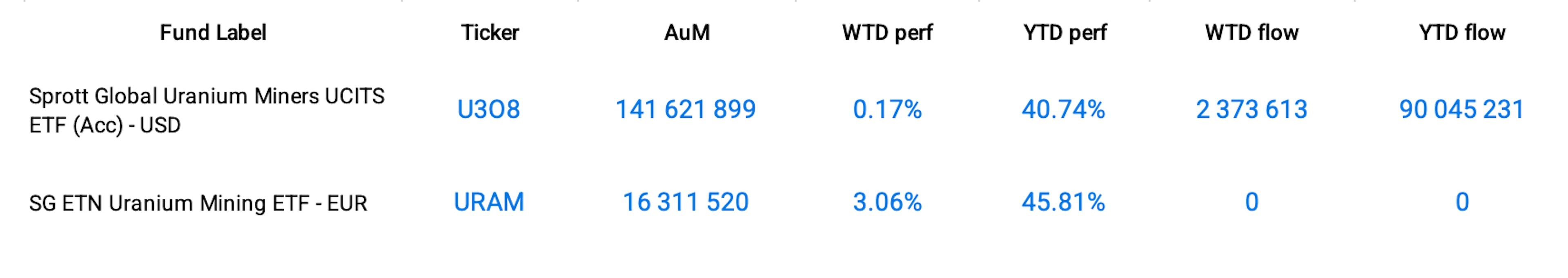

Reflecting this trend, SG ETN Uranium Mining ETF (U3O8) increased by +3.06% over the week, elevating its year-to-date performance to +45.81%.

Group Data: Nuclear Energy, Solar Energy, Wind Energy

Funds Specific Data: U3O8, URAM