- Nvidia reports results on May 24, and for the year, it expects profits and sales to be better than the previous year.

- It is estimated that some 30,000 Nvidia chips will be required to commercialize ChatGPT, and these chips sell for more than $40,000.

- The chipmaker is set to be a key player in the artificial intelligence sector in the coming years

Nvidia Corporation (NASDAQ:NVDA) has been a trailblazer in graphics technology, revolutionizing the gaming industry and high-performance computing. Its remarkable performance on the stock market reflects its exceptional track record:

- Over the past 10 years, the stock has skyrocketed +8289%, making it the top performer in the S&P 500.

- In the last 15 years, it ranks third (after Netflix (NASDAQ:NFLX) and DexCom (NASDAQ:DXCM)) with an impressive rise of +5543%.

- Over the past 20 years, Nvidia secured the ninth spot with a remarkable rally of +17741%.

- In the last 5 years, it ranks 11th with a substantial return of +350%.

The company's trajectory positions it as a significant player in the stock market. One of the key factors contributing to its success is its dominance in AI chips, with an 89% market share in the booming artificial intelligence sector.

This market supremacy towers over competitors such as Advanced Micro Devices (NASDAQ:AMD), Intel (NASDAQ:INTC), and Micron Technology (NASDAQ:MU). Moreover, Nvidia's AI semiconductors command prices 10 to 20 times higher than its gaming-focused chips. This pricing advantage means that the company doesn't need to rely solely on increasing sales volume to achieve its projected growth levels.

With its innovation, market leadership, and strong financial performance, the California-based chipmaker is poised to continue making waves in the stock market and the AI industry.

Using InvestingPro tools, let's take a closer look at the company's prospects ahead of its earnings report.

Artificial Intelligence Craze

The artificial intelligence sector is rapidly emerging as the future, despite some accompanying challenges seen in sectors like online education and customer service.

Artificial intelligence can be described as the ability of machines to mimic and replicate human capabilities such as reasoning, learning, creating, and thinking. It empowers devices like cell phones, computers, robots, and machines to perform tasks that traditionally require human intelligence.

It's worth noting that anything associated with the phrase "artificial intelligence" or its acronyms in English or Spanish (AI, IA) is currently experiencing a significant boost, capitalizing on the industry's tremendous growth. This has overshadowed the previously prominent metaverse concept.

Unsurprisingly, Nvidia, a leading provider of chips for chatbots, is witnessing remarkable stock market gains. In fact, the company's shares have soared by an impressive 94% in 2023 alone.

In case you're unfamiliar, chatbots are virtual assistants that communicate with users via text messages. They enable users to engage in conversations using software integrated into specific messaging systems.

Chatbots tirelessly address user queries and doubts without requiring human intervention, operating 24/7.

Why Is Nvidia Stock Going Up?

Nvidia's shares are soaring due to its major role in the artificial intelligence sector. The demand for its chips is surging, with an estimated 30,000 chips needed for commercializing ChatGPT. These chips currently sell for over $40,000.

Moreover, Nvidia has introduced software tools to improve chatbot behavior and protect against unwanted responses. In response to Microsoft's (NASDAQ:MSFT) limitations on Bing search engine queries, Nvidia's tools address language monitoring for chatbots.

Nvidia has also begun shipping DGX H100 supercomputers to notable customers, including the Boston Dynamics AI Institute, Scissero for legal service chatbots, the Johns Hopkins University Applied Physics Lab for language model training, Sweden's KTH Royal Institute of Technology for research, and DeepL for translation services.

These advancements, coupled with its ongoing innovation and strategic partnerships, have propelled its market position and contributed to the remarkable surge in its shares.

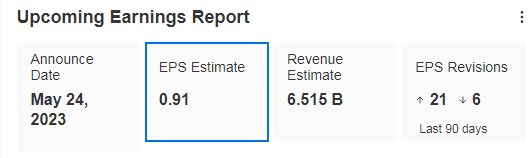

The company will release quarterly results on May 24.

Source: InvestingPro

The InvestingPro tool shows that earnings per share are expected to be $0.91.

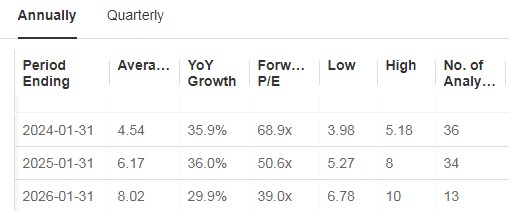

Source: InvestingPro

And here, we can also see the revenue and profit forecasts provided by InvestingPro for 2024, 2025, and 2026.

Source: InvestingPro

The latest results presented on February 22 showed interesting figures, with an increase in earnings per share of +9.5% and revenues above market expectations.

Source: InvestingPro

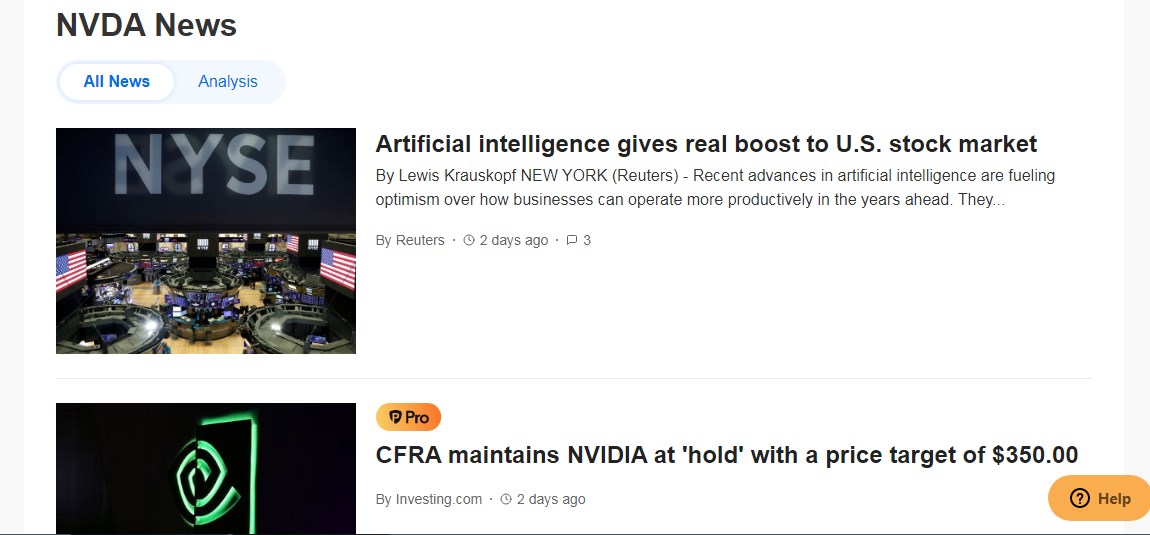

In the news section of the InvestingPro tool, we can see the latest word on the company. Source: InvestingPro

Source: InvestingPro

Nvidia had 37 buy ratings, 11 hold ratings, and 0 sell ratings.

CFRA maintains Nvidia with a $350 price target, up from a previous price target of $300.

It has an Altman Z-score of 26.6. This is positive, as above 2.99 implies that it is a healthy, solid company and highly unlikely to go bankrupt.

Source: InvestingPro

In February, a golden crossover formed, indicating a bullish signal as the 50-day moving average crossed above the 200-day moving average. Since then, Nvidia's performance has been strong.

Bottom Line

With a dominant market share in AI chips and impressive stock performance, Nvidia is well-positioned for future growth. Although the stock is currently expensive because of its parabolic rally, it is surely a name to watch going ahead.

InvestingPro tools assist savvy investors to analyze stocks, as we did in this article. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor.