The S&P 500 finished the day down around 30 bps following a more hawkish reading of FOMC minutes than what was expected, at least in my view. This is interesting because many of the speakers I have heard have suggested they would raise rates if needed, but they have done it with caveats.

The way the Fed minutes read, it came across as much more straightforward. Additionally, it was clear from the minutes that not all Fed officials seem to think that the policy is very restrictive and question how tight the policy is. So, we saw some volatility later in the day. It showed up around 1:30, before the Fed minutes, and moved lower immediately thereafter.

Meanwhile, Nvidia (NASDAQ:NVDA) reported results that were better than expected, which was expected and driven by a revenue beat. Additionally, adjusted non-GAAP gross margins were better. The guidance also came in better at $28 billion versus estimates for $26.8 billion, while the gross margin is expected to be at 75.5%, which was below estimates of 75.6%.

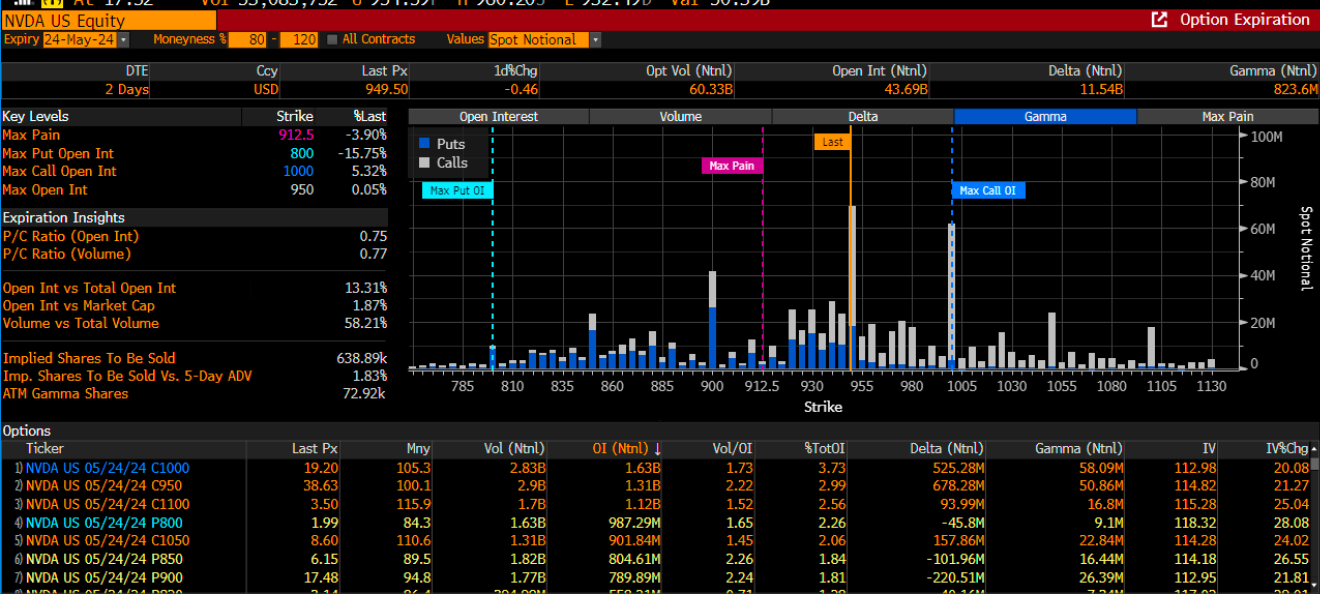

The market looked past that miss on gross margin and focused on the 10-to-1 stock split, which means nothing other than the reduced price and more shares outstanding. But the market liked the split news, and the shares moved higher. Another story is where the stock trades today and whether it holds the gains. The positioning was very bullish heading into the results, and the IV was very high; the key is for the stock to hold over that $1000 level because that is the “call wall,” and if option holders choose to sell those calls, it could keep a lid on things.

The tricky thing, of course, is that the $1,000 calls for expiration on 5/24 had a premium of $19.20. With the IV coming down and the stock trading around $1000, those calls may lose value today, which could prompt sellers. This is similar to the $950 calls, which had premiums of $38.63, and that would require the stock trading above $989 for those to start paying off by Friday’s expiration.

(BLOOMBERG)

We also saw the USD/MXN move higher today and towards resistance around $16.70. So, we will want to pay attention to this move higher in the USD/MXN to see if it sticks and if there is some life to it.