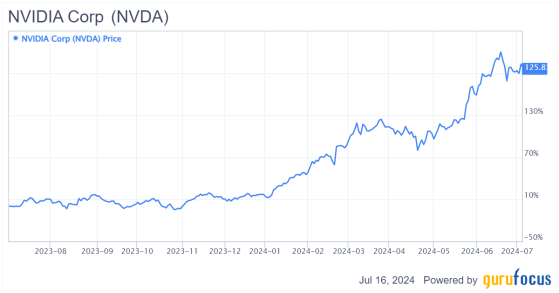

Over the past several years, the rise of Nvidia Corp. (NASDAQ:NVDA) has epitomized the financial fervor surrounding the artificial intelligence gold rush. The sentiment of the entire U.S. market is heavily influenced by this one stock, highlighting its critical role in the current tech landscape.

The recent rally in its share price was driven by two main factors: the enormous demand for GPU chips for AI model training amid the generative AI boom and the substantial expansion in its valuation multiples due to continuous upward revisions in the company's growth outlook. With the benefits of AI being widely recognized, it is no surprise that Nvidia, as the largest manufacturer of data center chipsets, is reaping significant benefits.

NVDA Data by GuruFocus

In mid-2024, Nvidia's soaring stock price propelled it to become the most valuable company on Earth, overtaking both Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) in terms of market capitalization. This achievement will undoubtedly be studied by market historians for years to come. The company has convincingly demonstrated to investors the demand for its AI accelerators is real and enduring, resulting in a significantly increased valuation multiple. The demand for its next-generation H200 and Blackwell platforms remains robust, with demand outstripping supply well into 2025.

Additionally, Nvidia's customer base is broadening, with enterprise and consumer internet companies becoming larger customers. Given the company's pace of innovation, I expect it to stay ahead of the competition in the near to medium-term, which bodes well for its future prospects. Nvidia's dominance as the world's largest producer of critical chipsets for next-generation computing is a vital component of the global AI infrastructure. The company holds a 98% revenue share of the data center GPU market, generating $36.20 billion, a more than threefold increase from $10.90 billion in 2022.

Looking ahead, the company's rapidly expanding business is beginning to segment into different verticals, led by the data center enterprise. Considering these factors, I believe there is still significant upside potential for Nvidia's fundamentals compared to current analyst estimates, which could support further increases in the share price in the second half of the year. However, this growth might occur at a more moderate pace than in the first half as the valuation of shares has, in my opinion, gotten a bit ahead of itself.

While some investors might argue Nvidia's stock is overvalued given its remarkable price surge over the past year, I firmly believe this is merely the beginning of its growth trajectory, although future appreciation may be more moderate. The share price reflects not only the company's current operational performance, but also its future potential in a rapidly expanding market. With management still guiding excellent second-quarter 2025 numbers and market trends indicating durable long-term generative AI demand, I believe Nvidia remains well poised to retain its AI market leadership and that its long-term growth potential is still very much intact.

Source: Nvidia

Unprecedented demand and expansionAccording to CEO Jensen Huang, more than $1 trillion in data center infrastructure and hardware will be built over the next four years, doubling the current global supply of computing power. This projection underscores Nvidia's objective of upgrading supply to meet the robust demand for its next-generation H200 and Blackwell platforms, with demand outstripping supply well into 2025.

The strong growth in Nvidia's data center business is primarily driven by large cloud providers, which now constitute about 45% of its revenue. These providers are investing heavily in the company's AI infrastructure due to the strong return on investment. Additionally, it has seen a broadening customer base, with enterprises driving strong sequential growth in the data center segment this quarter. For instance, Tesla (NASDAQ:TSLA) expanded its AI training cluster to 35,000 H100 GPUs to enhance the performance of its FSD Version 12 and advance its autonomous driving software. Nvidia anticipates the automotive sector will be a major enterprise vertical in the data center segment this year.

Blackwell ecosystem: A game changerIn March, Nvidia officially announced its new Blackwell platform at the GTC conference. This next generation of GPUs promises significant performance improvements, especially for inferencing workloads, with a 30 times performance increase compared to the H100 GPU-equivalent. The Blackwell GPUs are manufactured using a custom-built 4NP TSMC process, featuring 208 billion transistors. The Blackwell chips, including the B100 and B200, offer enhanced memory capacity, memory bandwidth and floating-point performance metrics, essential for deep learning model training.

The GB200 Superchip, consisting of two Blackwell GPUs and one Grace CPU, is priced between $60,000 and $70,000, offering doubled memory capacity and bandwidth compared to previous generations. These advancements are expected to sustain Nvidia's dominance in the AI chip market and make its chips more economically sustainable, with up to 25 times lower costs for AI model training workloads.

Source: Nvidia

Chinese market recovery amid strong competitionAnother catalyst for Nvidia's top-line growth in the coming quarters is the recovery of its Chinese market. Traditionally accounting for around 20% of total sales, this market faced a downturn due to U.S. restrictions on chip exports. Nvidia responded by tweaking its GPUs to meet government criteria, resulting in the H20, L20 and L2 GPU lineup. Revenue from China reached $2.50 billion for the fiscal first quarter of 2025, a 28% quarter-over-quarter improvement after a steep fall the previous quarter.

This indicates Nvidia's data center GPUs for the Chinese market are gaining traction. However, the production costs for these specific GPUs could be higher than those of the H100 GPUs due to increased memory capacity, potentially leading to decreased margins. While Nvidia could see several billions in additional revenue from the recovering Chinese market, this growth might be tempered by muted growth in additional earnings.

Financials: Analyzing Nvidia's stellar performanceTo understand Nvidia's remarkable rally over the past year, look no further than its core data center business, which grew by an astounding 427% year over year in the last quarter. While many tech companies are focused on their growth rebound strategies, Nvidia has maintained over 100% year-over-year growth for the past four quarters, with each quarter surpassing the previous one.

Source: Nvidia

This growth was largely driven by the Hopper GPU architecture, with demand continuing to increase. Data center revenue comprised 86.60% of total sales for the quarter, highlighting the dominance of this segment.

Nvidia reported total sales of $26 billion, exceeding its guidance by $2 billion and beating analysts' consensus of $24.6 billion. This tremendous growth signals a strong bullish sentiment, attracting investors even at current price levels. The high double-digit growth is particularly impressive compared to its peers, including AMD (NASDAQ:AMD) and Intel (NASDAQ:INTC), which are experiencing single-digit growth rates.

Source: Nvidia

Future growth and revenue projectionsHigh-growth companies typically include a safety buffer of around 5% when announcing guidance to ensure they can comfortably exceed expectations. Applying this to Nvidia, the best estimate for next quarter's revenue would be adding 5% to the recently announced guidance of $28 billion, resulting in expected revenue of $29.40 billion. This projection indicates the tech company's top-line growth could continue at an impressive rate, suggesting that fears of peak revenues are overblown. Huang has stated that demand for the H200 and upcoming Blackwell architectures will exceed supply well into 2025, supporting the outlook for sustained strong top-line growth.

Margin expansion and financial strengthIn addition to its impressive growth, Nvidia has seen significant expansion in its margins. Achieving over 3,000 basis points of gross margin expansion in less than two years is remarkable for a mega-cap company. The overall gross margin has consistently expanded over the past eight quarters, driven mainly by the data center segment. As the compute and networking mix increases, overall Ebit margins are expected to rise given that this segment boasts 75% margins. This trend is already playing out, with Nvidia's operating leverage allowing it to quadruple its levered free cash flow in the first quarter from $3 billion to $12 billion. Consequently, its total cash grew sequentially from $25.90 billion to $31.40 billion, while total debt remains a manageable $11 billion compared to the company's nearly $3 trillion market cap.

Competitive edge through innovation and financial muscleInnovation is crucial in the semiconductor industry, and Nvidia's advanced GPU technologies have allowed it to nearly monopolize the market. Another bullish indicator is its financial strength, which far surpasses that of major rivals. Intel is grappling with a deep net debt position and a below-one coverage ratio. Although AMD's balance sheet is cleaner, its cash reserves are five times smaller than Nvidia's. This financial advantage gives Nvidia significantly more potential to reinvest in research and development, maintaining its edge.

Source: Nvidia

Nvidia's exceptional performance in the data center segment, robust growth projections, expanding margins and superior financial strength make it a compelling investment. The company's continued innovation and ability to reinvest in cutting-edge technologies further solidify its dominant position in the market.

Valuation: Justifying Nvidia's market position and potentialFrom a valuation standpoint, Nvidia might not attract traditional value investors since both intrinsic and relative valuation measures suggest it is not appealing based on normalized growth estimates. Despite the stock rising significantly over the past year, the company's consistent performance and significant revenue growth justify its current price levels. This performance is not merely driven by AI industry hype; it is supported by substantial revenue increases and improving margins. With a 98% market share in the data center GPU market, no competitor is poised to challenge Nvidia's dominance in meeting the rising global data center demand.

Nvidia's continuous innovation keeps it ahead, as data center operators are eager to build new facilities and upgrade existing ones to meet next-generation customer expectations. Over the past two years, the data center segment has become the largest component of its business. According to Markets and Markets, the data center GPU market is projected to grow by 35% annually over the next five years, quadrupling annual demand by 2030. Given this forecast, Nvidia has significant upside potential for its new and existing products.

Source: AlphaSpread

When considering aggressive 5-year growth estimates, which are appropriate for a company with such growth potential, the data center accelerator market is projected to reach approximately $400 billion by 2027. Nvidia's recent data center revenues indicate the accelerator market is on track to exceed the $100 billion threshold this year, supporting the aggressive estimates in this valuation.

Nvidia's product roadmap, including new offerings like Blackwell, is expected to bolster its competitiveness. Additionally, strong partnerships with major cloud providers are likely to sustain its growth. Using a discount rate of 9.40% and a terminal growth rate of 1% (which is conservative beyond the five-year mark), we can derive a discounted cash flow equity value of $166 per share, indicating an upside of 26% from current levels.

Source: AlphaSpread

This upside is calculated even with the assumption of a gradually decreasing market share for Nvidia (80% market share by 2027) as competing products gain traction and pressure margins. Based on this analysis, I recommend buying Nvidia shares or accumulating more during slight pullbacks. Given the numerous positive catalysts, there is potential for upward revisions in fundamentals, which could lead to substantial gains.

ConclusionNvidia's remarkable rise epitomizes the AI-driven financial fervor, reflecting its critical role in the tech landscape. With robust demand for its AI accelerators, continuous innovation and financial strength, the company is well positioned to maintain its leadership in the AI and data center markets. The company's future growth trajectory, backed by substantial revenue increases and expanding margins, presents a compelling investment case even at current levels. As the company continues to capitalize on the AI gold rush, it remains a strong buy, with significant upside potential and enduring market dominance.

This content was originally published on Gurufocus.com