The recent regional banking crisis in the U.S. and forced Credit Suisse (SIX:CSGN) takeover have raised fears of a global financial recession by the end of the year. The risk of contagion to other sectors of the economy has also intensified with flashbacks of 2008 starting to play out in investors' minds.

Although the market primarily punished the financial sector over the last 3 weeks, certain commodities were also caught up in the turmoil. Energy commodities are highly sensitive to economic growth projections (at least in the short term) and were hit particularly hard during the initial sell-off. The price of oil fell to a low of $66, down from an established range of $75 to $80 in place since December.

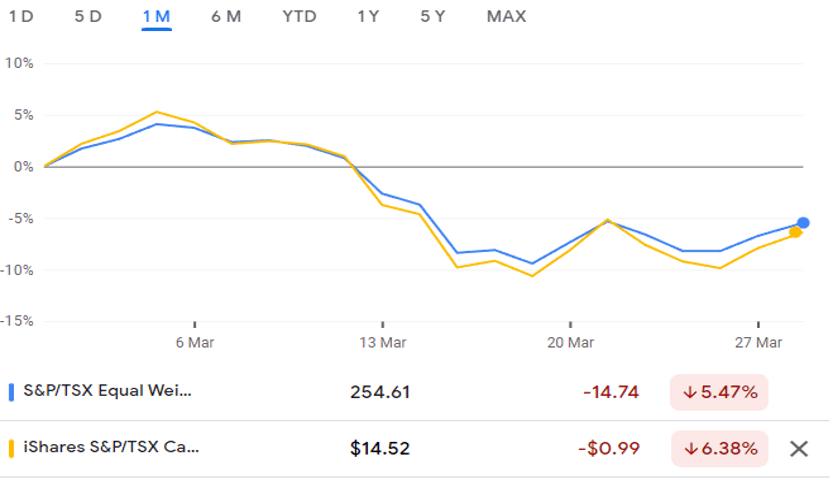

As a result, the S&P/TSX Equal Weight Oil and Gas index (TXOE) fell 13% between March 6th – 16th, while the iShares S&P/TSX Capped Energy Index (XEG) fell almost 16% over the same period. Both indexes have since started to recover, and are only down between 5.5% and 6.5% respectively, for the month.

Oil Prices and Global Recessions

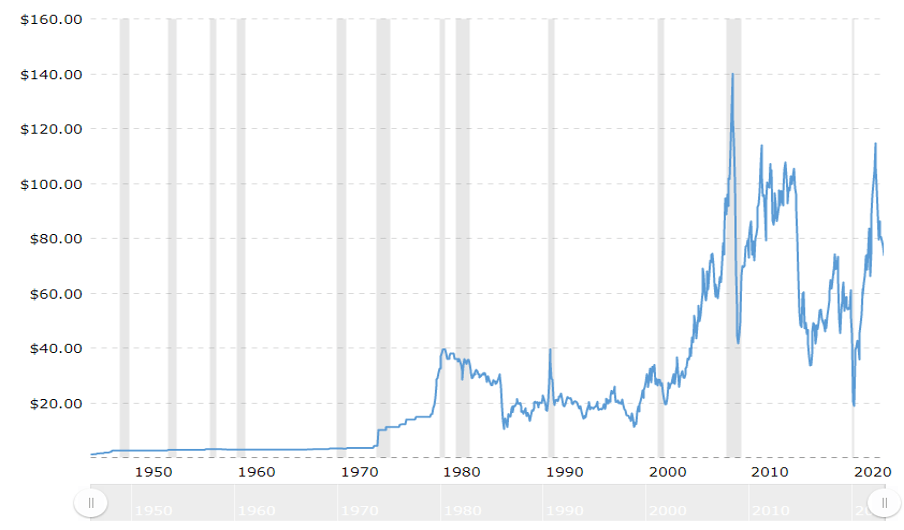

Being an economically sensitive commodity, recessionary expectations tend to correlate to lower oil prices in investors’ minds, and there is some data to support this view. Tracking the last 80 years, we can see the price of oil experienced moderate declines during the shaded periods, representing recessions.

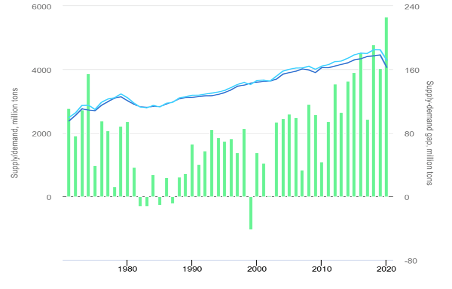

But it’s important to remember that correlation does not necessarily imply causation, and that global demand dynamics have shifted towards non-OECD countries over the past few decades.

Removing the two obvious outliers in this graph (2008 and 2020), we see that any declines in prices were moderate throughout the 80s and 90s, and were mostly a return to the mean, rather than an all-out price crash. At the same time, the demand for oil has consistently grown since 1975 and is projected to continue growing - despite a predicted recessionary environment over the next 2 years - powered by China, India, and other non-OECD countries.

Oil price forecast updates

Despite the 'doom and gloom’ scenarios promoted by financial media outlets, oil price and demand forecasts provided by major banks, research firms, and data providers have not actually changed that much since the banking troubles began. Here are a few of their forecasts:

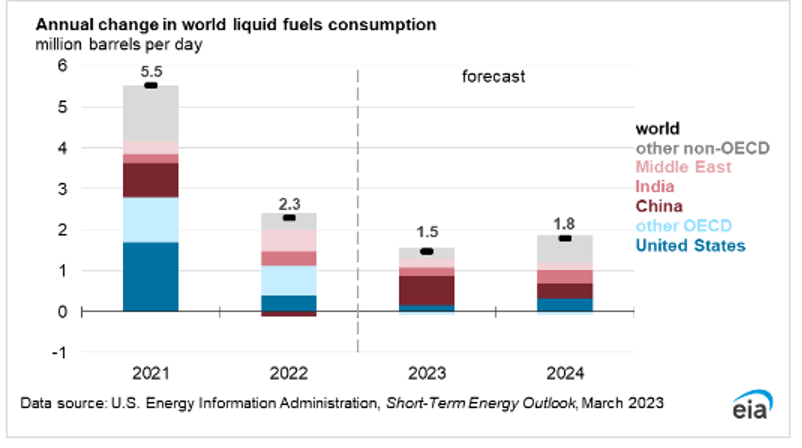

- March 7th - U.S. Energy Information Administration expects demand growth of 1.5 and 1.8 million b/d in 2023 and 2024

- March 8th - Barclays (LON:BARC) forecasts prices between $87-$92 in 2023

- March 17th - ING is predicting $90-$100 oil in Q4 2023

- March 20th - Goldman Sachs (NYSE:GS) forecasts oil prices of $94 and $97, in 2023 and 2024 respectively, on the back of Chinese growth.

Despite downward revisions from their previous targets, these forecasts are far above the current price of oil which is sitting around the $70 mark, suggesting a pickup in demand as the banking jitters pass.

An opportunity to gain or increase exposure?

Energy was one of the few sectors in 2022 to experience positive performance, with the price of oil peaking at $120 in July. The price drifted lower in the second half of the year to stabilize in the $75 to $80 range.

Should investors use the current uncertainty to gain exposure or add to their energy positions? At least two high-profile money managers believe so. The first is Warren Buffett himself, who has been adding to his Occidental Petroleum (NYSE:OXY) position throughout the banking crisis, accumulating 23.5% of the outstanding shares.

The second is a more local name, managing the third-largest energy Fund in the world. Eric Nuttall of Ninepoint Partners is particularly interested in Canadian energy names with a heavy focus on free cash flow, share buybacks, and dividend increases.

"We believe recessionary fears are overblown. Even with modest demand destruction in the United States and Europe owing to an economic slowdown, we still see global inventories falling to multi-year lows by the end of 2023 due to Chinese demand normalizing as it emerges from covid-zero lockdowns combined with ongoing non-OECD demand growth. Given record free cashflow and a commitment to return the majority of it back to investors, we believe we stand on the cusp of very meaningful dividends and share buybacks which will act as the catalyst to drive a re-rating in valuations.” – Eric Nuttal, Partner and Senior Portfolio Manager at Ninepoint Partners LP.

Investors looking to add exposure to energy names can conveniently screen, compare and select a variety of ETF products listed on NEO’s ETF Market.

Alternatively for investors primarily seeking Canadian exposure, the Ninepoint Energy Fund ETF or the Ninepoint Energy Income ETF are worthy of consideration. Inherent benefits of these strategies include active management by an experienced team with deep industry knowledge and insights, and a focus on free cash flow fundamentals.

For a more passive exposure, the Horizons S&P/ TSX Capped Energy Index ETF is a solid option with a low fee of 0.27%.

This content was originally published by our partners at the Canadian ETF Marketplace.