Unlike last year, the first half of 2023 has been a tough period for crude oil. Despite Saudi Arabia announcing production cuts, and the concerted endeavors of OPEC+ to curtail supplies until 2024, the WTI crude oil price has lost 10.57% year-to-date, pushing the S&P energy sector down 8.32%.

As the global crude oil market continues to grapple with low prices, there are three main reasons for this predicament.

First, the surging influx of oil from Russia to China, Turkey, and India, its largest customers. Ironically, the EU sanctions against Russia have resulted in higher levels of Russian oil exports than was the case before the invasion of Ukraine.

Second, the United States increased its production level by 400,000 barrels per day (bpd) to reach 12.4 million bpd in June, according to data published by the Energy Information Administration. If this trend continues, the United States might break its February 2020 record of 13.1 million bpd. Meanwhile, other oil exporting countries, OPEC members included, need to increase their output as they are struggling to meet their debt payments.

Finally, the sluggish outlook for economic growth drives oil prices down. Indeed, the last OECD report states that global GDP growth is expected to be 2.7%, the lowest rate since the financial crisis of 2008 (except for 2020 in the wake of the Covid-19 outbreak).

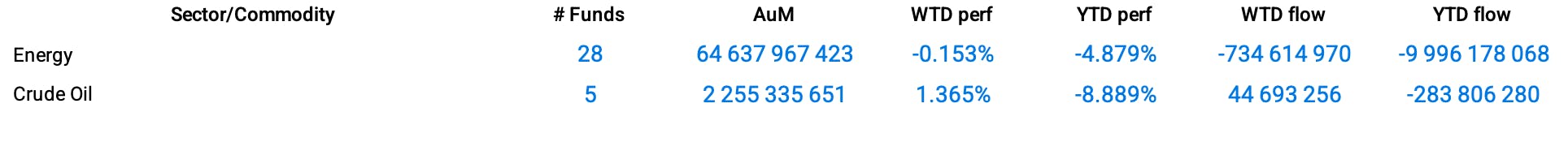

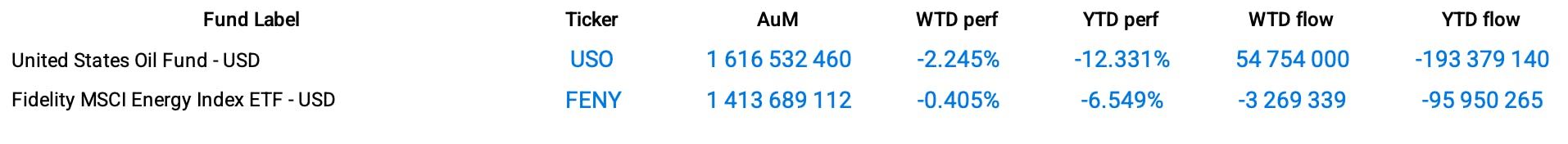

This bearish trend led to ETFs such as the United States Oil Fund (NYSE:USO) and the Fidelity MSCI Energy Index ETF (FENY) losing 2.25% and 0.41%, respectively, over the week. Investors echoed this sentiment by redeeming assets, with energy sector ETFs recording net outflows of 9.6 billion since the beginning of the year.

US Group Data

Funds Specific Data

This content was originally published by our partners at ETF Central.