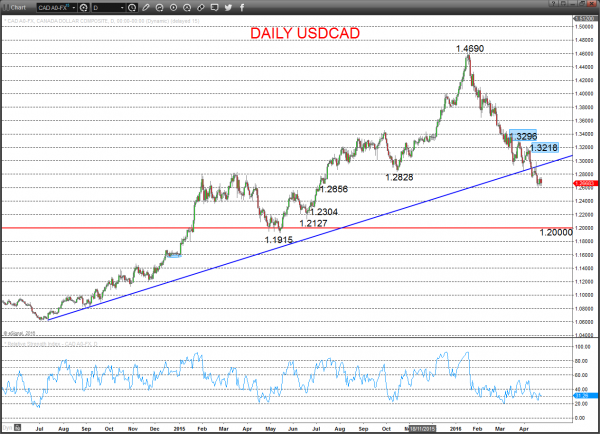

The strong oil price rebound last Monday (17th April) from early weakness after the outcome of the Doha talks saw the ICE Brent Crude Futures stage a firm recovery effort through last week, to maintain upside pressures from the underlying bull theme from early Q1 2016. This points to higher prices into late April and through into mid-Q2.

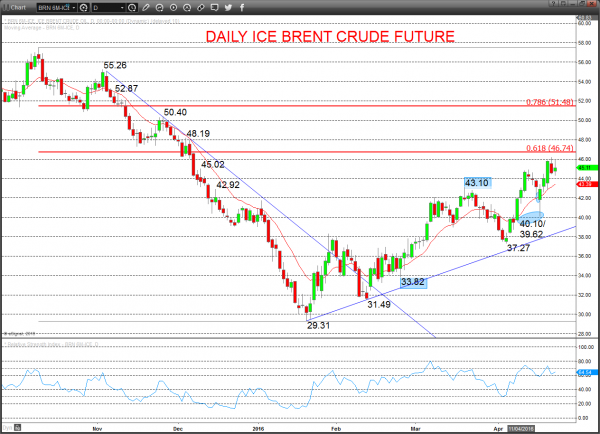

In addition, this bullish Oil theme lends a bullish tone to the Canadian Dollar, reinforcing the USDCAD bear trend, aiming for further downside into May.

ICE Brent Crude Future (June 2016 Contract)

A firm rebound Friday to reinforce an underlying bull tone from the strong turnaround rebound last Monday from the 40.10/39.62 support area, to keep a bullish tone for Monday.

Furthermore, the previous push through the 43.10 level set a bullish intermediate-term theme.

For Monday:

- We see an upside bias through 46.18 for 46.74; break here aims for 48.19.

- But below 44.30 opens risk down to 42.60.

Short/ Intermediate-term Outlook - Upside Risks:

- We see a positive tone with the bullish threat to 45.02.

- Above here targets 46.74 and 48.19, maybe 50.00.

What Changes This?

Below 37.27 signals a neutral tone, only shifting negative below 33.82.

Daily ICE Brent Crude Future (June 2016 Contract) Chart

USDCAD

A bearish outside pattern Friday for a more negative tone, to reject the Thursday rebound, with another stall ahead of modest 1.2780 resistance, to set a negative tone again Monday.

For Monday:

- We see a downside bias for 1.2619 and through the new low at 1.2590 for 1.2555; break here aims for 1.2500 and 1.2460.

- But above 1.2758/80 opens risk up to 1.2855 maybe 1.2932.

Short/ Intermediate-term Outlook - Downside Risks:

A bearish shift in the intermediate-term outlook was previously signalled below 1.3360.

- We see a negative tone with the bearish threat to 1.2304.

- Below here targets 1.2127 and 1.2000.

What Changes This?

Above 1.3218 signals a neutral tone, only shifting positive above 1.3296.

Daily USDCAD Chart