In what could mark a significant momentum shift in the oil market, WTI prices surged to a four-month peak this week, above $81 a barrel, propelled by unexpected drops in U.S. crude and gasoline inventories, and concerns over potential supply disruptions following attacks on Russian refineries. The combination of factors including optimistic demand forecasts from OPEC and resilient U.S. economic indicators, despite inflation, is shaping a bullish narrative for oil. As an illustration, the Horizons NYMEX Crude Oil ETF (HUC) gained 3.93% over the week, bringing its year-to-date performance to 9.36%.

Unanticipated Drops in U.S. Inventory Levels

The U.S. Energy Information Administration (EIA) revealed a surprise withdrawal of 1.5 million barrels from U.S. crude oil stockpiles for the week ending March 8. This move, coupled with a more significant than anticipated drop in U.S. gasoline stocks, fueled the oil price rally, highlighting a stronger-than-expected demand in the domestic market.

Ukraine's Attacks on Russian Refineries Stir Supply Concerns

Adding to the bullish sentiment are the recent escalations in Eastern Europe, as Ukrainian forces launched drone strikes on Russian oil refineries, including a significant attack on Rosneft's largest refinery. These strikes not only caused immediate damage but also raised fears of longer-term supply disruptions, amidst an already tense geopolitical climate.

OPEC's Positive Outlook and U.S. Economic Resilience

OPEC's latest reports remain optimistic about oil demand growth, providing a supportive backdrop for the price surge. Moreover, the oil and broader financial markets have found an additional pillar of support from the U.S. economic front.

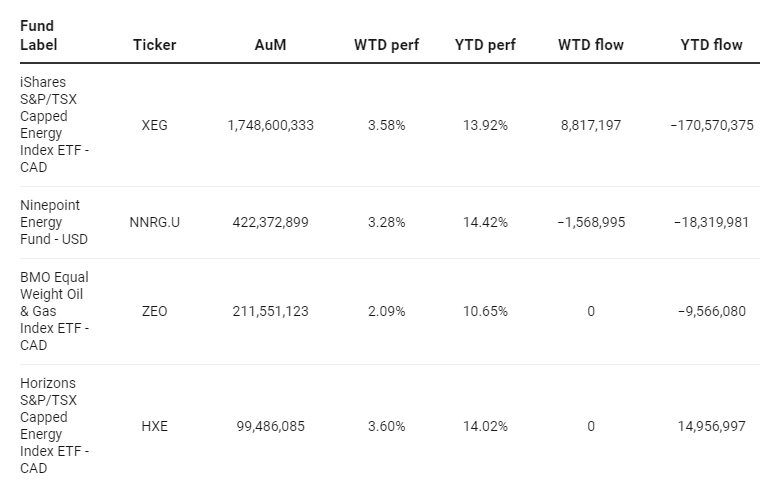

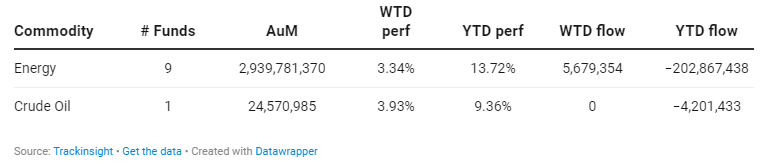

Despite recent inflation data, there is a prevailing sentiment that the Federal Reserve's potential interest rate cuts will not be derailed, even if they were somewhat delayed in time, fostering hopes for sustained economic growth and, by extension, oil demand. Energy ETFs gained 3.34% on average over the week, and 13.72% since the beginning of the year 2024.

Group Data:

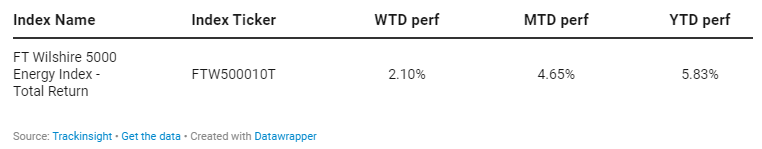

Index Data:

Funds Specific Data: