Okta Inc. (NASDAQ:OKTA, Financial) has gone from a high-growth identity security play to a more mature, highly profitable enterprise. The company has proven its ability to scale efficiently, as revenue is expected to grow steadily and EPS quadruple in the same period. It also has AI-driven security, strong enterprise adoption, and an ever-deepening partnership with Amazon’s (NASDAQ:AMZN, Financial) Amazon Web Services (AWS).

Moreover, profitability is improving, with strengthened free cash flow and increasing operating margins. While Okta’s valuation is still high, it is justified by strong execution, wider margins, and leadership in identity security. Notably, the forward P/E ratio of the stock is expected to fall significantly by 2035, making it more attractive over time. The company has a compelling upside with solid growth, improving profitability, and an appealing long-term valuation.

While key insiders are selling, Okta’s leadership remains optimistic, focusing on profitability, enterprise expansion, and AI-driven security solutions.

Company overview

Okta is a leading identity and access management company, acting as a digital gatekeeper for businesses. Whether logging into a work app, or a cloud service, Okta makes sure to enable secure, smooth access. It has been able to build itself up in enterprise security around AI-driven authentication and zero-trust frameworks. Additionally, it is a Software as a Service (SaaS) provider offering scalable and cloud based solutions that help organizations to manage user identities more easily and efficiently.Okta delivers strong fourth-quarter

Okta just wrapped up Q4 with a solid beat, showing why they continue to be a key player in identity security. Sales chalked up to $682 million, up 13% from a year ago and beating Wall Street’s 11% estimate. What is more impressive is the company’s 25% remaining performance obligations (RPO) growth, which was up significantly from Q3’s 19% growth. That is a very strong multi-year deal activity, a crucial metric for a subscription business. Okta’s ability to lock in long-term contracts, and therefore, lock it into the IT budgets of companies across industries means that its solutions remain mission-critical.Moreover, Okta is proving that it can grow profitably beyond top-line growth. Non-GAAP operating margins increased to 25%, up four points year over year, as cost control and operational efficiency improved. This is important as the company is becoming more balanced and sustainable. A free cash flow of $284 million (42% of revenue) gives further flexibility for reinvestment, acquisitions, or shareholder returns.

Another bright spot was that Auth0, Okta’s 2021 acquisition, performed very well. With increased bookings growth, the authentication platform demonstrated that Okta is a competitive force in identity security. Auth0 for Gen AI is also being launched with beta, and this is opening new opportunities in a fast changing AI-driven tech landscape.

Overall, Okta is executing well. Net revenue retention is still a little bit pressured at 107%, but Okta is accelerating its RPO, expanding profitability, and continuing to add AI-driven product innovation which all point to the company being on a great trajectory.

Okta’s strong financial position

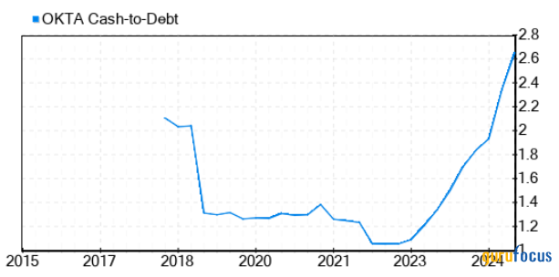

Okta is in a strong financial position. As of January 31, 2025, it has $2.52 billion in cash and only $952 million in total debt. This gives it a solid cash-to-debt ratio of 2.65, which is more than twice the cash required to repay its debts. The amount of liquidity at this level is a big deal, allowing Okta to invest into AI security inventions, grow visibility in the cloud marketplace, and get through economic uncertainty while not being too dependent on debt.Source: Okta’s stock pdf (Gurufocus)

Okta’s $1B AWS milestone and security evolution

Okta is making bold moves in both security and growth. It didn’t just patch things up after last year’s customer support breach; instead, it doubled down, further tightening Help Center security and meeting with regulators. OpenID Foundation is creating new security standards and last year’s Spera Security acquisition boosted its threat detection.On the growth side, Okta is crushing it in cloud marketplaces, reaching $1 billion in AWS. The company is moving away from a lengthy enterprise sales cycle with an 80% increase in FY25 AWS Marketplace sales. Additionally, Okta has entered into a new Strategic Collaboration Agreement with AWS, which positions Okta as an indispensable cloud security player.

Okta’s massive market opportunity and why it matters

Okta has a rock-solid financial foundation and is sitting on a gold mine. The company’s TAM is estimated to be $80 billion, but it has barely scratched the surface, with only 3% penetration. Therefore, there is still a lot of space to grow. The best part is that identity security is not just limited to tech; it applies to any industry from healthcare to finance.That said, a big growth driver here is Auth0. It increased its TAM by $15 billion. But this is not just about finding more customers, but about deeper integrations, more use cases, and higher retention. Okta is well placed to grab a much bigger share with cybersecurity remaining as the top priority.

Steady growth with room for upside

As we look at Okta’s earnings and revenue trajectory through 2035, the company is on a good upward path. By 2035, earnings-per-share (EPS) is expected to increase to $11.41 from just $3.17 in 2025. Meanwhile, the total amount of revenue is anticipated to rise from $2.89 billion to an amazing $6.19 billion. It means that while Okta may no longer be in hypergrowth mode, it is indeed on a path to become a more profitable and mature business.Source: Okta’s EPS estimates (Seeking alpha)

Also, margin expansion is taking place. Since revenue nearly doubles, EPS is almost quadrupling, indicating the company is becoming more efficient. This is a great sign that the company strengthening its bottom line as it pursues growth.

Source: Author generated based on historical data

What’s even more remarkable, however, is that the forward price-to-earnings (P/E) ratio is expected to shrink from 34 times in 2025 to less than 10 times by 2035. This is a significant decline that indicates the expectation of strong earnings growth outpacing stock price appreciation, a change from a high-growth valuation to a more mature earnings multiple. As Okta scales profitability, it will become worth less as a SaaS high-premium play and more as an established software company, potentially contributing to lower multiple over time.

All this looks good for Okta’s continued upside for several years to come. Valuation remains a major consideration as the company transitions from a high-growth business. With Okta’s leadership in identity security, investors are willing to pay a premium, but let’s see if its current valuation still makes sense in light of its growth trajectory.

Valuation: A premium, but justified

Okta is overvalued on a traditional valuation basis, but it is worth considering in the context of high-growth SaaS companies. Currently, Okta trades at 8.4 times forward sales, which is much higher than the industry average of 5.6 times. In addition, its 42 times forward EV/EBITDA is also far above the sector median of 15 times as investors clearly value this stalwart security company.That said, this premium valuation is justified given Okta’s strong execution, improving margins, and profitability. The company’s Rule of 40 score of 52% (revenue growth + FCF margin) also confirms its premium valuation, as top-tier SaaS firms with scores above 40% tend to trade at higher multiples.

Furthermore, Okta’s forward P/E is expected to fall as EPS grows, which makes Okta’s valuation more appealing over time.

Okta’s growth outlook and revenue potential

As profitability scales, Okta’s long-term growth trajectory is looking solid. The revenue is expected to ascend steadily, with consensus estimates of $2.85 billion in FY26, which translates to about 9-10% growth rate. However, with Okta being a well-adopted enterprise, having some of the best AI-based security innovations, its stock has the potential to exceed these expectations.If I assume a higher annual growth rate of 12% for further two years, then my estimate for FY27 is $3.20 billion and for FY28, it is about $3.58 billion, which is higher than consensus.

Profitability gains and expanding marginsSimilarly, Okta’s profitability is improving. Its EPS is expected to increase from $3.17 in FY25 to $4.86 in FY28. Operating margins are expected to expand, with FY26’s non-GAAP operating margin forecasted to be 25%. Assuming a one-percentage-point increase per year, Okta’s FY28 operating margin should be 27%, generating an operating income of about $967 million. Now, with an 8% discount rate, which is reasonable based on Okta’s profitability trajectory, low debt levels, and SaaS model with high customer retention, the present value of this operating income is about $770 million.

Source: Author generated

Projecting Okta’s future price potentialLet’s now see the price targets. A reasonable price target for Okta is $116 per share using consensus estimates and management projections. I, however, set the P/E multiple of 30 times to an estimated FY28 EPS of $4.50, resulting in a higher price target of $135. This gives an upside potential of 25% over its current price of $108, making Okta an appealing long-term investment.

Risks to my thesis

Okta has a lot going for it but alongside some risks.The identity security space is getting increasingly competitive as giants like Microsoft Corp (NASDAQ:MSFT, Financial) now forge into security with complimentary products that make it harder for Okta to stand out. In order to stay ahead it will require to constantly innovate and execute strongly.

Security is another major concern. Any breach would be catastrophic for a company built on trust. Okta isn’t immune to the risks of major security incidents, which we’ve seen cybersecurity firms struggle to get over. Customer churn and stronger regulatory attention will come in one hit with a single high-profile breach.

Lastly, Okta’s premium valuation seems fair given its strong performance, but any growth or profitability slumps can impact it. This means, that investors will get more sensitive to performance metrics and even the slightest deviation from the expectations may affect the stock performance.

Managing these risks while maintaining profitability will be critical to future success.

Insider selling and Okta’s capital strategy: Should investors worry?

Although insider selling is something to keep an eye on, it’s not always a bad thing. Main insiders to recently sell Okta shares are Chief Revenue Officer Addison Jonathan James, Chief Financial Officer Brett Tighe and Director Frederic Kerrest. The Rule 10b5-1 trading plan allows pre-scheduled stock sales to avoid accusations of insider trading and James sold 9,850 shares on October 14, 2024 following this rule. Frequent sales are worrisome, but are usually tied to personal financial planning rather than doubts about the business.Management’s confidence despite sellingIn addition, the lack of insider buys can mean that management believes the stock is fairly valued or even expensive, rather than an attractive buy at these levels and sales from key leaders, such as those in charge of financials and revenue growth, may cause doubts about whether Okta has the confidence in its long-term upside. However, after reading quarterly transcripts, its apparent that Okta’s leadership remains very confident. CEO Todd McKinnon reiterates Okta’s long runway for growth, and CFO Brett Tighe talks about improving profitability, disciplined cost controls, and big enterprise deals.

While high rate of insider sells and no insider buys can be a sign of worry and should be considered, Okta is sticking to its strengths of scaling profitably and executing efficiently rather than relying on financial engineering. That is a reassuring sign for long-term investors.

In what other ways should investors approach Okta?The timing of the selling trend is what makes it all the more interesting. Many sales were when Okta’s stock was trading at low levels and the still price continued to rise. This implies that wither insiders weren’t anticipating such a large recovery or simply cashing in on recent gains.

For investors, Okta’s upcoming earnings and guidance are one of the major factors to watch. The stock may be pulled back if the company reports weaker than expected results or signals declining growth. The investors are supposed to watch the trends of revenue, profitability, and any remarks that the company makes about future business conditions.

That said, all signals are not bearish. Let’s reflect on guru trading, which tells a different story. Unlike insiders, whose sales are usually based on pre-planned financial decisions, Gurus invest with deep analysis and long-term potential. For Okta, the chart shows gurus consistently stepping in during price dips, which is a sign of institutional interest remaining steady.

Although there are guru sales as well, it is evident that institutional investors are still in the game and see value here. The insider selling pales in comparison to the large funds’ growing confidence in Okta’s long-term prospects. Watching what institutional activity may have in store for the stock over the coming months will give a better picture and help predict where Okta may find itself going.

Your takeaway

All in all, Okta is having a fire with high revenue growth, increasing margins, and a good financial situation. The company has been able to stay in the ID security space because of its multi-year deals and its leading AI-driven security innovation.That said, execution is everything. Insider selling is neither a red flag nor something to be avoided. There is also competition, security risks are always around, and valuation is still up in the air. While Okta isn’t cheap, its long term potential is noteworthy given its growing profitability and EPS about to almost quadruple by 2035.

Ultimately, patient investors will have the opportunity to enjoy double-digit growth if Okta continues to execute. But any misstep would cause confidence to break. For now, it is a high quality growth name to keep an eye on.

This content was originally published on Gurufocus.com