After a series of highs and lows, the Canadian Real Estate industry has begun to cool in 2023. Inflation is coming under control, and the consecutive announcements from the Bank of Canada to keep the interest rates steady have been the major factors contributing towards the improvement in the market. The stability of the market has given rise to an increase in the demand for homes, but there is a concern that the supply will not be able to match the demand, leading to a price hike.

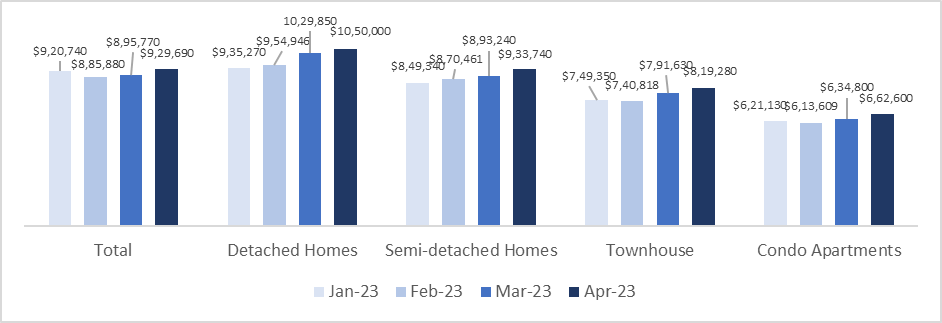

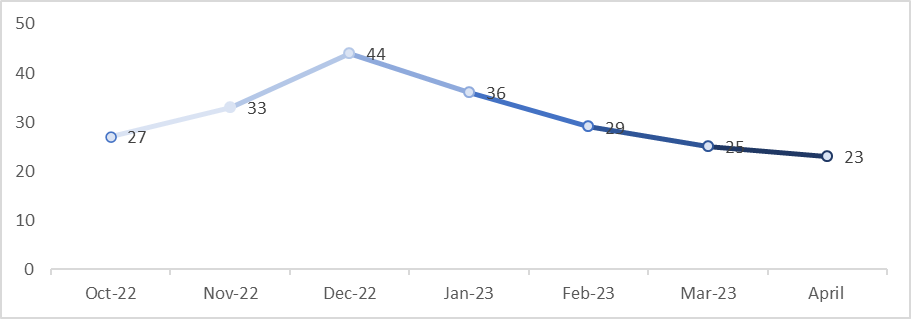

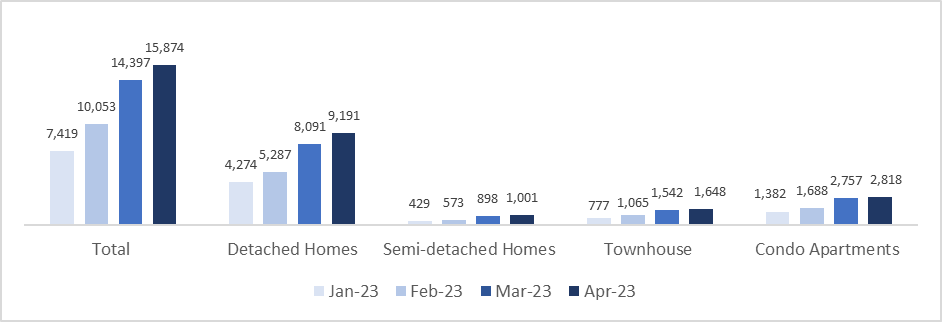

Homes are already selling out fast, and the prices are increasing, indicating an upcoming change in the seller's market. In the last few months, the number of sales has started to pick up, and so have the home prices. In April 2023, there was a 10% increase in sales compared to the previous month. The number of days on the market decreased to 23 from 25 days last month, and the average house price increased by 3.7%. Moreover, in the last three months, there has been a continuous increase in sales and selling prices in Ontario. With stable interest rates, prices will continue to rise for the rest of the year. Sellers will have more room for negotiation; there will be more competition between buyers, which can lead to bidding wars amongst buyers.

AVG. SELLING PRICES IN ONTARIO

NO. OF DAYS ON THE MARKET

Shedding light on the current market scenario, Mr Manoj Karatha, Broker of Record, The Canadian Home Realty Inc., says: “We recommend that buyers act now before prices rise again in Ontario. More than 400,000 people immigrated to Canada in 2022, contributing to higher housing demand; another 485K are expected in 2024. A growing population, stable interest rates and a shortage of available housing will increase demand. Hence, we can expect an increase in house prices.”

NO. OF HOUSES SOLD IN LAST FOUR MONTHS

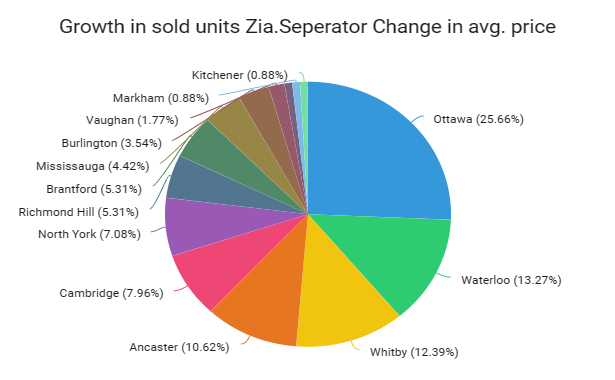

Cities with maximum sales growth*

The highest-growing cities in Ontario were Ottawa (29% increase), Waterloo (15% increase), Whitby (14% increase), and Ancaster (12% increase), followed by Cambridge with a 9% growth. The cities with the highest price increase were Waterloo, Toronto, Markham, Etobicoke and Burlington.

As per Mr Robin Cherian, CEO of The Canadian Home Realty Inc., things look bright for sellers, and buyers need to act fast, explaining he adds, "Given the current market conditions vis-a-vis prices and no. of days on the market, the demand will not match the supply, which will lead to an increase in the price. So, if you're a buyer looking to dip your toe into the real estate market, you'll want to move fast; buy now while housing is still affordable.”

As the Canadian Real Estate market recovers from the last few years of instability, this is the perfect time for buyers to act on their decision and become a homeowner as early as possible. Controlled inflation and stable interest rates will continue to boost the market, increasing sales and average selling prices.

Therefore, it is wise for buyers to act fast before the prices rise again. This is the best time to take the opportunity and invest in the Canadian Real Estate Market to reap the fruits of a competitive market later.

*Source: The Canadian Home