Escalating interest rates and rising inflation have been pushing away the homeownership dream for many. As a result, the housing market in Canada has been slowing down for the last few months. This trend will likely stretch into the winter months since this season is known for reduced activity in the housing market anyway.

According to a study conducted by CREA, in Canada, there was a 29.7% drop in new property listings, a 10.4% decrease in home sales, and a 6.3% decline in home prices during the winter of 2022-2023. In the last few years, inflation, interest rates, and the housing affordability crisis have made this decline even more pronounced.

Renowned economists in Canada have tried to predict the housing market performance in the coming winter months. According to the Bank of Canada, there might be a 3% decrease in home prices for the next season. The Norada Real Estate Investment has taken a slightly more conservative stance in this regard, predicting a moderate 5% decline.

As Canada gears up for the winter season, it looks like something special is on the horizon for aspiring homeowners. Our outlook is that the Bank of Canada will keep interest rates steady until December 2023. We also expect a decline in home prices and new listings while properties will take more time to sell.

Stable Interest Rates: A Prime Opportunity for Homebuyers

We went over this in our report from October 6th, 2023. There was a 3.2% increase in home sales soon after the BoC kept the interest rates steady on September 6th, 2023. This indicated a trend that if BoC sticks by its decision to hold interest rates steady then this could potentially motivate a large number of homebuyers to enter the housing market.

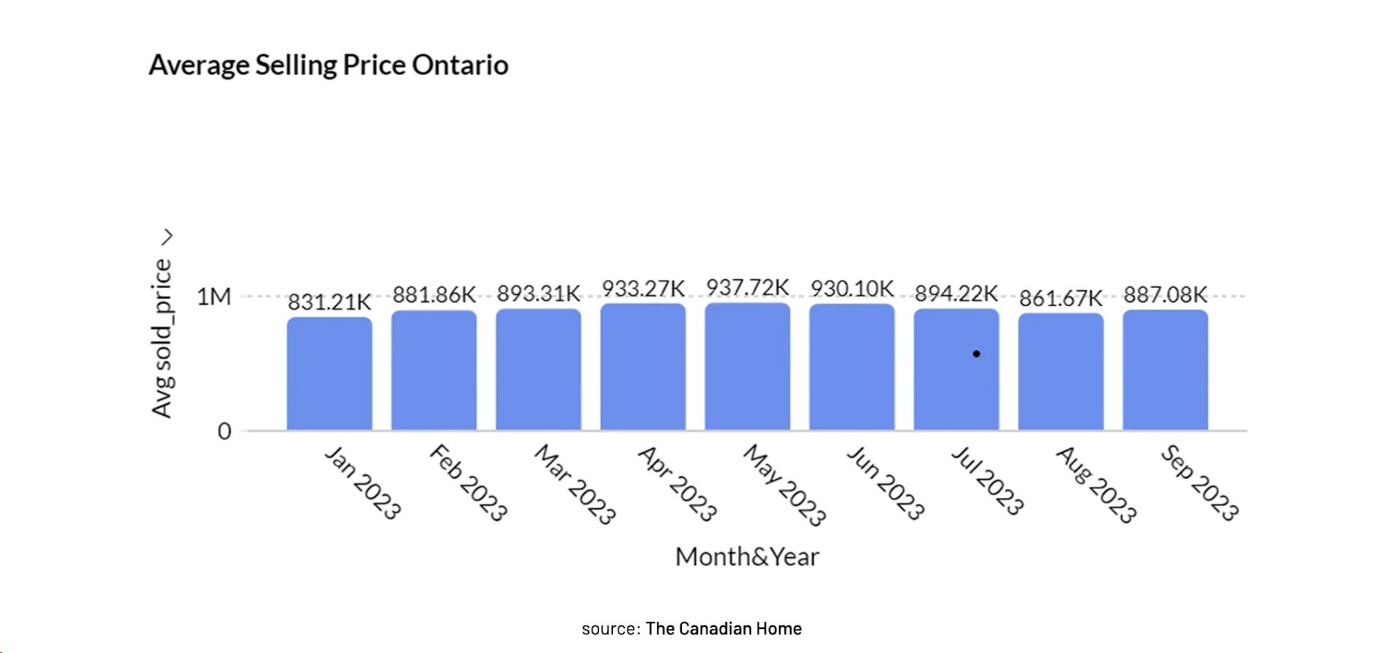

This is obvious as there is usually an inverse relation between interest rates and the prices of homes. When interest rates rise, home prices tend to fall and when interest rates decline, home prices go up. Between July and October 2023, there has been a 7.5% decrease in the average home selling price in Canada and 8.2% in Ontario. These price drops along with the approaching winter season make the housing market perfect for home buyers to step in.

Manoj Karatha, Broker of Record for The Canadian Home says, “It is highly unlikely that the Bank of Canada is going to raise the rates any further in 2023, and this has two significant implications. First, it provides a breathing room allowing the market to cool down and second buyers will now be in a better position as the market is completely in their favour, provided they know where to look and how much they can afford."

Ontario Market Is Leaning in Favour of Homebuyers

In the home-buying process, homebuyers and sellers are the two main players. The demand-supply dynamics usually determine which side will hold the most power when it comes to price deals. When supply exceeds demand, buyers have the upper hand and in a seller’s market, demand is higher than the available supply.

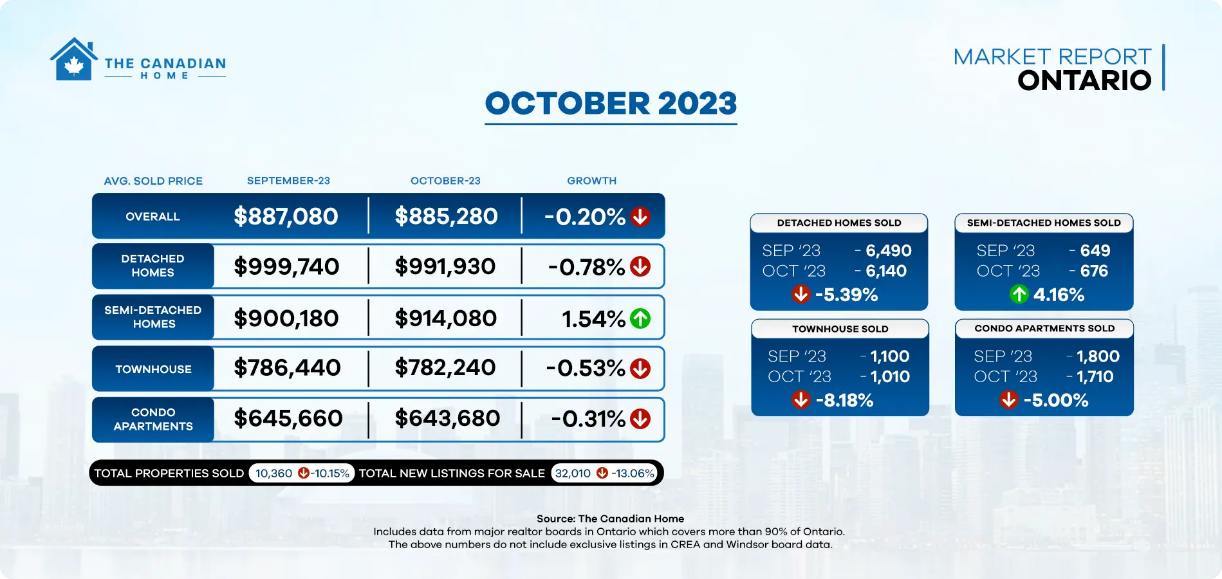

Here are some eye-whopping data about the Ontario real estate market -

-

There has been a 14.5% decline in the no. of property transactions from July to October.

-

Between July and October, there has been an 8.2% drop in the average home selling price.

-

The average time required to sell a house has increased by 21% from July to October.

As you can see from the above data, we have officially stepped into a buyer’s market. This means that homebuyers will have the upper hand when it comes to negotiations. For those of you who have been waiting to buy your dream home in Ontario, now is your time. The market is leaning in your favour so you can get more favourable terms and deals.

Here is what Robin Cherian, the CEO of The Canadian Home has to say about the current housing market, “I believe this winter season is going to be something special because there is a lot that has aligned for home buyers perfectly. You have steady rates, declining home prices and a market where you hold all the negotiation power. All it will take is timing and an expert realtor and you can grab the best deal this season."

Take Your Time Analysing the Market, but Act Fast Before the Opportunity Slips Away

Homebuyers negotiating power, coupled with the winter’s influence on home prices will have a significant impact on the Ontario housing market. But remember, the type of property you choose and the location will remain crucial.

If you are house hunting on a modest budget and set your heart on a resale detached home in Mississauga, you may have to return empty-handed. But this won’t happen if you consider cities like Niagara, London, and Kitchener where the starting prices of homes are around $539K. In these cities, you can find attractive properties that won’t strain your wallet. Or you can look into cities such as Oshawa, Scugog, and Uxbridge where homes are priced between $700K-$800K range.

But wherever you choose to look for houses for sale in Ontario, act swiftly. In the coming days, more homebuyers will step into the market. So, the demand-supply balance may slowly tilt in favour of sellers. Many sellers refrain from putting their houses out there on the market during the winter months because of the traditionally slow activity. However, prices may rise once again if the demand for houses exceeds the available inventory. So, conduct thorough research, weigh your options, and start searching for houses for sale by partnering with an expert Realtor.