Overview

As mentioned in a previous article, the Office of the Superintendent of Financial Institutions (OSFI) initiated a change in the liquidity requirements for high interest savings account (HISA) ETFs as of January 31, 2024. According to these new rules, banks that hold deposits for high-interest savings account funds will have to hold “sufficient high-quality liquid assets, such as government bonds, to support all HISA ETF balances that can be withdrawn within 30 days”. As a result of these new rules, banks now must classify deposits from HISA ETFs as unsecured wholesale funding with 100% run-off; this stricter classification means lower rates for deposits from the funds. As a result, the combination of lower rates offered by deposit-taking banks and changes to the underlying holdings of HISA ETFs is affecting the yield of these solutions.

Looking below the surface

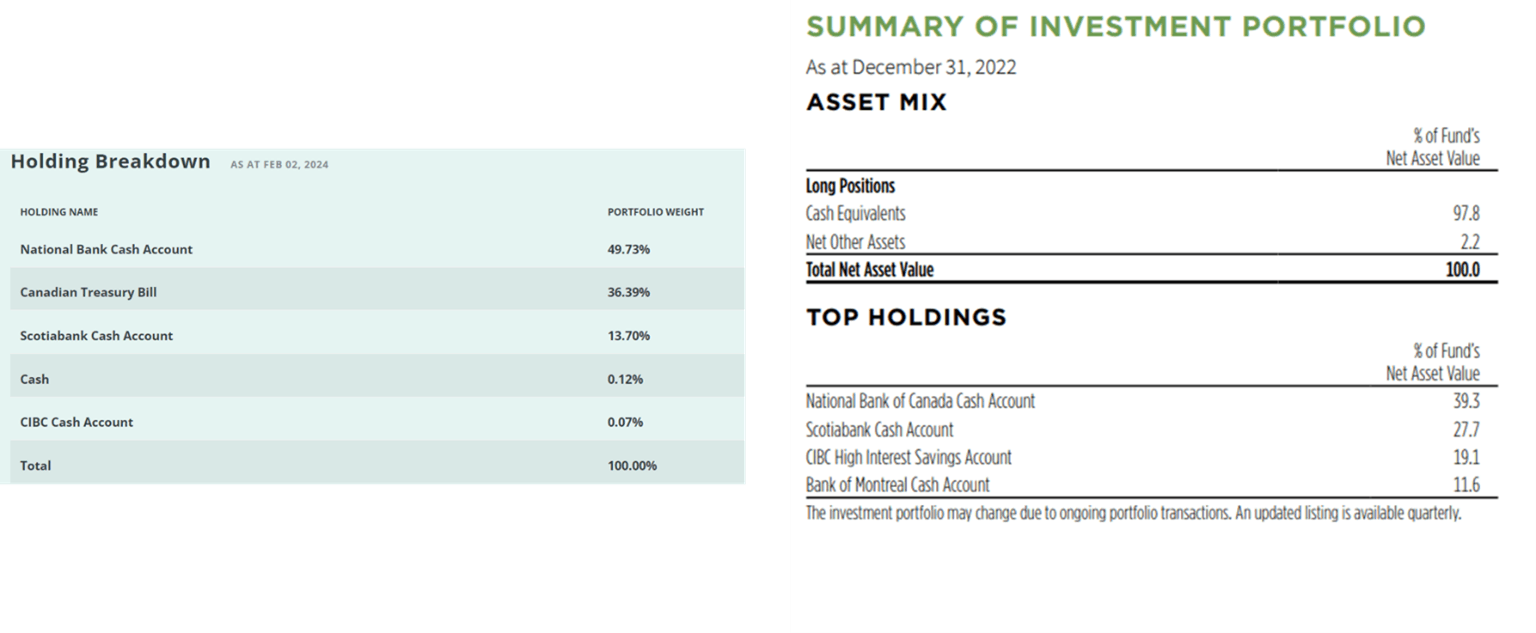

The material nature of the changes implemented by OSFI is evident when looking at the composition of some of the most notable HISA ETFs, as their holdings have adjusted to reflect the new reality. For example, in contrasting the December 31st, 2022, vs. February 2nd, 2024, holdings of the Purpose High Interest Savings ETF (TSX:PSA) (Ticker: PSA), there is now a 30 per cent allocation to Canadian Treasury bills (see below).

Similar changes were observed when looking at the CI High Interest Savings ETF (TSX:CSAV) (Ticker: CSAV), which now has a 10 per cent allocation toward Canadian money market issuances; and the Ninepoint High Interest Savings Fund (NLB:NSAV) (Ticker: NSAV) which has a 26.94 per cent allocation to short-term corporate bonds and 22.43 per cent allocation towards Banker’s Acceptance as of December 29th, 2023.

Conclusion

As the landscape of HISA ETFs enters a new chapter, investors will begin to reconsider the value proposition of these investment solutions, as the elevated yield they are supposed to provide is dissipating. With the underlying exposure of these mandates shifting partially towards money market instruments, investors may consider pivoting towards fixed income solutions that have a defined maturity and exposure, allowing them to capitalize on the current elevated interest environment with greater certainty going forward.

With the current outlook for HISA ETFs being changed due to OSFI’s regulation, investors should evaluate their ability to deftly use these solutions to fulfill their investment goals.

This content was originally published by our partners at the Canadian ETF Marketplace.