In this Ozone Chain (OZO) price prediction 2024, 2025, 2026-2030, we will analyze the price patterns of OZO using accurate, trader-friendly technical analysis indicators and predict the cryptocurrency’s future movement.

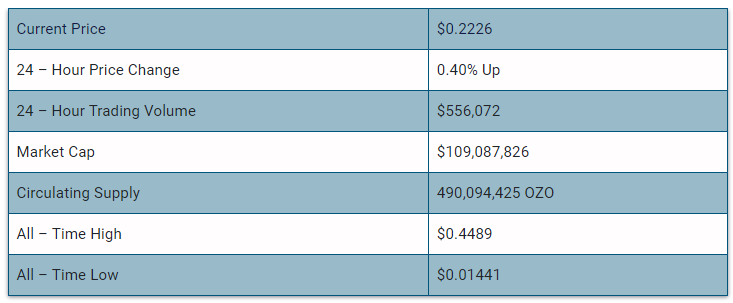

Ozone Chain (OZO) Current Market Status

What is Ozone Chain (OZO)?

Ozone Chain is the world’s first quantum-resistant blockchain platform. It utilizes quantum random numbers (QRN) and post-quantum cryptography (PQC) to make the blockchain quantum secure and quantum-resistant and improve security and scalability for DeFi. It supports smart contracts and decentralized applications (dApps), including cross-chain support.

With the help of a special consensus algorithm, Ozone Chain provides high-speed transactions and strong resistance to potential quantum computing threats. Ozone Chain also has a token called $OZO. The token is used to pay transaction fees within the Ozone Chain network and can further be used for staking and governance.

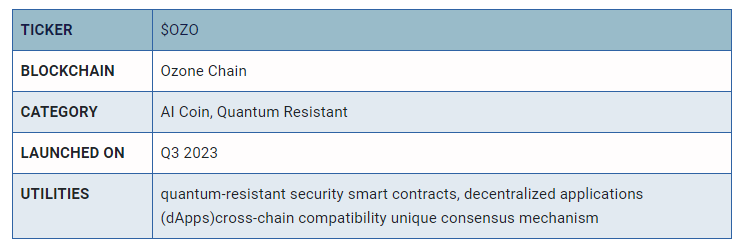

Ozone Chain (OZO) 24H Technicals

Ozone Chain (OZO) Price Prediction 2024

The price prediction for 2024 has raised expectations of an increase in one month to $0.73274 and, in six months, at around $0.62598. There is nothing to worry about regarding the forecasted lower price six months away since it represents an ordinary retracement in a highly volatile market such as crypto.

The volatility rate of the OZO token is relatively low, given at 1.83%, which means that investors can consider it a legitimate option for long-term investing because this asset is relatively secure compared to other cryptocurrency solutions, although it has variable values.

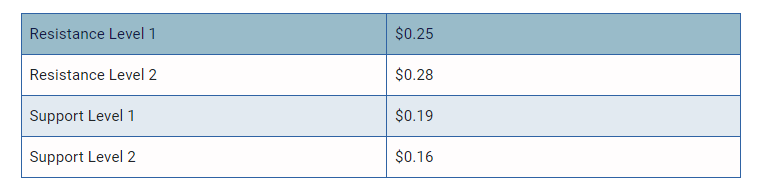

Ozone Chain (OZO) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Ozone (OZO) in 2024.

From the above chart, we can analyze and identify the following as resistance and support levels of Ozone (OZO) for 2024.

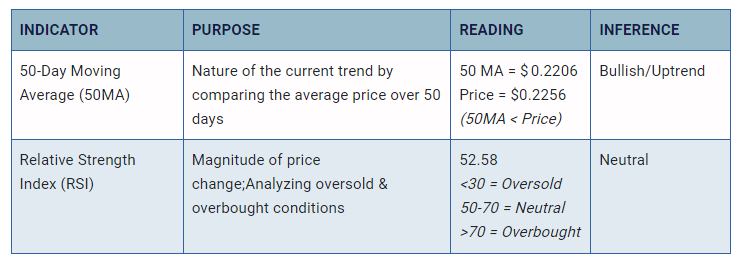

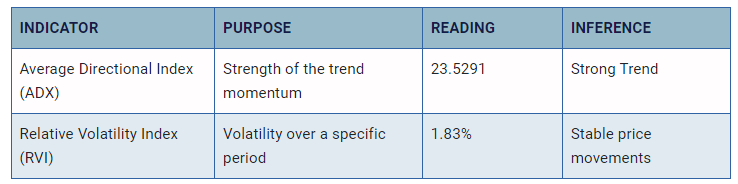

Ozone Chain (OZO) Price Prediction 2024 — MA and RSI

The technical analysis indicators such as the Moving Average (MA), and Relative Strength Index (RSI) of Ozone (OZO) are shown in the chart below.

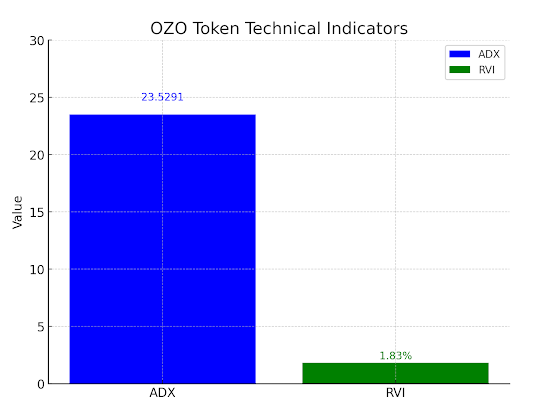

Ozone Chain (OZO) Price Prediction 2024 — ADX, RVI

In the below chart, we analyze the strength and volatility of Ozone (OZO) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

Comparison of OZO with BTC, ETH

Let us now compare the price movements of Ozone (OZO with that of Bitcoin (BTC), and Ethereum (ETH).

From the above chart, we can interpret that the price action of OZO is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of OZO also increases or decreases respectively.

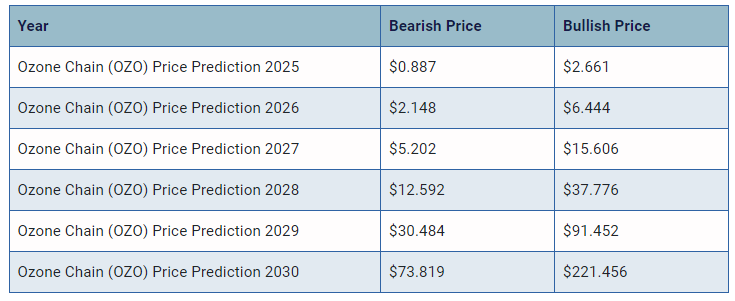

Ozone Chain (OZO) Price Prediction 2025, 2026 – 2030

Conclusion

The Ozone Chain (OZO) token is expected to experience a gradual increase in prices from 2025 through 2030. It would begin with a small hike from $0.887 to $2.661 by 2025, increasing annually. The price range will scale up to $2.148 – $6.444 by 2026, with a more sustainable positioning on the market that would drive the demand for patient monitoring devices much higher than it currently is!

In the bull scenario 10 and 11 years from now, OZO tokens may rise as high as $91.452 (2029) or even further to $221.456 in 2030 – representing an unprecedented success case among professional investors who showed that they have all their belief in this possible future market adoption of economy parallel systems!!

This content was originally published by our partners at The News Crypto.