As noted in my earlier article on the Schwab U.S. Dividend ETF (SCHD), a popular equity factor that could lead to possible outperformance is "quality", which itself is comprised of the Fama-French factors of investment and profitability respectively.

While many investors gain exposure to quality stocks via dedicated factor ETFs like the iShares Edge MSCI USA Quality Factor ETF (QUAL), it turns out that quality stock exposure can be obtained in other, more roundabout ways as well.

In the example of SCHD, I noted that the ETF's underlying index screened for not only consistent historical dividend growth, but also metrics like sufficient free cash flow, and return on equity.

That got me thinking: could investors gain exposure to the quality factor without the brand name of a quality factor ETF? The answer might just be "yes". Enter the Pacer Cash Cow series of ETFs, which do exactly like their name suggests: invest in companies with high free cash flow yield.

The Cash Cow thesis

Pacer's lineup of cash cow ETFs bases their investment thesis on one main observation: the importance of strong free cash flows to a company's valuation and fundamentals.

The core idea is that free cash flow is the final, "one metric to rule them all" indicator for a company's overall prospects, with other metrics like book value, price to sales, and price to earnings feeding into it as precursors.

With sufficiently high free cash flow, a company can undertake a variety of measures that could increase shareholder value, such as paying out dividends, buying back stock, or making acquisitions. All three of these actions are capable of increasing long-term growth.

To put it plainly, consistent free cash flow is more often than not an indicator of a quality company. After all, generating free cash flow implies robust profitability – the company must generate more cash than it burns in the course of running its business.

To underscore the importance of companies with high free cash flow, Pacer stresses three beneficial attributes these companies possess:

- Productivity: Companies with free cash flow require less external debt financing to grow.

- Reliable: Free cash flow is a more trustworthy measure of profitability than earnings.

- Self-sufficient: Companies with robust free cash flow are unlikely to dilute shareholders.

The Cash Cow lineup

Currently, Pacer offers a series of eight cash cow ETFs. On the domestic side, the following ETFs are available, with some sporting funny naming conventions depending on whether or not they add a unique dimension to the overall base strategy:

- Pacer US Cash Cows 100 ETF (COWZ): 0.49% expense ratio.

- Pacer US Small Cap Cash Cows 100 ETF (CALF): 0.59% expense ratio.

- Pacer US Cash Cows Growth ETF (BUL): 0.60% expense ratio.

- Pacer US Large Cap Cash Cows Growth Leaders ETF (COWG): 0.49% expense ratio.

For investors looking to diversify, Pacer offers the following Cash Cow ETFs with international exposure, covering both developed and emerging markets:

- Pacer Global Cash Cows Dividend ETF (GCOW): 0.60% expense ratio.

- Pacer Developed Markets International Cash Cows 100 ETF (ICOW): 0.65% expense ratio.

- Pacer Cash Cows Fund of Funds ETF (ECOW): 0.70% expense ratio.

Finally, for investors that prioritize simplicity, Pacer offers the appropriately named Pacer Cash Cows Fund of Funds ETF (HERD), which wraps multiple underlying Pacer Cash Cow ETFs to provide a globally diversified portfolio at a 0.73% expense ratio.

Assessing COWZ

Out of all the ETFs listed above, COW has attracted the most investor attention thanks to its historically strong performance and US large-cap centered focus.

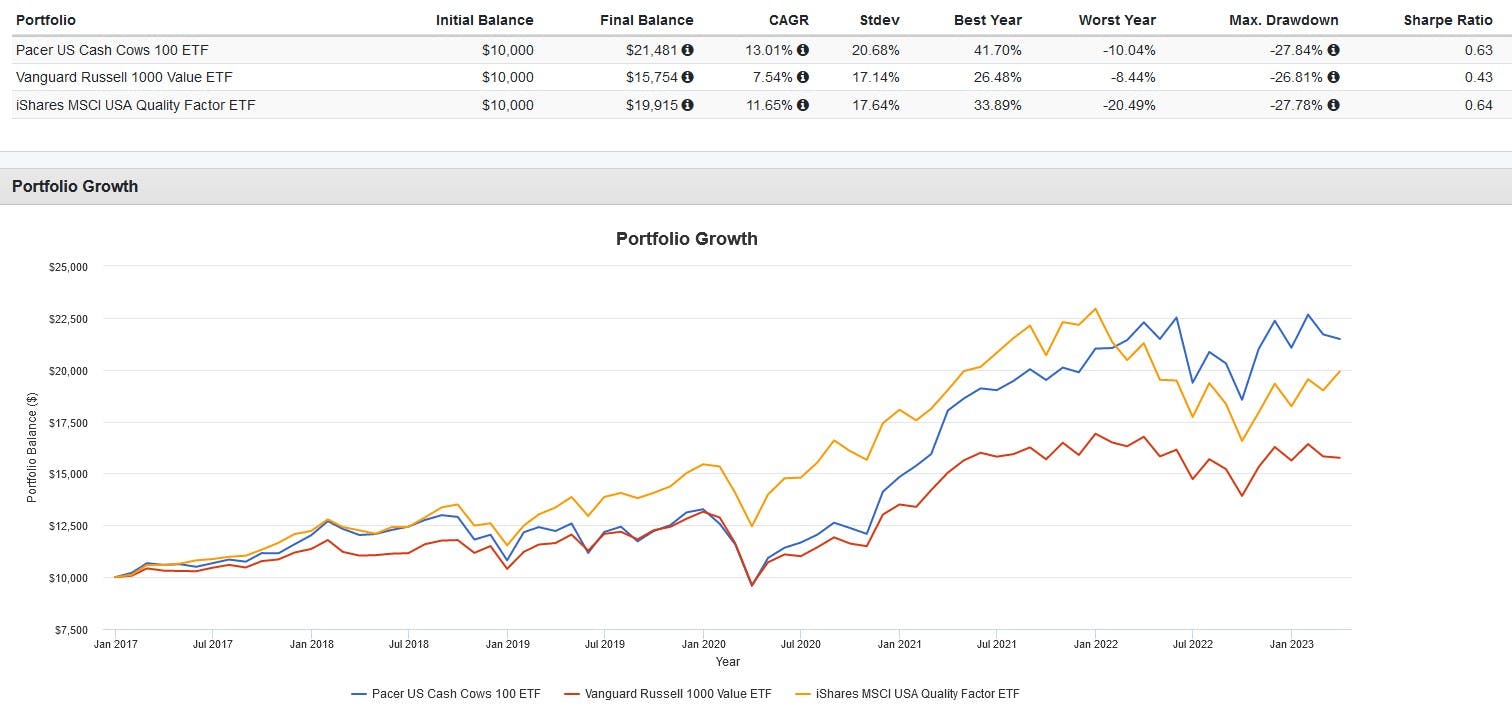

The ETF is benchmarked to the Russell 1000 Value Index, so we'll be taking a look at how it performed historically versus the Vanguard Russell 1000 Value ETF (VONV) and a "name brand" quality factor ETF in the form of QUAL.

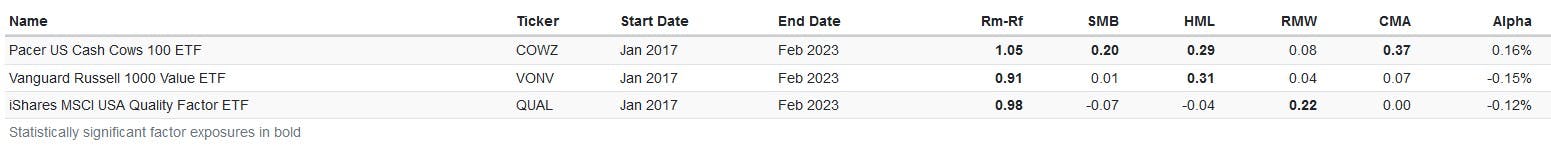

From 2017 onwards, COWZ has outperformed both QUAL and VONV despite having a much higher expense ratio. It also had a statistically significant loading to the Fama-French factors of value and investment, and surprisingly size as well.

Overall, this implies that historically, the free cash flow screener used by COWZ has been able to identify smaller, more attractively valued companies with conservative investment tendencies, making the ETF almost a multi-factor fund in all but name.

However, COWZ did not have a statistically high loading to the profitability factor, which I think is worthy of investigation in a follow-up later.

This content was originally published by our partners at ETF Central.