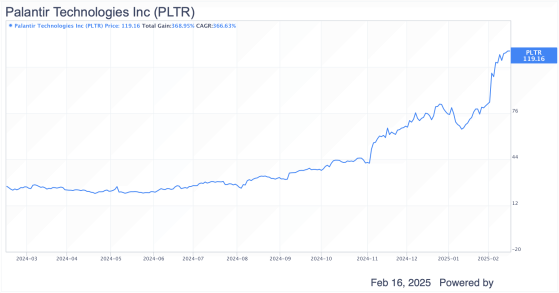

Palantir (NASDAQ:PLTR) is a data analytics company that has positioned itself as a direct AI play in today’s investment landscape. Like many AI-driven companies outside of Nvidia (NASDAQ:NVDA), Palantir’s acceleration in AI growth took some time. It’s a controversial stockvalue investors argue it’s overpriced, while growth investors see further upside. I lean toward the former. The stock currently trades at $117 per share, having skyrocketed from around $30 mid-last year. Back then, I thought shares looked expensive but still had room to run based on the company’s fundamentals and growth potential. Now that the stock has more than quadrupled, many still believe it has more upsidebut at some point, this rally will lose steam, and I think that moment is approaching sooner rather than later.

PLTR Data by GuruFocus

While Palantir’s strong operational track record and growing demand for AIP could push results beyond street expectations, the stock’s current valuation presents an unattractive risk-reward profile if things don’t go as planned. I’m not questioning its execution or fundamentalsits US Commercial segment has delivered impressive growth since the launch of AIP, alongside improving GAAP profitability. However, given where the stock is trading now, I see more downside than upside in the near term. Palantir remains a strong company with a competitive edge, and I’ll highlight some of its key strengths later, but the valuation looks too stretched at this point. For now, I’m giving the stock a Sell rating.

AIP’s Value Is Undeniable, but Growth Expectations Look StretchedPalantir’s AIP platform delivers something incredibly valuableit enables organizations to make faster, more effective decisions. In today’s corporate world (and even in military operations), better decision-making around logistics, resources, and strategy can be the difference between winning and losing. It’s rare to find a high-quality business that can scale aggressively while also improving efficiency, but Palantir has managed to do just that. Initially, there was no clear pricing model for AIP, as CEO Alex Karp noted, but that has changed. The company is now in a phase where AIP is being monetized properly.

Since Q1 2024, the bulk of Palantir’s growth has come from existing clients, meaning customers who have been with the company for more than a year are spending more. This signals strong customer retention, the increasing value of Palantir’s offerings, and solid potential for further scaling. Given the complexity of modern enterprises, PLTR’s solutions provide significant value, making them a worthwhile investment for organizations looking to optimize their operations. The key question now is how many new enterprises will integrate Palantir into their tech stack. While I’m optimistic about Palantir’s growth, I struggle to see the company achieving the ambitious ~30% average annualized revenue growth that analysts are currently projecting over the next decade.

Fundamentals: Strong Earnings, Accelerating Growth, and Expanding MarginsPalantir’s latest earnings report was nothing short of impressive, causing the stock to gap up significantly. From my perspective, the results were strong across the board. The company has consistently delivered beat-and-raise results for over a year, leading investors and analysts to realize they may have historically underestimated Palantir’s potential. Since Q3 2023, PLTR has either met or exceeded both top- and bottom-line estimates, creating a halo effect’ around the stock.

What stands out to me is Palantir’s accelerating revenue growth. The company has managed to grow at an increasing rate despite an already expanding revenue base. Throughout late 2022 and early 2023, YoY revenue growth hovered in the mid-teens. However, in Q4 2023, growth picked up momentum as demand for Palantir’s AIP platform surged, capturing more corporate SaaS budgets. This has resulted in a sequential increase in revenue, while YoY revenue growth has also gained momentum, forming an exponential-like growth trajectory.

[Palantir Investor Relations]

The most notable growth driver has been Palantir’s US commercial segment, which has significantly benefited from the AIP bootcamp go-to-market strategy. In Q4 2023, this segment reported a staggering 95% YoY growth, and even against a tough comparison period, Q4 2024 still delivered 84% YoY growth. Additionally, the company’s RPOa key performance indicator measuring sales not yet recognized as revenueclimbed 40% YoY to $1.73B. This suggests that future revenue growth could remain strong, if not accelerate further. The Q4 earnings reinforced my belief that AI adoption in the US is gaining momentum, with more enterprises racing to stay competitive. Palantir stands to be a key beneficiary of this trend.

Profitability has also seen a meaningful shift. When PLTR first went public, it wasn’t profitable, but over the past few years, its margins have improved significantly. The company’s gross and net profitability are now approaching levels seen in more mature tech firms. However, what truly stands out to me isn’t just Palantir’s revenue growth or margin expansion individually, but the fact that it’s achieving both simultaneously.

[Palantir Investor Relations]

One of the most common ways to measure growth quality for a SaaS business is the Rule of 40, which adds revenue growth and profitability. If the combined figure surpasses 40%, the company is considered to have high-quality growth. A company might post 60% revenue growth, but if margins are eroding at -30%, it wouldn’t pass the threshold. Palantir, however, far exceeds this benchmarkits latest quarter came in at an impressive 81%, highlighting both its strong growth trajectory and improving profitability.

Valuation: A Pricey Stock in a Normalizing MarketAt its current price, there’s no denying that Palantir is expensiveI don’t think anyone can argue otherwise. My bearish stance on the stock is primarily driven by valuation concerns rather than any issues with its fundamentals or AIP’s long-term potential. Palantir has spent most of its trading history at elevated valuation multiples, making it particularly susceptible to being overpriced for prolonged periods. The ongoing hype surrounding the company only amplifies this, leading me to believe that the stock is trading well beyond what its fundamentals and expected growth can reasonably justify at this point.What makes this even more concerning is that the broader SaaS industry has been under pressure, with valuation multiples contracting across the board. Despite this trend, Palantir continues to trade at a premium. While some may argue that this premium is warranted given the company’s strong fundamentals and AIP’s growing adoption, I see it as a red flag. When comparing Palantir’s valuation metrics to other leading SaaS namessuch as CrowdStrike (NASDAQ:CRWD), Salesforce, and Adobe (NASDAQ:ADBE), all of which boast solid growth trajectoriesthe disparity becomes even harder to ignore.

To illustrate this point, let’s look at Palantir’s market cap relative to its revenue, comparing it to other major players in the same segment:

[Author’s Workings]

This isn’t just about high growth or the appeal of AI-powered product lines. What we’re seeing with PLTR is the result of an exceptionally strong investor narrative, pushing the stock into what I’d call full mania’ territory. The market is no longer in the speculative tech-bubble phase of 2021, where most software companies traded at excessive valuations. Many of those names have since seen their multiples compress, yet Palantir remains one of the few still holding onto a 2021-like premium.

[Alpha Spread]

Given this landscape, I anticipate that Palantir’s valuation multiple will eventually contract. Based on current market conditions, I expect the stock to trade at a forward P/E of around 80x, which is still high but more in line with a comparable company like CrowdStrike. If that adjustment happens, it would imply a downside risk of roughly 34%, bringing the stock closer to $79 per share. When I look at names like CrowdStrike and Salesforceboth of which are growing at above-market rates while trading at more reasonable valuationsit’s clear that investors seeking AI-driven growth stories have better options that don’t come with Palantir’s outsized valuation risk.

Final ThoughtsPalantir has certainly silenced many skeptics by proving that its AIP platform delivers real value, driving strong customer adoption and accelerating growth. I have no doubt that the company’s trajectory remains positive, and under the right industry conditions, growth could even outpace expectations. However, that doesn’t change the reality that the stock has raced ahead of its fundamentals. While I’m confident in the strength of Palantir’s business, the recent surge in share price has elevated expectations to dangerously high levelsleaving little room for error.

We’ve seen it time and time again: stocks that fly too high often come crashing down when they fail to meet investor expectations. Palantir’s valuation, currently at an eye-watering 102.7x sales, makes the stock incredibly vulnerable to any sign of underperformance. While it’s impossible to predict exactly when sentiment will shift, I expect a meaningful valuation reset in the coming weeks or months as the market digests the company’s true earnings potential. For now, I see Palantir as a great business with a risky stock, and I’d prefer to wait for a better entry point before considering an investment.

This content was originally published on Gurufocus.com