2024 has been a banner year for Palantir Technologies Inc. (NYSE:PLTR). It will soon be part of the S&P 500, a remarkable milestone for any company. Investors who were patient enough to ride the wave have been handsomely rewarded, with the stock up more than 100% year to date.

With all this upward momentum, a natural question arises: Have I missed the boat on Palantir?

About PalantirPalantir builds and deploys software platforms that function as central operating systems for its customers, focusing on data analytics. It originally began as a data analytics company serving government clients, especially in counter-terrorism, but has since expanded into the commercial space. More recently, it has made significant strides into artificial intelligence, a natural progression for a company already handling massive datasets.

Its four main software platformsGotham, Foundry, Apollo and the Artificial Intelligence Platform (AIP)help organizations transform large amounts of data into integrated, actionable insights. Platforms like Gotham and Foundry allow institutions to embed data directly into their operations, while AIP enhances decision-making by incorporating machine learning and generative AI models, such as large language models, directly into its software.

Palantir is essentially a hybrid, balancing its strong government business with the more competitive and unpredictable commercial market. In my opinion, its competitive advantage lies in its government contracts. The company has deeply ingrained relationships with government clients and switching away from such systems is typically a slow, complex process. This gives it a durable moat and sustained competitive advantage in that sector. The commercial side, however, is a different story. The data analytics market is crowded, with many established players already integrated into existing ecosystems, creating much fiercer competition.

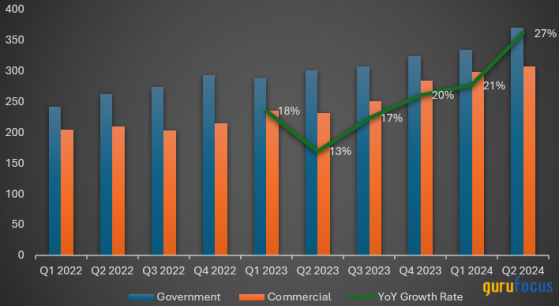

So why have Palantir's shares soared?Palantir's second-quarter 2024 earnings report delivered a significant beat, exceeding both its own guidance and Wall Street's expectations. The company posted revenue of $678 million, representing a 27% year-over-year increase, marking its fourth consecutive quarter of accelerating growth.

Source: Author

Palantir's U.S. commercial revenues led the charge, growing 55% to $159 million, driven largely by an 83% increase in U.S. commercial customers. The international commercial segment lagged behind, growing only 15% year over year with a slight sequential decline, raising concerns about its global scalability and the ability to replicate its U.S. success.

On the government side, often seen as a slower growth driver, Palantir saw strong results with a 23% increase in revenue. Much of this growth was tied to contracts with U.S. government agencies and foreign governments, particularly in the defense sector.

The balance sheet is in excellent shape, with $4 billion in cash and no debt. Moreover, Palantir has filed for a mixed securities shelf registration, which suggests a plan to increase its cash reserves further, although it adds an extra layer of dilution for current shareholders. It is worth noting that stock-based compensation remains high at 21% of revenue, so I would expect this to increase given Palantir's operational and stock performance.

Source: Palantir Investor Presentation

Palantir achieved GAAP profitability for the seventh consecutive quarter, with its customer count growing 41% year over year and outpacing top-line growth. Net dollar retention was 114% in the second quarter and the Rule of 40 stood at 64%, although Palantir calculates this by using adjusted operating margin plus year-over-year revenue growth, which kind of inflates the figure. The more traditional Rule of 40, which adds the free cash flow margin plus year-over-year revenue growth, would be closer to 49%.

Source: Palantir Investor Presentation

During the earnings call, CEO Alex Karp provided a compelling perspective on the company's strategy and performance, emphasizing the significant challenge and opportunity of deploying AI solutions at scale. He said:

"The immense challenge of deploying enterprise production AI software at scale is one that very few companies can tackle. Palantir has proven it can meet this challenge head-on, which is why we're seeing increased adoption of our AI platform across industries like defense and energy."Another important takeaway from the call was the company's improved guidance for the full year. Palantir raised its revenue forecast from $2.742 billion to $2.750 billion at the high end and its adjusted income guidance from $966 million to $974 million. This increase reflects management's confidence in sustained growth, even as many of its tech peers temper their expectations due to macroeconomic headwinds.

Palantir also revealed substantial gains in both commercial and government sectors, including high-profile partnerships with Microsoft (NASDAQ:MSFT) and BP (NYSE:LON:BP).

Its partnership with Microsoft focuses on serving U.S. defense intelligence agencies by providing cutting-edge AI solutions. This collaboration integrates Palantir's AI capabilities with Microsoft's cloud infrastructure, aiming to streamline operations and enhance decision-making processes for critical government agencies. This strategic alliance strengthens the company's position in the defense sector and demonstrates its potential to drive innovation within secure, high-stakes environments.

In the commercial sector, Palantir's five-year partnership with BP showcases its versatility and ability to cater to large-scale industries like energy. By integrating its AIP into BP's operations, the companies plan to improve the efficiency of oil and gas production while exploring new AI-driven advancements. This collaboration highlights how Palantir's technology can optimize complex operations and contribute to the energy sector's digital transformation.

To help boost investors' sentiment, Palantir will be added to the S&P 500 in the next rebalancing period. Joining the S&P 500 requires a company to report a profit in its most recent quarter and have cumulative profitability over the past four quarters. In the second quarter, the company's net income totaled $135.60 million, up from $27.90 million in the same period a year earlier. The company turned profitable in the final quarter of 2022.

This announcement has fueled enthusiasm for the stock, as inclusion in the S&P 500 serves as validation of its business model and financial health. Shares tend to rise after such announcements, as passive funds that track the index are "forced" to buy shares to closely mirror the S&P 500, resulting in a surge in demand.

International strugglesWhile Palantir's U.S. business is thriving, its international story is less impressive. Commercial growth outside the U.S. lagged at just 15% year over year and sequentially, it actually shrank by 1% in the second quarter. This potentially is a red flag for a company that needs to expand globally to justify its current valuation. Europe's weak performance is particularly concerning given it is a major market for future growth.

Palantir's management has made it clear that its AI platform will drive future expansion. However, the company's growth is likely to be more methodical, supported by long-term contracts and steady customer adoption. This creates a dilemma for investors, as the current valuation assumes an extraordinary level of future growth.

Is Palantir overvalued?Palantir has proven the strength of its technology, but the one thing that keeps many investors cautious is its valuation. It is still in its early days of profitability, so perhaps one of the best metrics to look at here is the price-sales ratio.

The stock trades at a trailing 12-month price-sales ratio of about 34 and a forward price-sales ratio of about 31 based on 2025 guidance. The company is expecting 25% year-over-year revenue growth for the third quarter and 21% growth for the fourth quarter. To put it in perspective, the S&P 500 trades at a price-earnings ratio of about 21.

Wall Street estimates project around 20% annual revenue growth for the next five years, but even in the best-case scenario, Palantir's returns may fall short of what today's stock price implies. To justify its current valuation, Palantir must accelerate growth both in the U.S. and internationally. Given Europe's struggle, it is difficult to pinpoint where this acceleration will come from.

For a company growing revenue by under 30%, Palantir's current multiple seems high. To justify this valuation, it would need to grow revenue by more than 30% annually. Palantir is already seeing a rebound in its U.S. government business, and its new partnerships could potentially boost growth further. However, at its current valuation, it seems the market is already pricing in such developments.

When applying a reverse discounted cash flow model to Palantir's valuation, Wall Street expects a 22% compound annual growth rate over the next five years. To be more conservative, I factored in a 25% growth rate to account for potential dilution, which resulted in a price target of $12.82 per share, far below its current trading price.

Source: Author

However, some might argue Palantir is not optimized for profitability or FCF at this stage, which could skew valuation models. To explore this perspective, I adjusted my assumptions by modeling a future where the company achieves a long-term FCF margin of 35%. Using the company's estimated 2025 sales and rerunning the model, I found that for Palantir's current share price to be justified, the company would need to grow revenue by 37% annually over the next five years and 25% thereaftermuch higher than Wall Street's projections of a 22% CAGR.

This analysis signals the stock may be overextended in the short to medium term unless Palantir can unlock new, substantial revenue streams or dramatically expand its profit margins beyond current expectations.

Some may also argue Palantir does not follow traditional metrics because it is a "retail darling" stock, once linked to the meme stock saga, and the AI narrative has just begun. While this is difficult to dispute, it's worth noting that even Catherine Wood (Trades, Portfolio), known for her disruptive technology-focused investments, has trimmed her position, signaling some concerns over Palantir's valuation.

Have I missed the boat? In some ways, the boat might have already left the dock. Palantir's stock is priced to perfection and any hiccup, whether in international expansion, government contracts or the broader AI rollout, could result in a sharp pullback.

That being said, Palantir is still a solid company with impressive fundamentals. It has become profitable on a GAAP basis, carries no debt and has a substantial cash position. For long-term investors, there is still upside, particularly if the AI market continues to evolve in its favor. However, new investors should be cautious. The current valuation leaves little room for error, and as we have seen with many high-growth tech stocks, the market can turn quickly when expectations are not met.

I think Palantir has a good long-term opportunity, but given its valuation, I would prefer to buy on a pullback. Even the best tech companies go through periods where their stock prices fall, and I would rather be patient and not chase the shares at these valuations.

This content was originally published on Gurufocus.com