Introduction: A strong gold and silver contender.

Pan American Silver (NYSE:TSX:PAAS) is a long-term investment in the gold and silver mining sector that I have successfully owned and traded over the years despite its high stock volatility. Recently, I covered other companies on GuruFocus, including Newmont Corp. (NYSE:NEM), Barrick Gold (NYSE:NYSE:GOLD), Agnico Eagle Mines (NYSE:TSX:AEM), and Kinross Gold (TSX:K) (KGC).

The company released its third-quarter 2024 results on November 5, 2024. This article updates my Gurufocus article from April 15, 2024. In the fourth quarter of 2023, Pan American Silver concentrated on acquiring most of Yamana Gold (TSX:YRI)'s assets, with the exception of the 50% share of the Canadian Malartic mine that was purchased by Agnico Eagle Mines. With three quarters passed since then, it is time to evaluate the company's progress.

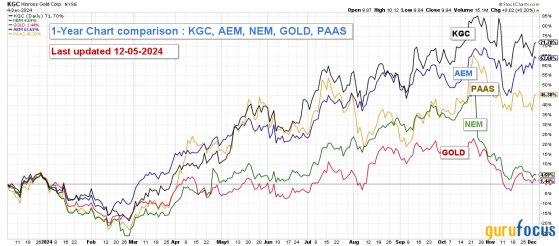

Pan American Silver has shown strong year-over-year performance, although it lags behind two of its peers, Kinross Gold and Agnico Eagle Mines. PAAS is up 45%, as we can see in the chart below:

PAAS outperformed gold, which is up about 30% year over year, and silver, which is up only about 10% year on year.

However, before analyzing the third quarter results, I want to clarify a major misconception about Pan American Silver. Many of you believe the miner is primarily a silver producer, which needs to be corrected. Since Pan American Silver acquired Tahoe Resources in 2019, the company has become mainly a gold producer despite owning an impressive silver reserve. Pan American Silver is comparable to Fortuna Silver Mines (TSX:FVI) (NYSE:FSM), Hecla Mining (NYSE:HL), and Coeur Mining (NYSE:CDE), which are also silver producers but at a lower level.

On September 11, 2024, PAAS reported mineral reserves and resources as of June 30, 2024, indicating probable and proven reserves of 468 Moz of silver and 6.893 Moz of gold, respectively. I noted a significant increase in gold mineral inferred resources of 1.2 Moz of gold, highlighting the potential of the La Colorada Skarn Project.

Source: PAAS Presentation December 2024.

In 3Q24, revenue came from two precious metals (gold and silver) and byproducts (zinc, lead, and copper). The revenues are made up of gold and silver, while the revenues from other metals or byproducts are used to offset costs. The revenue breakdown by metal in 3Q24 is shown below:

Gold represents approximately 72.1% of total revenues, whereas silver contributes only around 20.8%. However, this dynamic may shift if the Escobal silver mine in Guatemala is reopened after years of being on care and maintenance. The mine contains substantial silver reserves.

The company said:

So far, it remains a significant "if" regarding its success, and at the actual pace of the negotiations, the mine could get a go by 2026. The positive aspect is that if the mine remains closed, it will not impact the stock. However, investors will be pleased if the mine reopens, and the stock will likely rally. For investors who want to gamble a little, I recommend investing in PAASF, which is a contingent value right CVR trading in the OTCPK market.From 2014 to 2017, when the mine was operating, it produced approximately 20 million ounces of silver per year. Escobal is one of the world's largest primary silver deposits, with reserves of 264 million ounces.

CEO Michael Steinmann said in the conference call:

Gold and Silver Production in 3Q24: On track to meet 2024 guidance. PAAS owned eleven producing mines in 3Q24, as shown in the chart below, along with their gold and silver production. However, during the conference call, PAAS said it received regulatory approval to sell its La Arena gold mine in Peru. Finally, the sale of the mine to Zijin was completed on December 3 for approximately $245 million and a $50 million contingent payment. Thus, production will be slightly impacted in 4Q24. In the conference call:The Xinka Parliament is in the process of conducting meetings in their communities, but no new time line has been published yet for plenary consultation meetings. The Escobal mine remains on care maintenance, and there is no date for a restart of the operation.

The agreement also grants Pan American a life of mined gold net smelter return royalty of 1.5% for the La Arena II project and an additional contingent payment of $50 million when commercial production starts from the project.The chart below shows that La Arena produced approximately 10% of the total gold and a small amount of silver in 3Q24.

CEO Michael Steinmann announced that the company is on track to meet its production targets in 2024. The company expects silver production to be between 21 million and 23 million ounces, likely falling toward the lower end of this range. In addition, gold production is projected to be between 800,000 and 1 million ounces.

Gold and Silver Production for the 3Q24 was 5.467 million ounces of silver and 225K ounces of gold. This represents a slight decrease compared to 3Q23, where production totaled 5.687 million ounces of silver and 244.2 thousand ounces of gold. Although there was a slight decline, operational efficiencies and mainly increased metal prices mitigated the negative impact.

The average realized prices for silver and gold were $29.52 per ounce ($23.11 in 3Q23) and $2,475 per ounce ($1,927 in 3Q23), respectively, showing significant year-over-year increases. Gold and silver prices received for metal produced are now at a record level.

The all-in-sustaining costs (AISC) amounted to $19.53 per ounce of silver and $1,496 per ounce of gold. The AISC for gold is too high, and the company should aim to reduce it to the $1,350 level it achieved in 2Q23. The chart below shows that the AISC remains nearly unchanged year-over-year despite rising input costs and inflationary pressures. This stability can be attributed to improved production efficiencies, particularly at La Colorada.

Many investors feel that PAAS needed to respond more adequately to the recent rally in gold and silver prices, which has led to disappointment regarding its stock performance. However, the yearly results show that PAAS has significantly outperformed the metals. Gold and silver are up 30%, while PAAS has risen 48% yearly, as illustrated in the chart below.

A quick review of the 3Q24 financial results. Improving the debt profile is the key.

Pan American Silver announced its third-quarter results for 2024, reporting diluted earnings of $0.16 per share, a significant improvement from a loss of $0.06 in the same quarter last year.

The company's revenues reached $716.1 million, reflecting a 16.2% increase compared to the previous year. Additionally, adjusted earnings stood at $115.1 million, exceeding expectations.

Improvements at the La Colorada and Jacobina mines drove these strong results, which achieved robust silver production this quarter while reducing costs.

PAAS reported a net income of $56.7 million for the quarter, driven by a higher mine operating margin due to rising gold and silver prices and increased sales volumes. This represents a significant increase from a loss of $21.8 million last year.

The company reported a free cash flow of $151.1 million in the third quarter, a substantial increase compared to the $5.9 million earned in the same quarter last year. Cash flow from operations reached $226.2 million, while capital expenditures amounted to $75.1 million.

Given the current level of free cash flow, it would have been reasonable for the company to consider raising dividends; however, management has decided against it. Assuming a strong performance in 4Q24, PAAS will likely increase its dividend next year unless there is a significant drop in gold and silver prices. In the company's recent presentation:

Pan American has a dividend framework that pays a quarterly base cash dividend of $0.10/share with a defined variable dividend linked to net cash: Pan American introduced a share buyback in March 2024, with a discretionary approach to repurchasing shares.The company is providing a quarterly dividend of $0.10 per share, resulting in a yield of 1.8%. Additionally, Pan American Silver is a Canadian miner, and US investors are subject to withholding Canadian tax at a 25% rate, reducing even further the yield. Hopefully, the company will be more generous to its shareholders in 2025.

Pan American Silver concluded the third quarter with $469.9 million in cash, cash equivalents, and marketable securities, an increase from $386 million in the previous quarter. The company's long-term debt was approximately $707.5 million, including current debt, which remained relatively stable compared to $719.7 million in the previous year's quarter. As a result, the net debt now stands at $298 million. In addition, the company has $750 million available through an undrawn credit facility.

The total debt indicated by PAAS is $815 million.

Technical Analysis: A descending channel pattern.

Note: The chart has been adjusted for dividends.

Pan American Silver forms a descending channel pattern, with resistance at $23.7 and support at $21. The relative strength index (RSI) is at 46, indicating a slight bullish trend.A descending channel can be interpreted as bearish, but it often results in a bullish breakout as a continuation pattern.

The general rule is straightforward: if a descending channel forms after an uptrend (as is the case here), the stock will likely conclude the pattern with a bullish breakout, suggesting a continuation of the upward trend. Conversely, if a descending channel appears following a downtrend, the chances of a breakdown increase. Of course, as we approach the end of 2024, market conditions are rapidly changing, so this analysis should be updated on a daily basis to reflect new information that may impact PAAS.

With a support level established around $21.1, this may be a good time to consider adding to your position starting at $21.7.

Additionally, selling a portion of your shares might be wise once the stock price rises above $23.50. Selling part of your position using the LIFO (Last In, First Out) method is essential, particularly if the stock experiences a false bullish breakout followed by a quick retracement.

However, if the price of gold declines from its all-time highs, PAAS could drop as low as $20. Please refer to my chart above for further details.

It is important to take partial short-term profits using the LIFO method. Consider selling about half of your position for short-term trading while maintaining a core long-term investment. This approach allows you to capture potential significant gains while still collecting dividends.

Warning: The technical analysis chart should be updated regularly.

This content was originally published on Gurufocus.com