Peter Lynch's "One Up On Wall Street" remains one of the best investing books ever written for beginners. Among other teachings, one of the greatest lessons for investors is that one does not have to look for flashy things when it comes to finding the right investments.

In today's artificial intelligence era, it is easy to get lost among high-flying tech names while searching for alpha opportunities. However, there are boring businesses that print money and still trade at attractive valuation multiples. Parker Hannifin Corp. (NYSE:PH), a diversified industrial giant founded in 1917, is a classic example of such a business.

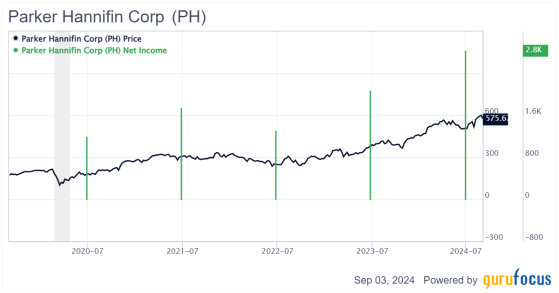

Parker's impressive financial performance in the recent past, characterized by strong net income growth, has been well-rewarded in the market with the stock up 250% in the last five years.

Exhibit 1: Parker net income and stock price

PH Data by GuruFocus

The strong momentum behind earnings growth is poised to extend into Parker's new fiscal year, which just began. The attractive valuation makes the stock a steal even on the back of recent blockbuster gains.

The business At its core, Parker Hannifin is a motion and control systems manufacturer with a massive global presence in more than 100 countries. The company conducts business in two main segments.

The diversified industrial segment accounts for the bulk of revenue, but as depicted below, the aerospace systems business has been the sole contributor to revenue growth in the last couple of quarters.

Exhibit 2: Parker Hannifin segment revenue

Source: FinChat

More than 90% of the earnings per share growth in the last quarter was driven by the aerospace segment, which had an outstanding 19% organic growth rate and record sales of $1.50 billion. This resulted in an increase in aerospace operating margins by 130 basis points. On the other hand, the diversified industrial segment in North America witnessed a decline in organic growth of 3%, reflecting softness in the off-highway and transportation markets. In contrast, adjusted segment operating margins rose to an all-time high of 25%.

The industrial segment faces short-term headwindsParker's industrial business is likely to remain under pressure for the foreseeable future due to unfavorable developments.

First, the U.S. manufacturing sector, a key end market for the company, is continuing to remain under pressure from high interest rates and elevated inflation. The Purchasing Managers Index, a popular measure used to gauge the strength of the manufacturing sector, declined from 48.50 in June to 46.80 in July, well below the Wall Street consensus of 48.90. Any reading below 50 signals the manufacturing economy is contracting. Except for March when the PMI hit 50.30, the index value has been below 50 since mid-2022, highlighting the challenges faced by the manufacturing sector.

Exhibit 3: Purchasing Managers Index

Second, the automotive industry, which is also a critical end market for Parker, is facing challenges. In the second quarter, new vehicle sales in the U.S. came to 4.10 million units, a marginal year-over-year improvement of just 10 basis points. This lackluster growth is the result of high interest rates, uncertainty surrounding economic growth and persistent inflation. Because of challenging market conditions, many automakers have pressed pause on vehicle production and planned expansion projects, impacting the demand for components sold by Parker. General Motors (NYSE:GM), Ford Motor Co. (NYSE:NYSE:F) and Stellantis (NYSE:NYSE:STLA) are among the automakers to slash production for 2024 or hold plans for capacity upgrades.

Exhibit 4: U.S. automotive sales volume

Source: MarkLines

Parker-Hannifin (NYSE:PH), due to macroeconomic headwinds, is unlikely to see a meaningful improvement in the industrial segment performance this fiscal year.

The aerospace segment is a bright spotParker's aerospace systems business has seen stellar growth in the last few quarters on the back of the strong comeback of the commercial airline sector. After suffering a massive blow during the pandemic, the commercial sector is making a strong comeback, leading to robust demand for aerospace systems used in commercial aircraft.

Accenture (NYSE:ACN) projects commercial aerospace industry revenue to surpass the 2019 peak by 11% this year on the back of robust aircraft deliveries projected for the year. Combined net-new orders from Airbus (EADSF) and Boeing (NYSE:NYSE:BA) reached 3,410 in 2023, a notable increase from just 1,594 and 986 in 2022 and 2021. This is an indication of the strength of the aerospace market, which is good news for Parker.

Exhibit 5: Global commercial aerospace index

Source: Accenture

Boeing, in its Commercial Market Outlook report published in July, estimated 43,975 new aircraft deliveries between 2024 and 2043, an ambitious prediction that reflects the strong demand for new aircraft amid the aggressive expansion efforts of leading airlines. Parker, which has a long-standing relationship with Boeing, is likely to benefit from the strong growth in new aircraft production in the coming years.

Exhibit 6: Boeing's estimated fleet by 2043

Source: Boeing

The expected increase in defense aviation spending also bodes well for Parker as the company works closely with military aerospace customers to develop tactical and combat aircraft. The company develops rotary wings, fixed wings and other motion and noise control systems that enable advanced air mobility for defense customers.

Increasing geopolitical tensions will likely lead to an increase in defense spending globally. According to the Stockholm International Peace Research Institute, global military spending hit a record high of $2.40 trillion in 2023. Continued growth is expected in the coming years as global leaders strengthen their military power to secure national and regional security amid increasing threats.

Long-term growth catalystsParker's long-term outlook is bright. The booming aerospace system is just one promising aspect. The manufacturing sector, despite facing short-term headwinds, is well positioned to see a strong comeback in the next few years as recent investments start paying off. In the U.S., construction spending in the manufacturing industry has boomed over the last couple of years, driven by the passage of favorable policies such as the CHIPS Act and the Inflation Reduction Act.

These investments are likely to result in robust manufacturing growth in the coming years, paving the way for Parker Hannifin to enjoy strong demand for its industrial products. According to research firm Interact Analysis, the manufacturing industry will grow 15% through 2028 after returning to growth in 2025. The automobile sector is also poised for stellar growth in the long run with leading automakers projected to invest billions of dollars to embrace electric vehicles.

In addition to these favorable long-term macroeconomic trends, several other factors paint a promising picture of what the future holds for Parker.

Parker's investment in innovation is one such factor. The company has been aggressively investing in aerospace electrification technologies to cater to the changing demand of its customers. The company is also investing in product developments such as energy-efficient systems and components for the aerospace industry, which coincides with a broad market shift in the aerospace sector to embrace sustainability.

The company's global expansion strategy is another bright spot. It is expanding its presence in high-growth markets such as Asia and Latin America through tailored product development to address local market needs. To accelerate growth and expansion into these regions, Parker is investing in local manufacturing hubs as well.

Steady growth at a reasonable valuationParker-Hannifin is expected to see steady revenue growth in the next five fiscal years, accompanied by strong earnings growth.

| Fiscal year ending | EPS estimate | YoY growth | Forward P/E |

| June 2025 | $26.71 | 5.01% | 21.33 |

| June 2026 | $29.24 | 9.46% | 19.49 |

| June 2027 | $32.54 | 11.29% | 17.51 |

| June 2028 | $33.73 | 3.65% | 16.89 |

| June 2029 | $37.30 | 10.58% | 15.28 |

The stock is currently valued at a forward price-earnings ratio of 21, which is not cheap, but considering the long runway for steady growth in the aerospace systems sector and the expected revival of the industrial sector, Parker seems fairly valued today, presenting long-term-oriented investors with an opportunity to invest in a great business at a reasonable price.

TakeawayParker Hannifin, a global industrial giant, seems fairly valued today. The company enjoys several growth catalysts that ensure long-term growth. Mr. Market will likely reward the company for its operational excellence and the turnaround potential of the industrial business segment. Investors may want to keep a close eye on the diversified industrial segment amid the challenges faced by its end markets. The aerospace segment will prove to be the company's growth engine in the foreseeable future.

This content was originally published on Gurufocus.com