Every so often, the market overlooks a company delivering on all fronts, and PDD Holdings (PDD, Financial) might be one of them. The company has quietly become one of the most interesting disrupters and has built a global empire, turning its platforms, Pinduoduo (NASDAQ:PDD) and Temu, into household names across continents.

Moreover, the numbers speak for themselves in terms of soaring revenue, rising profits, and a balance sheet that provides it the flexibility to keep winning. Yet, the stock remains extremely undervalued. That kind of disconnect does not last forever. Under an aggressive expansion strategy and having proven the ability to do just that, PDD Holdings is changing the game.

And as the company grows continuously, this one of the most fascinating stories in the world of e-commerce will become difficult to ignore. For those who are paying attention now, it’s an opportunity that’s too big to miss out on.

Company overview and expanding global reach

PDD Holdings, the owner of Pinduoduo and Temu, is a major player in global e-commerce. It’s a socially driven shopping platform in China that started in 2015 and has since become a disruptive force in the industry with its aggressive pricing and speed of expansion. However, the real game-changer came in 2022 when PDD Holdings launched Temu. It is a cross-border marketplace that has taken the world by storm and is now live in over 40 countries.There is no accident to Temu’s meteoric rise. Its success has spiked with bargain-basement prices and treasure-hunt shopping experiences selling to millions of cost-conscious consumers. Even I had a great experience with it, and to say the least, the app is addictive. However, the growth at this scale comes with challenges, which you will later see in the analysis.

That said, PDD Holdings is doing more than sitting back. It is making smart moves to diversify its revenue. Its recent partnership with DigitBridge will enable it to bring small-to-medium-sized businesses and assist them in simplifying e-commerce operations so that sellers can seamlessly join Temu. It could serve as a strategic play to strengthen Temu’s future position.

PDD Holdings delivers strong Q4, defying expectations

Heading towards financial performance, PDD Holdings just reported another strong quarter with revenue up 24% year-over-year (YOY) to $15.15 billion. That is a good number, but it was less than expectations and has been the slowest growth rate since early 2022. However, the company’s fundamentals are still strong. The healthy consumer demand manifested itself in a 33% increase in revenue from transaction services. Meanwhile, the company is keeping profitability up despite rising costs, as operating profit rose 14% to $3.5 billion and net income jumped a solid 18% to $3.76 billion.Balance sheet strength and cost concerns: Moreover, PDD Holdings is in an enviable position on the balance sheet. Today the company boasts a whopping $45.4 billion in cash and short-term investments and its cash-to-debt ratio is a staggering 30.13. That’s a fortress-like balance sheet that allows it to be aggressive with the capital, while still being financially secure. Further adding to this, the debt levels remain minimal, which is a great sign.

Thad said, rising costs posing concern. Cost of revenue rose 36%, and if that is to be the trend, it might put pressure on margins. But this is not a red flag yet. A core bull case for PDD Holdings is that it has consistently found ways to remain profitable, and this is supported so long as its e-commerce and grocery delivery businesses are strong.

There was already some caution going in on this report. The previous quarter had seen YOY growth but a sequential decline, and even the management had warned about a possible dip in the profits. Yet, PDD Holdings delivered where it needed to, that is, in earnings growth. It is likely that the holiday season helped, but posting strong profits while absorbing rising costs is a sign of a tough company.

Looking ahead, investors should keep a close eye on how the company balances the two: expansion with cost control. If PDD Holdings continues its earnings momentum and keeps costs under control, the current valuation discount would be a positive rather than a negative.

PDD Holding’s stellar FY 2024: Growth and profitability in tandem

Beyond Q4, PDD Holding’s full-year performance is particularly impressive. With strong growth in both online marketing services up 29% YOY and an astounding 108% YOY spike in transaction services revenue to $26.84 billion, fiscal year 2024 was a blockbuster for it. It’s obvious that the company’s aggressive expansion is paying off. Still, more impressively, operating profit soared 85% YOY to $14.85 billion while net income climbed a mind-boggling 87% to $15.4 billion, indicating the company had pulled it off despite increasing costs.Speaking of costs, operating expenses jumped 35% YOY to $18.02 billion, probably due to high marketing spend, but PDD Holdings still managed to increase margins substantially. The company has plenty of financial firepower to keep on investing in growth with $16.7 billion in operating cash flow. There’s no doubt that PDD Holdings is balancing aggressive expansion with profitability, but with raising fulfillment and payment processing costs, sustaining this momentum without killing margins is the real challenge ahead.

PDD Holding’s discounted valuation signals opportunity

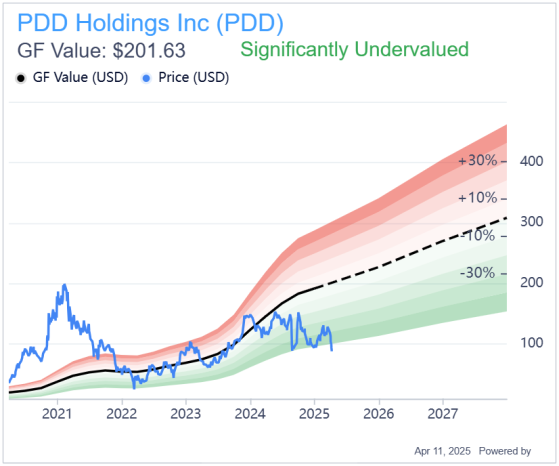

PDD Holdings currently appears to be a hidden gem in the market. The stock is trading at a steep 55.86% discount based on its GF Value of $201.63 compared to its current stock price of $88.97. Thats a significant gap, especially considering the companys robust earnings growth.As for valuation metrics, PDD Holdings trailing price-to-earnings (P/E) ratio of 7.70 times is 38.83% below the sector median, and the forward P/E of 7.30 times is 44.81% below. In short, the stock is cheap, and even though it has delivered solid profits, the market may not be fully appreciating of the stocks potential.

Digging a bit further, enterprise-value-based multiples corroborate the story. PDD Holdings forward EV/EBITDA of 4.44 times is at a 49% discount to the sector median of 8.72. Even more compelling is that its forward EV/EBIT of 4.42 times is at a 66% discount to the sectors 13.11. These numbers reveal that PDD Holdings is not only profitable, but profitable at a valuation that seems quite modest.

That said, there is one factor to watch. The companys forward EV/Sales multiple of 1.21 times is 12.97% above the sector median of 1.07. It means investors are factoring in strong revenue growth already. If margins dont come up to the levels of those expectations, then there could be some pressure on valuation.

Ultimately, PDD Holdings has an amazing balance sheet and surging profitability, which makes the disconnect between its intrinsic value and the market price an opportunity to watch out for. Therefore, for now, the valuation screams opportunity, but execution will be the key here.

PDD Holding’s valuation advantage over peers

Now, let’s compare MercadoLibre (NASDAQ:MELI, Financial) and Alibaba (NYSE:BABA, Financial) with PDD Holdings to determine who is a better value play out of the three.MercadoLibre is at a hefty premium, as its trailing P/E is 51.30 times and forward P/E almost 41.11 times, which is more than four times PDD Holding’s valuation. While MercadoLibre’s growth story is strong, that kind of premium pricing leaves close to no room for error. On the other hand, Alibabas trailing P/E of 11.94 times and forward P/E of 11.64 times are more reasonable but still slightly higher than PDD Holdings.

The trend continues when we take a closer look at EV metrics. MercadoLibre’s relatively high forward EV/EBITDA of 24.36 times and EV/EBIT (TTM) of 38.48 times indicate that there is a substantial premium. While EV/EBITDA at 8.17 times and EV/EBIT at 11.60 times for Alibaba is more moderate but again higher than PDD Holdings levels. No matter how you slice it, PDD Holdings is trading at a discount.

The gap remains wide on a revenue multiple basis. PDD Holdings EV/Sales is a much lower figure than MELIs 3.91 times or Alibabas 1.64 times. This makes it the most attractively valued of the three.

Source: Author generated based on historical data

Big money is betting on PDD Holdings

When top investors make a move, it’s worth noting, and PDD Holdings has been on the radar of some big names. Institutions like BlackRock (NYSE:BLK), Vanguard, and Baillie Gifford (Trades, Portfolio) (Trades, Portfolio) have large positions in the company, while billionaire investor David Tepper (Trades, Portfolio) (Trades, Portfolio)’s Appaloosa Management has also been adding to its stake. It is a powerful vote of confidence in PDD Holding’s long-term potential.The latest activity on guru trades is leaning bullish. Despite some investors taking profits, there is a notable uptick in buying which suggests that smart money sees value. The strong accumulation that took place in late 2024 and early 2025, particularly when the stock dipped, is a sign of conviction rather than hesitation.

Heavyweights are standing firm and building on top of their positions, attracting long-term investors. And as already mentioned, when top investors back something up, that is usually for a reason.

PDD Holding’s 12-Month price target

Source: Consensus EPS estimates (Seeking Alpha)

With that, here is where I see PDD Holding’s stock trading over the next year. Over the next three years, PDD’s forward P/E is estimated to drop steadily, from 7.33 times in 2025 to 5.29 times in 2027. The fact that earnings are expected to see strong growth is captured in this downward trend, and the consensus EPS estimates support it. As EPS continues to accelerate, PDD Holdings stock could be substantially undervalued at the current levels and thats where the opportunity comes. We would see a significant re-rating and a solid upside if sentiment shifts and investors start recognizing PDD Holdings momentum.

Base case-A conservative valuation re-rating: If I take, for example, a 2025 EPS estimate of $7.33 and apply a 9-10x forward P/E, which is in line with PDD Holdings historical valuation range, we reach a price target of $108.54 to $120.60. Its about 22% to 36% upside from current levels. The assumption in this scenario is that the execution remains steady but the market could still be cautious with PDD Holdings, preventing its multiple from expanding more rapidly.

Bull case-A stronger growth premium: But how PDD Holdings would react if investor sentiment improves? Thats where things get interesting. A 12-13 times forward P/E suddenly looks reasonable if the stock begins to get valued like some of its higher growth peers. If PDD Holdings were to trade at 12 times, it would be worth $144.72 and 13 times would result in $156.78, which is a 63-76% upside. To drive this out, PDD Holdings would need to continue its current earnings and margin expansion and have investors competent enough to have faith in its long-term trajectory.

Source: Author generated

Even in the worst-case scenario, PDD offers a modest upside. However, if things go right and the market sorts itself eventually, the gains would be high. GuruFocus analysts also believe that there is an upside of 73.37%, with bullish targets even higher. This is one of those setups where patience becomes the key, and for long-term investors, PDD Holdings is an opportunity waiting to be discovered.

Risks to my thesis

Not even the best growth stories are without risk, and the same is true of PDD Holdings. Right now, regulatory scrutiny is one of the biggest concerns. Temu is probed for product safety violations and alleged labor violations related to the supply chain in the U.S. The sales tactics of the firm are also being considered red flags by European regulators. If these problems become worse, PDD Holdings could be fined, restricted in operations, or experience a loss of reputation, all of which are obstacles to its long-term growth.Another wildcard is China’s regulatory environment. PDD Holdings is a Variable Interest Entity (VIE) that allows foreign investment in Chinese companies. However, if Beijing goes too hard on this, PDD Holding’s entire corporate setup could be at risk.

And let’s not forget the competition. Alibaba and JD.com (JD, Financial) are already fighting back and slowing revenue growth. If PDD Holdings can’t hold its edge, investors betting on its continued superiority may need to readjust their hopes.

Your takeaway

PDD Holdings is a compelling case being a high-growth, cash-rich e-commerce powerhouse trading at a steep discount. It is continuously executing, and delivering profitability even as it is aggressively investing. However, the market has not yet fully priced in its potential and that’s the opportunity.There are risks, but they exist everywhere, isn’t it? PDD Holdings has always been able to adapt and outperform. With earnings momentum still strong and institutional investors betting big, it is hard to ignore its upside. If the company stays on course, today’s discount could become tomorrow’s massive gain.

This content was originally published on Gurufocus.com