PepsiCo Inc. (NASDAQ:PEP) is a global player in the food and beverage industry. As the leading company in the salty snacks category and the second-largest non-alcoholic beverage producer, it operates in over 200 countries worldwide. Around 61% of its revenue comes from North America while the remaining 39% is generated from international markets. The company's revenue is roughly split between its snack and beverage segments, with about 59% coming from salty snacks and food and 41% from beverages.

Why is PepsiCo a highly attractive stock? The main reason is its easily understandable business model for long-term investment. This straightforward business sells everyday products like sodas, chips, bottled water and energy drinks that are regularly consumed by the average person. As such, the company can provide long-term investors with solid, stable returns.

Even though the consumer staples sector has been among the top performers in the S&P 500 over the past month, investors have still turned to defensive stable niches amid the rising volatility. Despite the 8% rise in the S&P 500 since the sharp decline following turmoil in the Japanese market last month, the overall market is still in a bearish cycle.

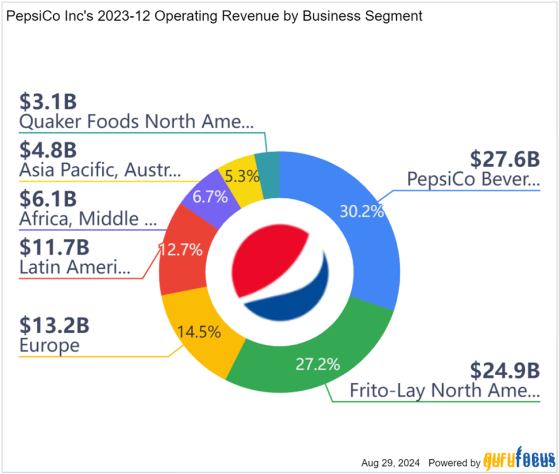

Financial performanceRevenue and income are important metrics when looking at a stock to evaluate its investment potential. Higher numbers translate to higher share prices and increased dividends. PepsiCo's diverse product portfolio has allowed the company to have multiple consistent revenue streams. The two biggest revenue contributors are its North America beverage channel, which contributes around 30%, while the Frito-Lay segment adds about 27%.

Before we get into the financial performance numbers, I would like to point out that data compiled by Deloitte shows that consumer spending has been decreasing as consumers continue to favor saving to offset high inflation levels and elevated interest rates.

Despite these challenges, PepsiCo's revenue has grown by nearly $25 billion annually over the last decade. More importantly, most of this growth occurred after the Covid-19 pandemic. Revenue between 2014 and 2019 was relatively flat at around $67 billion annually at that time. However, over the course of the last 12 months, it has exceeded $92 billion. The first two quarters of the current fiscal year also saw an increase of 1.50% in revenue. This growth has demonstrated its ability to increase revenue even during periods of high inflation, indicating that a mature company like PepsiCo has the pricing power to keep pace with or even exceed the overall inflation rates.

Net income has grown at a similar rate over the past decade, rising from $6.50 billion in 2014 to nearly $9.10 billion in 2023. This growth led to a 50% increase in earnings per share over the same period. Additionally, the first two quarters of the current fiscal year saw a 10% increase in earnings per share. While some companies improve their earnigs by aggressively buying back their own stock, this has not been the case with PepsiCo. While the company did announce plans to repurchase approximately $1 billion worth of shares in its last annual report, the rate of buybacks has actually decreased over the last decade and the overall number of outstanding shares has decreased slightly from 1.38 billion to 1.37 billion since the pandemic began. Fewer shares in the market translate to higher share price since earnings are less diluted on the number of issued shares.

Most importantly, PepsiCo's free cash flow has increased by 39% year over year to an astounding $8.10 billion. The company achieved this by implementing various cost-cutting measures, including global layoffs and other cost-saving initiatives. For instance, it continues to lay off employees in its Frito-Lay segment to offset slower sales growth and maintain the profitability momentum. In my opinion, by focusing on generating more cash during periods of lower sales volume, the company is well-placed to manage the economic headwinds more effectively.

With regard to the balance sheet, PepsiCo has maintained a strong return on equity, averaging 56.90% in the last five years, while its net margin has averaged 11.20%. ROE levels have been boosted by the balance sheet and the company's return on invested capital consistently remains in the high teens, indicating solid returns on its capital. Net debt has seen an increase recently, with a notable improvement between 2019 and 2020. This was likely due to the pandemic and the low interest rates those years made borrowing cheaper. PepsiCo's net debt was $28 billion in 2019; it has grown over 38% in almost five years to $38.30 billion. This could be problematic if the trend continues, but for now, the current debt level seems manageable.

PepsiCo may not be the fastest-growing company, but it is a blue-chip defensive business with some of the biggest brands in the world. In my opinion, due to its economies of scale, global distribution network, intellectual property, research and development capabilities and an ever increasing brand equity, the company has a lot of durable competitive advantages to make it successful in the long run. It has products that are widely popular and some products have even become somewhat addictive, which ensures consumer demand will increase at a stable rate regardless of the macroeconomic conditions.

A track record of dividend growthAs an investor who is interested in dividends, I always check out the company's dividend health. The company's track record is so great that it goes back decades. PepsiCO has increased its dividend for an astounding 52 consecutive years, making it a Dividend King. The company recently raised its quarterly dividend by 7.10%, from $1.26 to $1.35 per share. Over the past decade, the dividend growth rate has averaged 8.10%, with a 6.6% growth rate over the trailing five years. The 8.10% growth rate for the last 10 years shows that a slowdown in dividend is not a given even decades into the growth story.

So PepsiCo is consistently growing its dividend output at a high single-digit level and any capital appreciation is in on top of that. With the payout ratio of 66.50% as per the guidance for core 2024 earnings per share shared by the company, the dividend is set to grow in line with the business. If an investor gets 7%-plus dividend growth and 3%-plus yield, their income would double in seven-plus years with a growth rate of 10% annually (assuming a no major changes to the valuation). These are unusually high numbers for income-focused investors. This does not necessarily mean the share price will increase too much, giving capital appreciation to its holders, but income-focused investors should see their investments grow at a rate above the interest rate. For a mature, fast-moving consumer goods company, that is not bad at all.

Reasonably priced for a blue-chip stockPepsiCo currently trades at a forward price-earnings ratio of 21.15. It has a 2024 consensus earnings per share estimate of $8.16 and a consensus EPS estimate of $8.76 and 19.68 forward earnings ratio for 2025. These figures are surprisingly low for such a reputable blue-chip business and compare favorably to PepsiCo's own five-year average price-earnings ratio of 25. Additionally, the company's cash flow multiple of 16.10, which is also lower than its five-year average of 19.20, further supports the stock's undervaluation. The yield, as noted earlier, is significantly higher than its own recent historical average, making it an attractive option for income-driven investors.

With that, I believe the company's revenue will see a growth reacceleration in the second half of the year, driven by easing macroeconomic conditions, an increase in advertising and strategic price-pack changes focusing on value offerings, which should further help drive the earnings multiple.

Further, the company has an attractive forward dividend yield of around 3.12% and expected annual EPS growth of over 7% in the next few years, so even if the earnings multiple stays the same, the company is in position to deliver double-digit total annual returns in the medium term, which is why it is attractively placed right now for income-driven investors.

Risk ronsiderationsThe biggest risk I can see for the stock is potential adverse effects from foreign currency fluctuations due to its international operations. Additionally, if inflationary pressures worsen, they could negatively impact consumer spending and slow growth. However, large corporations like PepsiCo are generally better equipped to manage these pressures due to their economies of scale.

On the flip side, we are seeing interest rates decrease and inflation continues to cool, which could increase consumer spending, providing a catalyst for PepsiCo's growth. We have already seen inflation decline for two consecutive months, which could provide consumers with some relief and potentially boost sales volumes. Increasing sales volumes will also eliminate the need for price hikes.

ConclusionPepsiCo has demonstrated a strong history of growth, with its share price rising by nearly 89% over the past decade. While this growth rate may not match that of high-growth stocks, it still is a respectable increase for long-term investors. The company's dividend payout has also doubled over the past 10 years, indicating steady growth.

Looking forward, I expect PepsiCo's revenue growth to accelerate as it recovers from challenges related to lower consumer spending and specific product recalls within its Quaker Foods North America segment. This acceleration, combined with productivity and cost-savings gains and an improving margin mix, bodes well for overall margin growth.

In addition, PepsiCo remains attractively priced from a valuation perspective. I believe the stock remains seriously discounted in the market by the current high interest rate environment. As the company experiences accelerating revenue growth, I anticipate an upward re-rating of its price-earnings multiple. With an attractive forward dividend yield of approximately 3.12% and expected earnings per share growth of over 7% in the coming years, the company presents a compelling opportunity for long-term investors. The combination of growth potential, attractive dividend yield and healthy earnings growth makes it a strong candidate for generating substantial returns in the medium term.

This content was originally published on Gurufocus.com