Pershing Square (NYSE:SQ) (PSH) is a closed-end investment fund based in Guernsey with a market capitalisation of 6.9 billion. Listed on the London Stock Exchange (LON:LSEG) under the ticker PSH, it has an average trading volume of 150,000 shares per day, providing ample liquidity for investors. Although traded on the London exchange, all of the fund's investments are in U.S. equities and hence I have recommended it as a US investment.

So, Why Invest in Pershing Square?There are several compelling reasons to consider investing in PSH:

2. Trading at a Discount: PSH is currently trading at a 30% discount to its net asset value (NAV). Given William Ackman's track record, the fund should ideally be trading at or above its NAV, providing an attractive entry point for investors.

3. Insider Ownership and Share Repurchase: With 27% insider ownership, management's interests are closely aligned with those of investors. Additionally, the fund has repurchased 26% of its shares since listing, further enhancing value for existing shareholders.

How Does Pershing Square Achieve Such High Returns?PSH focuses on high-quality businesses with sustainable competitive advantages and predictable cash flows. The fund adheres closely to the value investing principles of Benjamin Graham, but what sets PSH apart is its:

1. Long-term perspective: As a closed-end fund, PSH benefits from having locked-in capital, meaning it doesn't face the pressure of redemptions from investors during periods of poor performance. This provides a significant advantage, giving the manager access to permanent capital that can be invested with a long-term focus. Unlike most funds, which allow quarterly redemptions, the closed-end structure enables the manager to pursue investments with a multi-year outlook, even if they may underperform in the short term. The average holding period for investments spans several years.

2. Activist approach: With its concentrated portfolio, PSH often acquires significant stakes in companies, allowing it to secure board seats and influence strategic decisions. This involvement helps drive meaningful improvements in company operations, ultimately boosting returns. Unlike many other funds, PSH is genuinely hands-on, working to transform companies and enhance their performance.

3. Flexible investment mandate and prudent use of leverage: PSH operates with a highly flexible mandate, which can be a double-edged swordpotentially risky with less skilled managers, but a strong advantage under the leadership of one of the world's top fund managers.

PSH can use leverage, trade derivatives, and previously took short positions (although it has since pledged not to short again since 2022). The strategic use of derivatives has historically delivered substantial gains. For example, during the 2020 pandemic, the fund realised $2.3 billion in profit from a $27 million investment in credit default swaps.

PSH also employs moderate leverage, with a debt-to-total capital ratio of around 15%. This debt is cheap with an interest rate of only 3.1%. Furthermore, it is fixed rate, long term (with an average duration of eight years), and not subject to margin calls. Given the fund's proven ability to generate over 20% returns before fees, this low-risk, low cost, sensible use of leverage serves to further boost returns.

Why is the Market Mispricing Pershing Square?The market's undervaluation of Pershing Square can be attributed to two main factors:

Misplaced Faith in Market Efficiency: Many people, particularly academics, have been taught that markets are efficient. This academic dogma, rooted in unrealistic assumptions, theories, and a lack of real-world experience, has convinced many that all funds are destined to underperform in the long run simply because they charge fees.

Perceived Investment Risks: Currently, many investment platforms issue a warning before purchasing these shares. This is because of the fund's fee structure, its concentrated portfolio, utilisation of leverage (albeit within very reasonable bounds), capabilities for short selling, and engagement with derivatives.

Key Risks to ConsiderAll investments carry risks, and in this section, I've analysed some of the main concerns surrounding PSH.

Many investors believe PSH should trade at a discount to its NAV compared to more conventional funds because it is riskier.

I disagree with this view and actually see PSH as less risky with strong potential for long-term returns.

Tracking Benchmarks: PSH does not closely align with the S&P 500 because of its concentrated portfolio. This can result in periods of underperformance, which may trigger emotional responses and prompt investors to sell at the least opportune moments.

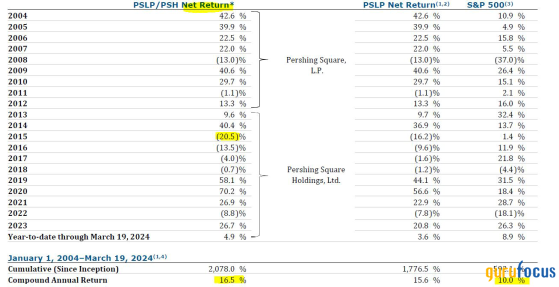

Volatility: PSH's returns are unlikely to be smooth or consistent, and investors who are uncomfortable with the potential for annual losses may prefer a more conservative alternative. The fund's largest annual decline has been 20%, which, although notable, is less severe than the S&P 500's 37% drop during the same timeframe. Despite its inherent volatility, PSH has demonstrated resilience during market downturns, often outperforming the broader market.

Ackman's Social Media Presence: Ackman's active and sometimes controversial presence on X (formerly Twitter) may be a concern for some investors. While his growing public profile will likely attract more interest in PSH, his remarks also risk backlash, possibly leading to regulatory scrutiny or legal issues.

Macro (BCBA:BMAm) and U.S. Political Environment: PSH's performance is closely linked to the U.S. economic and political climate. The U.S. is currently facing several critical challenges, including rising national debt, a public health crisis driven by chronic disease, uncontrolled immigration, etc.

ConclusionInvesting in Pershing Square offers the potential for significant long-term growth. If the fund compounds at a rate of 15% annually and eventually trades at its NAV, investors could see their investment increase 20-fold over the next 20 years.

While the current discount to NAV provides an immediate incentive, the primary focus should be on the long-term compounding potential of Bill Ackman (Trades, Portfolio)'s investment philosophy. With patience and conviction, Pershing Square presents a compelling opportunity for long term investors.

Disclaimer

Attempting to replicate Pershing Square's performance by mirroring its publicly disclosed positions is impractical. A significant portion of its success stems from Ackman's strategic macroeconomic insights and hedging strategies, which are not easily replicable. Additionally, since positions are disclosed after transactions, investors would likely buy and sell at less favourable prices, potentially harming their returns.

P.S I am also an investor in PSH. This is not financial advice.

This content was originally published on Gurufocus.com