- P&G expects 3% to 5% organic sales growth for the current fiscal year, the lowest since 2019

- P&G stock is down 12% this year, underperforming peers

- A sharp pullback in P&G stock will provide an attractive entry point to long-term investors

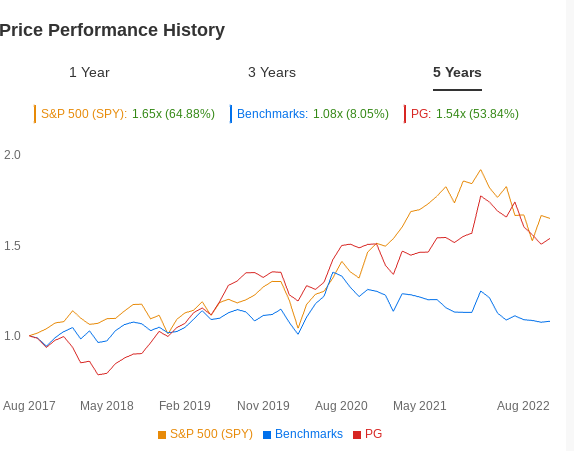

For investors of the global consumer staple giant Procter & Gamble Company (NYSE:PG), the long stretch of gains that lasted for many years seems to have stalled—at least in the short run. The maker of Tide and Pampers is down roughly 12% this year, underperforming the broader Vanguard Consumer Staples Index Fund ETF Shares (NYSE:VDC).

Source: InvestingPro

During its latest earnings report last week, P&G told investors it expects 3% to 5% organic sales growth for the current year, the lowest since 2019. The Cincinnati-based giant is also predicting earnings per share to hover from flat to up 4% due to the $3.3 billion hit it expects from the strong US dollar, plus higher commodity and freight costs.

This disappointing forecast damaged a bullish case for P&G stock based on expectations that the company was in a better position to pass on higher prices to consumers due to its vast portfolio of consumer goods and its efficient operations after many years of restructuring.

Instead, P&G’s rivals are showing resilience. Unilever (NYSE:UL), for example, said last month that its sales growth would exceed a stated range of 4.5% to 6.5%. Reckitt Benckiser Group Plc (LON:RKT) and Colgate-Palmolive (NYSE:CL) also raised their sales forecast for the year.

The most obvious challenge that P&G is facing in this harsh economic environment is to offer value when consumers have begun to show restraint in their spending.

Unit sales for all P&G’s businesses declined or were flat in the quarter, with the grooming business, including Gillette razors falling the most. Excluding Russia, the company said overall volumes would have been essentially flat.

Buy-On-The-Dip Target

Despite this short-term setback, P&G stock remains my favorite pick among the consumer staple companies. In fact, a sharp pullback will provide a much more attractive entry point to long-term investors.

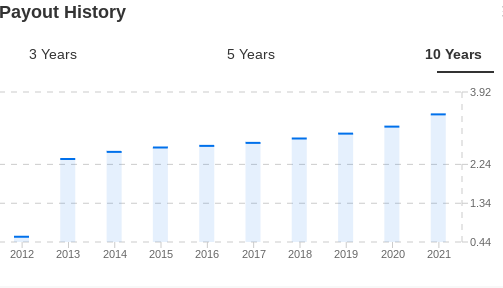

Over the long run, investors have many good reasons to buy P&G stock. The Cincinnati-based P&G is a reliable dividend stock in both good and bad times. It has increased its dividends for 63 consecutive years, a track record few companies can match. It currently pays $0.91 a share quarterly.

This consistent dividend growth also shows the power of the company’s cash-flow generation. Its range of products, including globally recognized brands such as Pampers diapers, Tide laundry detergent, and Charmin toilet paper, is strong enough to generate sustained performance through wars, recessions, and market downturns.

Another reason that makes P&G a reliable income stock to hold in your portfolio is that the company’s deep restructuring in recent years made it more efficient to deal with economic downturns.

Under the former Chief Executive Officer David Taylor, who retired last year, P&G cut its roster of brands from 175 to 65, focusing on the 10 product categories where margins are the highest. During that process, the company has also eliminated 34,000 jobs through a combination of brand sales, buyouts, and plant closures—slashing more than $10 billion in costs.

That said, it seems quite likely that growth in P&G sales will be muted relative to the past few years when demand for consumer goods was extraordinarily high due to the pandemic. Nonetheless, numbers should still be solid, driven by high employment levels and healthy household balance sheets.

Bottom Line

P&G’s latest earnings show that the consumer giant is entering a slow growth period, hurt by higher inflation, a strong US dollar, and business disruptions in Russia and China. But any weakness in P&G stock is a buying opportunity for long-term investors who want to benefit from the company’s consistent dividend growth and rebound potential.

Disclosure: The writer is long on P&G.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »