The traditional paradigm in the quantitative investment space has sought to employ factors derived from core fundamental, price, and estimate information for a given universe of issuers and securities. That model has since evolved to incorporate a broader range of alternative data sources as well as more robust ways of linking issuers to their external dependencies, which are often similarly rich in data.

Supply chain relationships data serves as a prime example of both phenomena due to the myriad of unique alpha factors that can be generated using various combinations of available data and economic linkages between companies. One of the original and often-cited studies in this area assumed that the collective performance momentum of a company’s customers is an indicator of that supplier’s future performance and that the time lag of this customer to supplier propagation stems from the finite information processing capacity of investors. Subsequent studies have observed similar customer-supplier momentum alpha with a particular focus on the U.S. market and short-term stock price propagation (e.g., one month).

In their research paper Momentum Information Propagation Through Global Supply Chain Networks, Yamamoto, Kawadai, and Miyahara extended some of the early studies in the following ways:

- Expand the universe to the global market and supply chain network

- Test the validity of using a network centrality as a weighting scheme in the customer momentum calculation

- Examine customer momentum propagation over longer-term frequencies and use multiple tiers of supplier-customer relationships

Customer Momentum

In their research paper Economic Links and Predictable Returns, Cohen and Frazzini assumed that the return momentum of customers would propagate back to their suppliers. They proposed a new momentum factor, calculated as a weighted average of customers’ stock price returns for the past month. They used suppliers’ revenue exposure to each customer as a weighting scheme of the factor calculation.

Empirical Analysis Universe and Time Horizon

Cohen and Frazzini did an empirical analysis of their theory for the U.S. market. All supply chain information is sourced from public companies listed on U.S. stock exchanges. On the other hand, we conducted an empirical analysis for the constituents of a broad market index from 2003 to 2019 with monthly rebalancing. The supply chain relationship information is derived from FactSet’s supply chain relationships database, which sources more than 27,000 international public companies globally.

Network Centrality as a Weighting Scheme

Each customer has a different impact on the supplier’s performance. The early study used a revenue exposure of suppliers to its customer as a proxy of the impact of the momentum propagation. Revenue exposure seems like a logical proxy, although this may drastically limit our pool of relationships since those figures are not frequently disclosed to the public by suppliers. Due to a lack of information, some studies suggested using network centrality as a proxy.

Centrality is a measure of the importance of nodes (i.e., companies) or edges (i.e., relationships) in the network. Using this measure as a weighting scheme assumes that the more important companies/relationships will have a greater impact on their suppliers' future performance. In this study, customer momentum uses edge betweenness centrality as a weighting scheme (i.e., the more important the relationship is, the more impact the customer will have on the supplier).

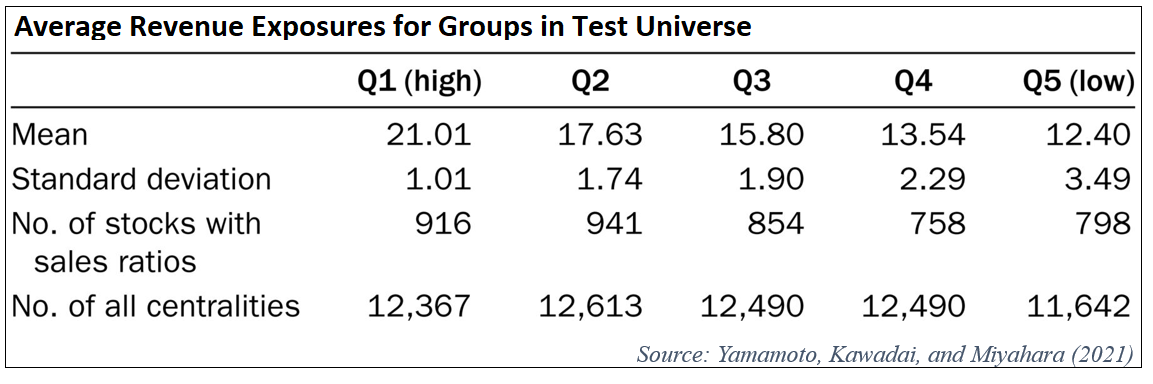

In order to examine the relationship between centrality and revenue exposure, all relationships are divided into five groups based on centrality. Then, the average revenue exposures are calculated for each group. The table below shows the average revenue exposures for each group in the test universe. As expected, Q1 (the highest centrality group) shows the highest average revenue exposure.

Multilayer Customer-Supplier Relationship and Longer-Term Customer Momentum

Many previous studies have used the first layer of the supplier-customer relationship (i.e., direct supplier and customer) to calculate the customer momentum factor. However, additional degrees of customer-supplier relationships may contain additional useful information which investors overlook. This study tests the effectiveness of the factor return using 1st, 2nd, 3rd, 4th, and 5th degree relationships.

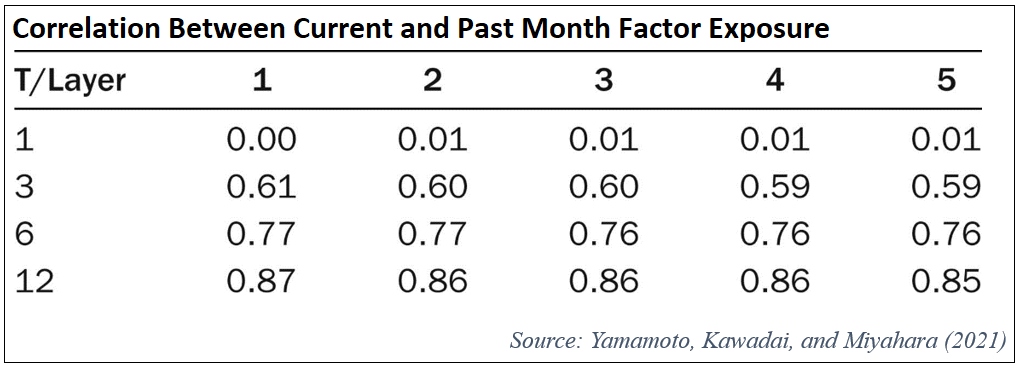

This study also examines the effectiveness of using mid-term customer momentum for the factor calculation. The below table shows the correlation between current and past month factor exposure using different layers of customer-supplier relationship and different time horizons of customer momentum. The high correlation indicates the low factor turnover. This result shows the highest correlation coefficients at a 12-month customer momentum return for all cases.

Factor Performance Result

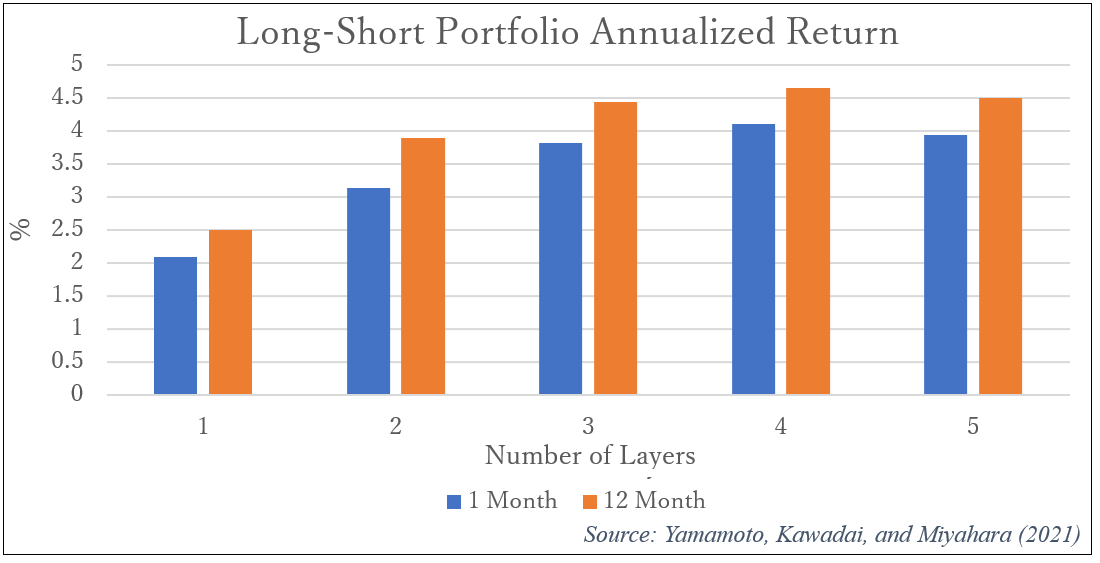

The empirical test is conducted by creating five portfolios from constituents of a broad market index based on the factor exposure and by measuring the return of a long-short portfolio, which holds a long position of the top group and a short position of the bottom (5th). The portfolio is rebalanced monthly. The below chart shows the annualized long-short portfolio return for one-month and 12-month customer momentums using varying numbers of layers of the customer-supplier relationship. In both cases, using up to 4th layer of the customer-supplier relationship indicates the best returns. The result also indicates a better annualized return when using 12-month customer momentum returns compared to one-month customer momentum.

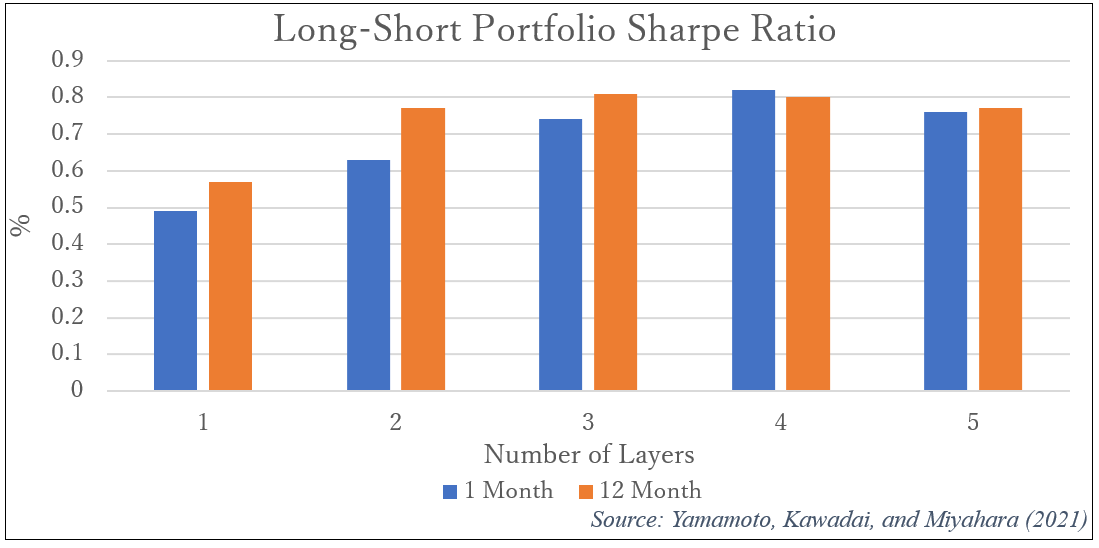

The next chart shows the Sharpe ratio for the long-short portfolio. The result is similar to the annualized return while the difference between one month and 12 months customer return is very small when we use the 3rd, 4th, and 5th layers of the customer-supplier relationship. Considering the high factor correlation over time for the mid-term customer momentum, using 12-month customer momentum might be preferable due to the reduced portfolio turnover.