Earnings are coming in nicely, but there is an overhang on this market – and until resolved, the market is stuck in the mud. First Republic (FRC) is now a zombie bank that no one wants to take over because they would need to raise a significant amount of equity capital against the upside down assets/write-downs.

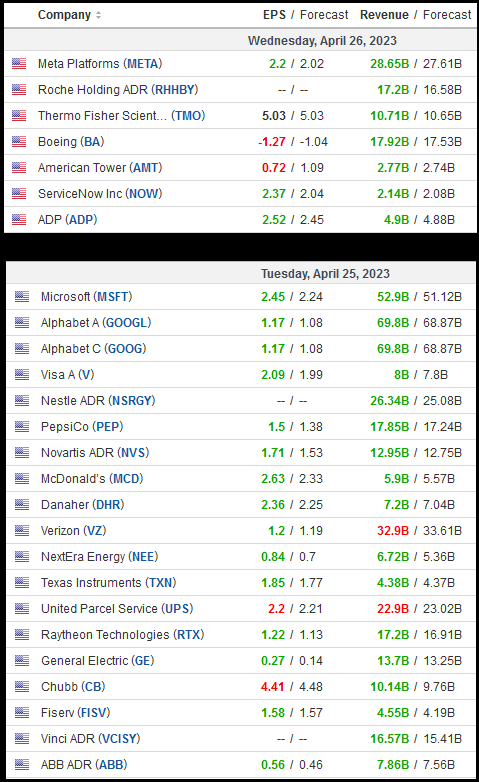

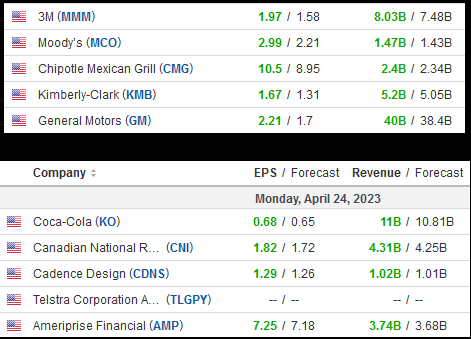

The bank is sitting in a fetal position waiting to die and no one will pull the trigger. In the meantime, the market suffers (waiting for the inevitable) despite better than feared earnings across the board:

Management deciding not to take any questions on their earnings call (after losing $102B in deposits) gave a dose of courage to the short sellers who felt like masters of the universe after that spectacle and pushed the stock as close to zero as the market would bear.

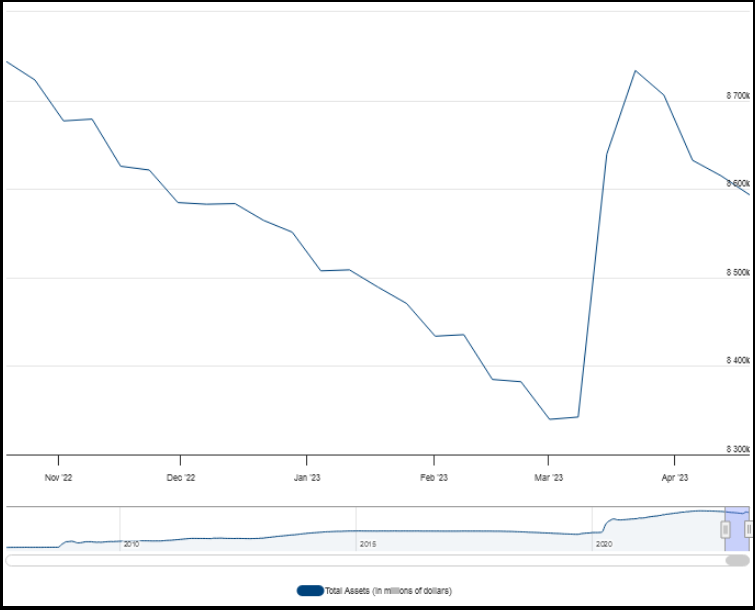

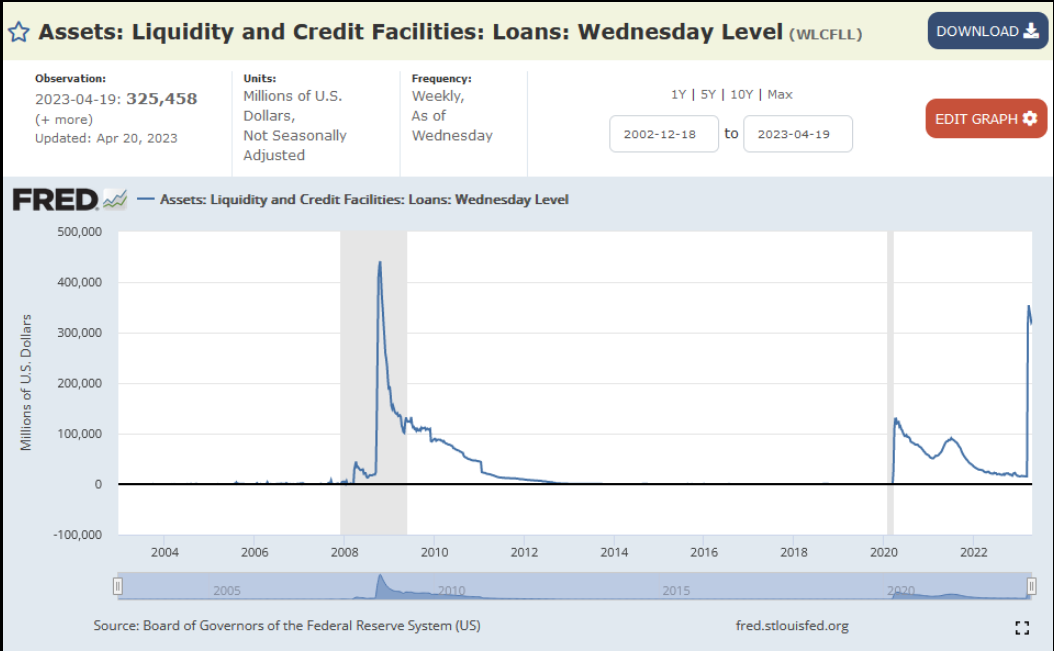

The Fed had to increase the balance sheet once again last month as a result of the mini-crisis.

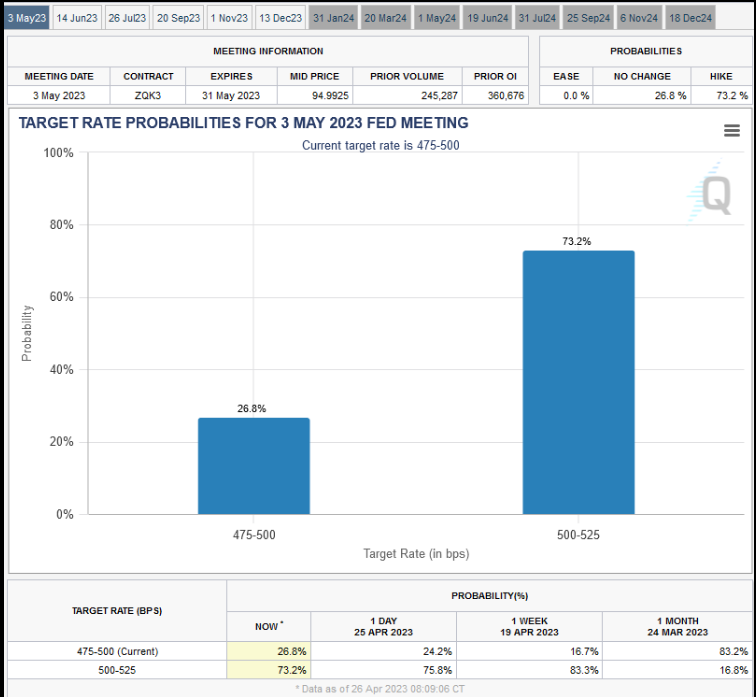

While that has cooled (for now), the resurgence of FRC fears may cause the Fed to think twice at their meeting next week – as to how hawkish they want to be. This is particularly true if there is not a forced marriage or receivership for FRC over the weekend. So while this does not look like a “pause” next week:

These three factors could skew the odds to a surprise pause (or raise and pause):

1)

Source: MUFG

2)

3)

Back in the real world, here’s what is happening with earnings beats:

On Monday, I joined Ann Berry on Public.com to discuss expectations going into this week. Thanks to Mike Teich for having me on.

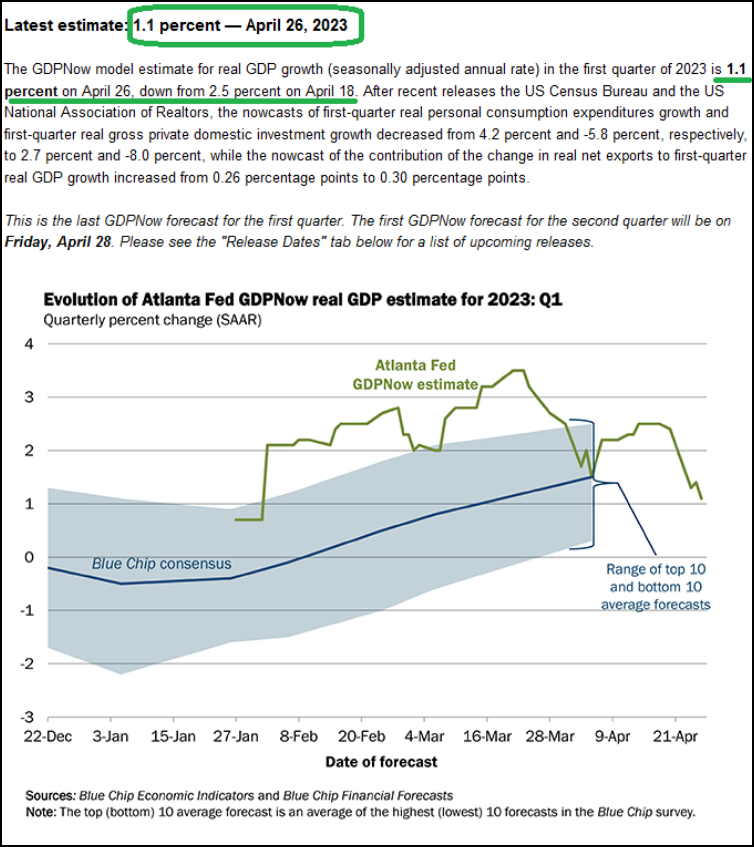

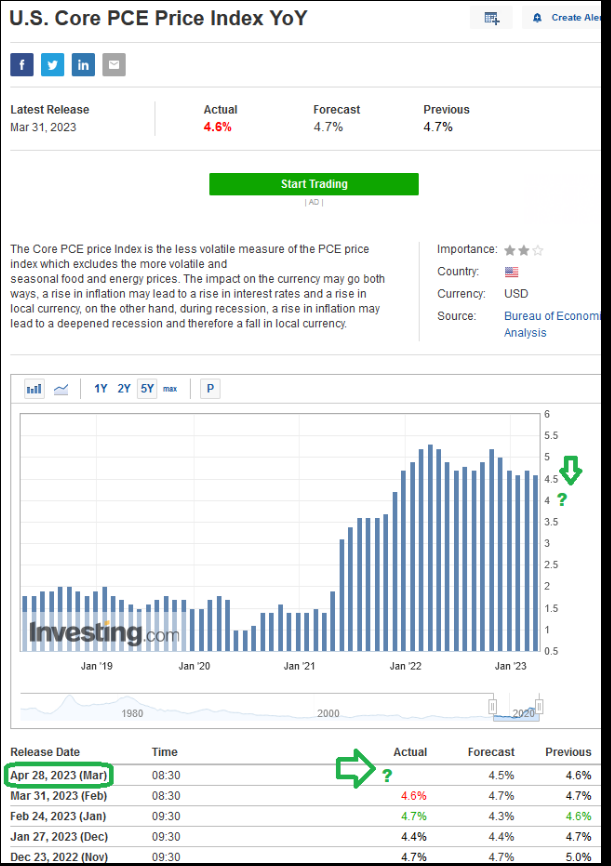

So far, tech has dramatically exceeded expectations. Now we wait for GDP and Jobless claims today, followed by Core CPE tomorrow. These are major data inputs for the Fed ahead of next week’s meeting:

Last Thursday, just before the podcast, I joined Liz Claman in-studio at Fox Business to discuss markets. Thanks to Liz, Kathryn Meyers and Jake Mack for having me on:

And finally, this week I joined Johan Lupton on his podcast “Investing with Whales.” He did a tremendous job asking me about individual positions. We covered BABA, AMZN, INTC, GOOGL, BAC, VNO, MMM and more. You will get tremendous value tuning into this one:

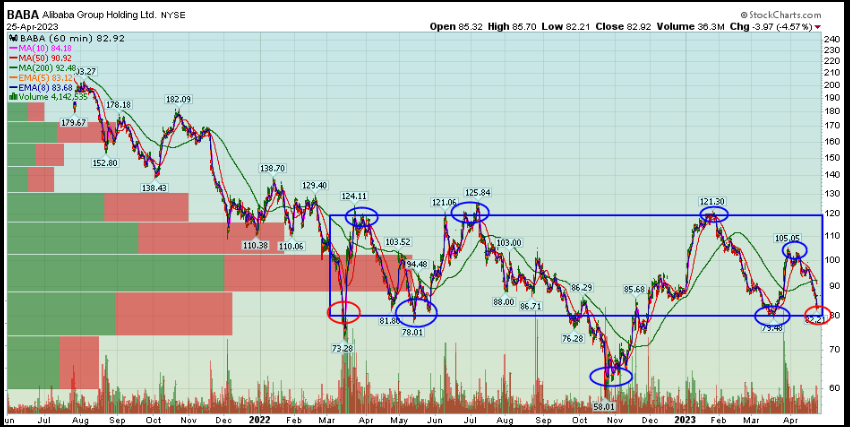

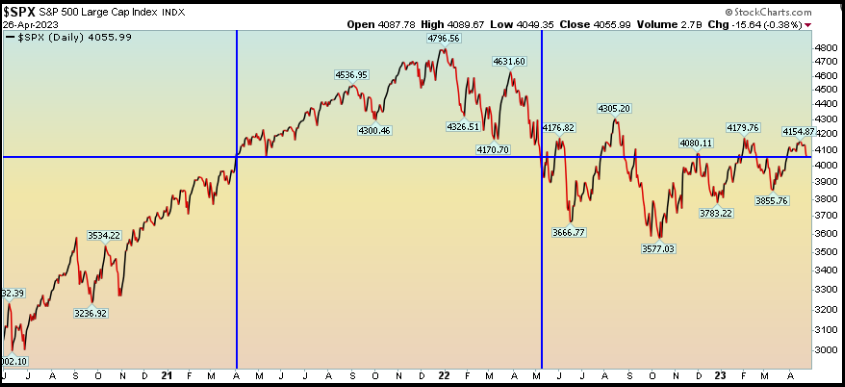

Alibaba (NYSE:BABA) Update:

While the stock price has done nothing for just about a year, the fundamentals and environment are improving dramatically. As volatile as Alibaba has seemed for the past year, it is not much different than the S&P 500 as a whole – which has not only “done nothing” for the past year, it has “done nothing” for the past two years (no change in price) – with a lot of volatility in-between:

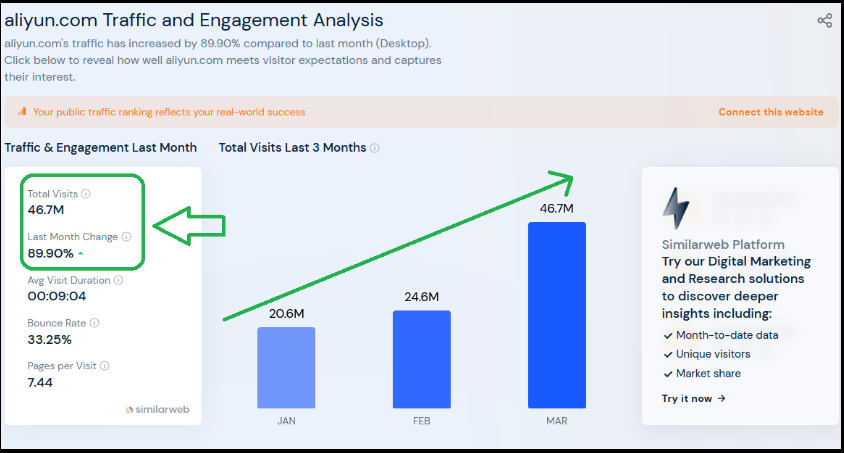

Here is Aliyun’s (AliCloud) US traffic. My guess, the traffic is mostly comprised of US Senators (and their aids) looking to ban it – as no one uses AliCloud commercially in the US:

This third response is the most important as I referenced it to a friend via an email this yesterday:

His Question:

“I know you were also very bullish on Ali Cloud. What do you make of the headlines today that Alibaba is cutting the cost of its cloud service by between 15-50% to win users? Do you think demand is slowing / competition is heating up / or the gov’t told them to do so? Either way prob not positive for margins?”

My Answer:

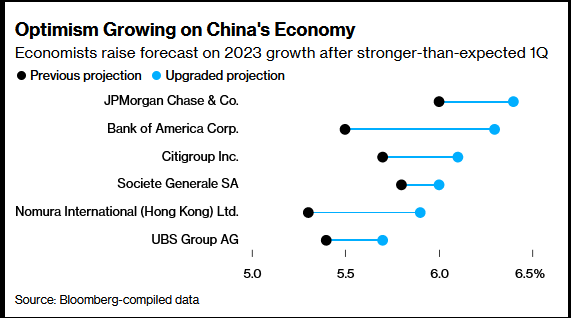

1. The Chinese traffic for Aliyun in the last three months since reopening is off the charts: https://www.similarweb (NYSE:SMWB).com/website/aliyun.com/#ranking

Compare that with Tencent Cloud which has around half the visitors and much slower growth since the reopening in January:

2. Aliyun currently has 36% share and is competing to gain share against Baidu (NASDAQ:BIDU), Tencent and a few soe’s. This is a razor/razor blade model with high switching costs. All of the money will be made on generative AI and other upgrades. They just need to sweep up all of the share at any cost and then turn on the services spigot over time for margin expansion. Amazon (NASDAQ:AMZN) followed the same strategy until they reached scale and their margins expanded tremendously. Furthermore, share gain/growth is of more importance ahead of IPO valuation than margins – especially considering how “early days” cloud conversion/digitization is in China. Same game Musk is playing. He is the leader squeezing the entrants until he owns the space. As Bezos said, “your margin is my opportunity.”

Vornado Update

We bought a 5% position in Vornado and Bank of America (NYSE:BAC) last month to take advantage of the “mini banking crisis” crash. We laid out our thesis with Jonah in the podcast above. Last night, Vornado announced they would start a buyback program for their shares of $200MM and postpone the dividend until year end (after they calculate asset sales and taxable income). We think this is a sensible and opportunistic plan given the environment, and is a more efficient use of capital.

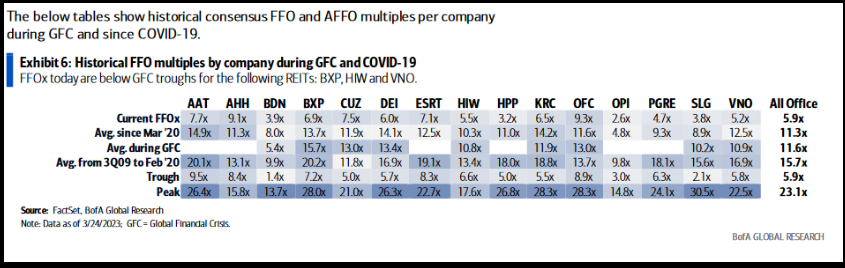

Ordinarily, when a REIT cuts the dividend, it is a move of last resort. In this case, they are being aggressive to take advantage of a once in a decade opportunity to buy in shares at a massive discount. They have among the lowest multiples among peers (lower than during the Great Financial Crisis), and the most liquidity of anyone in the group.

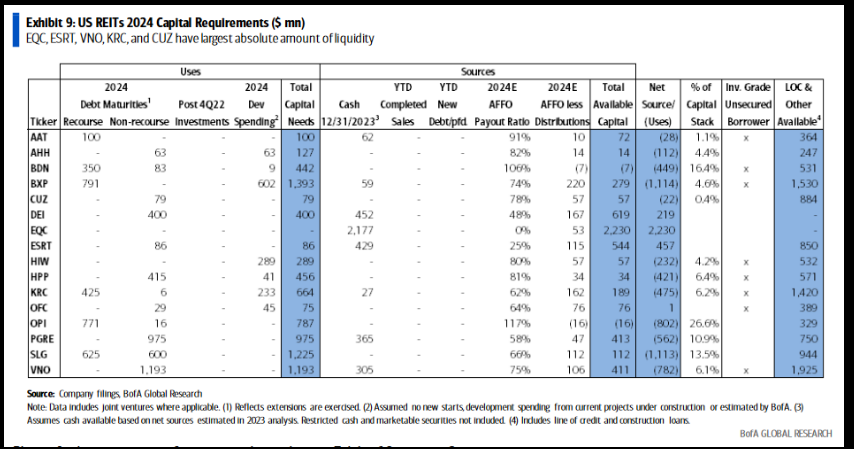

Bank of America’s analysis through 2024 shows VNO has $1.0bn in excess capital including its line of credit above upcoming debt maturities and current construction pipeline. Note the 2024 maturity is “non-recourse” so depending on the environment, they can simply turn in the keys to the individual building(s) without impacting the rest of the portfolio.

The stock is trading as if it is recourse debt and would impact the entire company. It is simply not the case. This is the lender’s problem, not the owner (Vornado) – which is why you are going to see the same regime of “extend and pretend” this cycle – as you do in most other downturns. The lenders do not want the properties (or the marks on their books), so they will have to be flexible with terms (extensions) as loans come due.

At some point the Fed will wake up and stop, and this will all be a distant memory. The question now, as it has been for months, is how much do they have to break before they get the message?

We will own a greater interest in the top buildings in the best city in the world without using any more of our own cash, plus we will not assume the tax bill of distributions in 2023.

The stock will sell off short-term as a knee jerk (maybe even test last month’s or GFC lows), giving management the opportunity to scoop up shares at a bargain price on the owners’ (our) behalf (increasing our percentage of ownership). In management’s shoes I would wait a couple of days to wring out all of the small investors who were in the stock to chase yield (with no analysis), then buy in the float (in size) in coming weeks (after earnings). Vornado reports on Monday evening (May 1). In the meantime, the underlying assets remain “beachfront.” Some short-term pain for long term gain.

-Office occupancy climbs to nearly 50% in renewed push for return-to-office initiatives (yahoo)

-SL GREEN: “.. recent evidence of higher office utilization within our portfolio as physical occupancy regularly exceeds 60% on many workdays .. an increasing drumbeat of optimism about return to work .. companies .. mandating people come back..” (commercialobserver)

Now onto the shorter term view for the General Market:

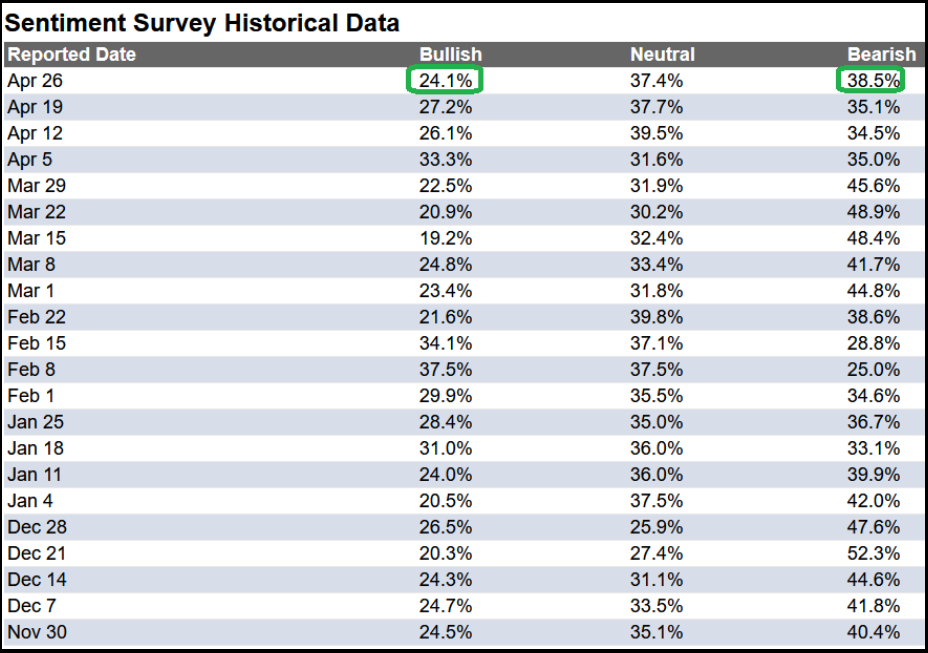

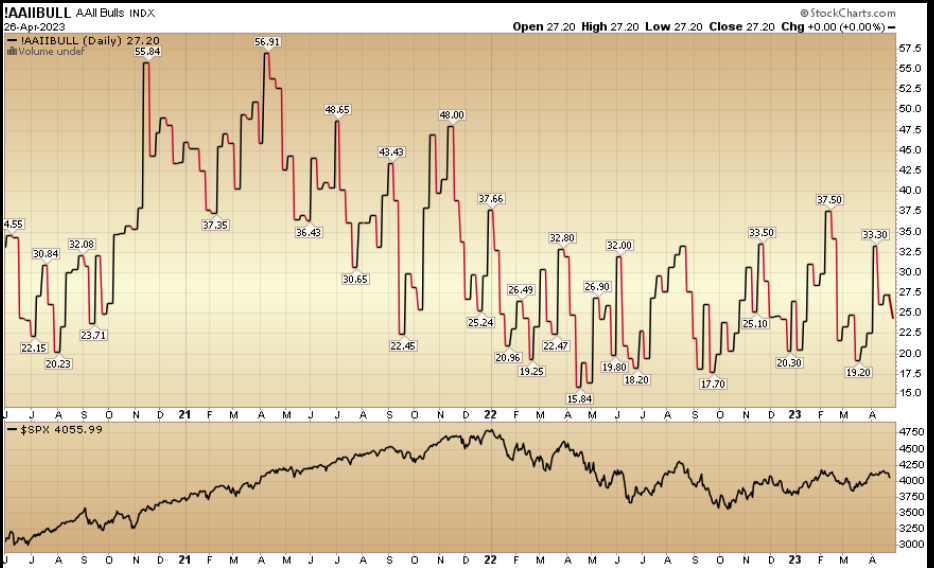

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 24.1% from 27.2% the previous week. Bearish Percent ticked up to 38.5% from 35.1%. Retail investor fear is still present…

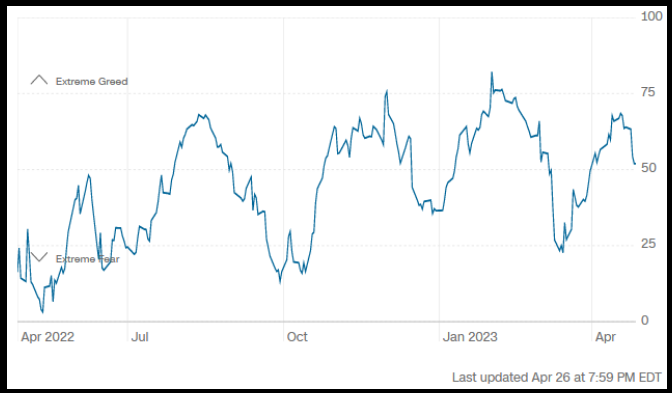

The CNN “Fear and Greed” dropped from 69 last week to 52 this week. Sentiment is indecisive. You can learn how this indicator is calculated and how it works here: (Video Explanation)

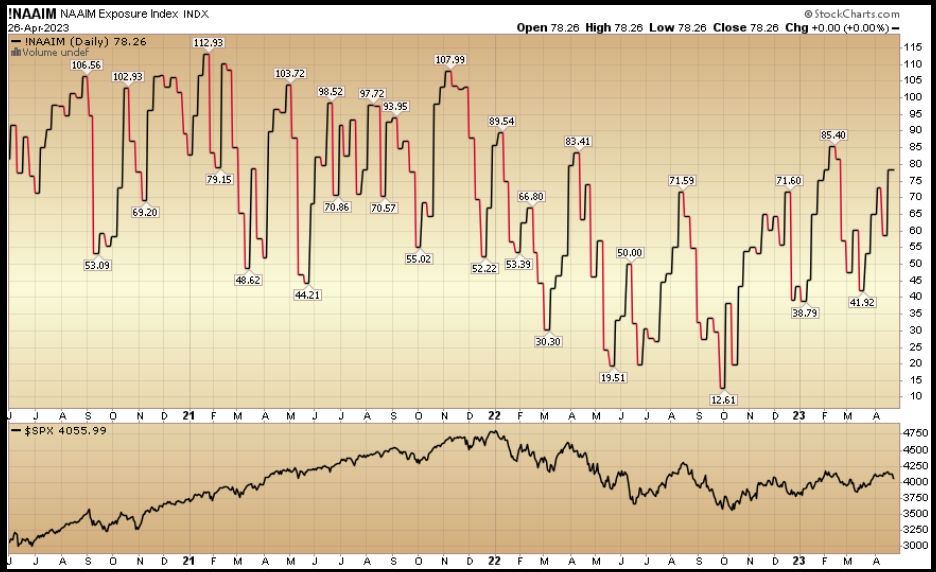

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 78.26% this week from 58.71 equity exposure last week.

This content was originally published on Hedgefundtips.com.