A few examples include:

- Fastenal Co (NASDAQ:FAST) missed on revenues and earnings per share and reported fastener sales down 4% year-over-year, with prices decelerating at a rapid pace. Fastener sales are a close reflection of manufacturing and construction.

- Snap-On Inc (NYSE:SNA) also missed big on sales but beat on EPS. The share price was punished.

- Prologis Inc (NYSE:PLD) is an industrial REIT that trimmed guidance on macro impacts, including high interest rates, increased supply, and rising vacancies.

If the economy is slowing, that may be good news for Fed watchers. We continue to rely on our 1990s analogy, which we have written about extensively for over a year. Despite higher levels of inflation (on average 3% during the decade) and a 10-year Treasury yield which averaged 5%-7%...plus geopolitical shocks, a war, a labor shortage, an inverted yield curve, a soft landing for the economy, and productivity improvements...stocks enjoyed enviable returns. The Fed raised rates aggressively in 1994, cut three times in 1995, then mostly let it ride.

All of this reinforces our (currently unpopular) view that investors should focus on reliable earners like technology and consumer discretionary stocks (plus industrials and energy). We added to names in the fall of 2022 when the market had written off technology for dead, and again in 2023. That has worked out well.

Keep in mind: Large, profitable technology companies are beneficiaries of higher interest rates. Just take a gander at their balance sheets. In 2023, interest and investment income rose threefold to $1.6B for Meta Platforms Inc (NASDAQ:META), while Alphabet Inc's (NASDAQ:GOOGL) haul increased 78% to $3.9B.

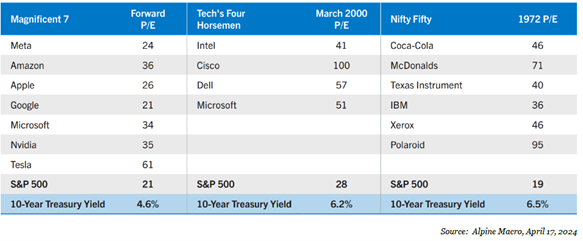

And despite handwringing over valuations, we are not in euphoria territory. See the above table from our friends at Alpine Macro. Then note the yield on the 10-year during the periods featured.

What does all this mean? We are using weakness to add to high-quality names. We reiterate our investing theme of old economy companies embracing this new industrial revolution of digitization and generative AI cloud computing.